Pension and social benefits

First insertion on Heterodox Gazette Sam de Wolff: 20 august 2018

E.A. Bakkum is a blogger for the Sociaal Consultatiekantoor. He loves to reflect on the labour movement.

The present column discusses two policy fields, namely the pension system and the support of the poor. The costs of the pensions can be paid by means of pay-as-you-go or capital funds. The system must be proof against the future ageing of the population as a whole. Poverty is actually difficult to define. The relief of poverty can unintendedly and undesirably make the beneficiaries dependent. The poverty trap must be avoided. Therefore the present policy aims at activation.

A century ago old age was often the same as living in poverty, even in the industrial states1. Nowadays old age and poverty are naturally decoupled. In the welfare state the redistribution of income in time guarantees, that the individuals are certain of a care-free evening of life. Unfortunately the welfare state has not yet solved all poverty, but this does take on a new form. This has made it more difficult to define poverty in a precise and meaningful manner. Both themes, old age and poverty, will be discussed together in this column. Namely, their problems are addresses merely in passing in economics, so that for each of them the material is insufficient for a separate introductory column.

Retirement pension

More than a century ago the security of subsistence during the evening of life was not really seen as a social problem2. The old people were embedded within the extended family, so that their children supplied care, when necessary. In fact this was an exchange between generations. The younger generation helps the older generation, which before had supplied the formation and parental care. This was a social contract, which apparently satisfied everybody3. Then the solidarity is mechanical. However, modern life with its individualism undermines the traditional way of life of the extended family. The society becomes anonymous, so that henceforth the solidarity must obtain an organic basis. At the start there are still attempts to cover the care for old age by means of private insurances on a voluntary basis. Unfortunately, then some remain uninsured.

Figure 1: Quartet game Concordia

At the beginning of the twentieth century, people start to realize, that the care for old age must be made obligatory by the state. Without obligation the individuals may engage in the moral hazard by expecting free care during the evening of life. Then the organizational form of the obligation is still controversial, and this debate continues to this day. The present paragraph summarizes the various ideas, which are available in this respect. A number of sources have been consulted, notably Economics of the welfare state (in short EW), Economics of the public sector (EP), Öffentliche Finanzen in der Demokratie (OF), and Économie politique de la protection sociale (EPP)4. In the abstract sense the retirement pension, the care for old age, is a redistribution of the personal consumption. The redistribution of consumption in the course of life is a utility optimization, which is modeled well in the overlapping generation model. This has already been discussed in a previous column.

In the redistribution during the course of life a choice must be made between two systems: pay-as-you-go (payg), and capital funds. The pay-as-you-go system actually continues the mechanical solidarity. Namely, the professional population is obliged to pay the pensions of the old people. Then, thanks to this obligation the professional population obtains the right to later receive a pension for herself, from the following generation. The professional population obtains a legal claim on the future earned national income, as if it were a social contract (p.408 in OF). The system of capital funds obliges the individuals to save for their future personal pension. The individual chooses his own distribution during the course of life, and becomes independent from future generations5. In principle no solidarity is needed. Mixed forms of payg and capital funds are obviously also possible.

Pay-as-you-go system

In the payg system the workers remit a contribution, which gives them the right to later demand a retirement pension. However, the yield of all contributions is spent immediately for paying the pensions of the retired persons. This implies, that the income of the old people depends on the actual economic situation. For instance, they benefit from economic growth. They have a claim "by contract" on a part of the real production, so that the pension is proof against inflation (defined-benefit system, p.189 in EW; p.408, 428 in OF)6. On the other hand, the height of the pension is affected, when the productivity lags behind the number of retired persons7. Incidentally, the pension will also decrease, when the labour productivity falls for other reasons (p.233 in EP). So the system is not actuarial. This is to say, the height of the pension is only party dependent on the preceding contributions.

Apparently in the payg system the (real) height of the pension is a political decision. The state can always raise the taxes for the professional population in order to maintain the payments of the pensions (p.360 in EP). Possibly the government will pay the pensions by means of government bonds. When desired it can diminish the height of the pensions, in spite of the promis "by contract" (p.408 in OF). According to some the payg system leads to periodical crises, when the number of pension claimants increases faster than the professional population (p.425 in OF). For, reforms of the pension system are unpopular with the electorat. Therefore the politicians will only intervene, when the situation really forces them to do so (p.428 in OF)8.

Capital funds

In the system based on capital funds annuities are paid. Suppose that at the start of the pension the insured person will live another N years. Suppose that the height of the yearly pension is y(n), with n=1, ..., N. Then at the end of his career the insured person must have contributed a sum with a size of (p.106 in EW)

(1) K = Σn=1N y(n) / (1 + r)n

In the formula 1, r is the rate of interest. Thanks to his contributions the retired person is certain, that he will indeed receive his nominal pension y(n) (defined-contribution systeem, p.189 in EW; p.355 in EP; p.428 in OF). The only uncertainty is his year of death, and therefore N. However, the insurance company can bear this risk by calculating the initial sum K with the actuarial method (p.193 in EW; p.360 in EP)9.

In principle the capital fund guarantees, that y(n) is not affected by the actual economic situation (p.191 in EW). For, the capital will be invested globally (p.422 in OF). The national shocks can be circumvented by adapting the investment portfolio. Therefore the aging of the western population does not undermine the pension. Consider the oil crises during the seventies10. Incidentally, the inflation is not a huge problem during the preceding period of saving, because she is commonly included in the rate of interest r. Domestic investments obviously do get affected by economic problems. This is especially so, because the workers are generally more powerful than the old people (p.195 in EW)11.

An important point of discussion is the influence of the system with capital funds on the individual behaviour of saving. During the accumulation of the pension funds the population as a whole must once save intensely (p.380 in EP). When subsequently the funds begins to pay out, then the ongoing saving is accompanied by the expenditures of the retired persons (p.204 in EW). When the population indeed saves more due to the system of capital funds, then extra investments in the domestic economy become possible, which furthers the economic growth (p.207 in E; p.414 in OF). But saving by means of a pension fund can also crowd out other forms of saving (p.364, 369 in EP). Moreover it remains uncertain, whether the saved capital is indeed invested productively (p.204 in EW; p.370 in EP)12.

It is fascinating to see, that even the introductory textbooks have opposing opinions about the optimal pension system. In principle the system of capital funds allows to have a global spread of the risks of an unfavourable conjuncture. However, sometimes it is stated, that the capital fund is yet sensitive to the national situation. Such statements are derived from the mentioned vulnerability of nominal pensions for inflation. For instance, when the domestic economy collapses, then the domestic currency will devaluate (p.197, 207 in EW). This will reduce the spending power of the retired persons with regard to foreign goods. In other words, they can not shift the production of their consumption to foreign states13.

Aging of the population as a whole

Figure 2: Union demonstration

AOW remains 65 (2009, Rotterdam)

In the western states the population as a whole ages due to an increasing expectation of life and a falling birth rate. Therefore the number of retired persons increases in comparison with the size of the active professional population (p.191 in EW). In other words, there are relatively less active people (p.213 in EPP)14. Then, in the payg system the costs of pensions can be paid only, when the height of the pension is restricted15. Since the increasing expectation of life is an important cause for the aging of the population, it is logical to raise the retirement age (p.208 in EW; p.374 in EP; p.423 in OF)16. Or the retirement age can be made flexible, and the pension can be raised for those who continue working for a longer time (p.371 in EP). Another option is to try to raise the birth rate. However, this is difficult, because the family size is mainly determined by cultural factors (p.216 and further in EPP).

In principle the system with capital funds is better able to cope with the aging population, because the payments are done by the global professional population. Yet the economists have different opinions about the aging population. According to Barr the capital funds are an inferior system (chapter 9 in EW). But Blankart is convinced, that only a pension system with capital funds is durable in an aging population (p.414, 420 in EW). The payg system leads to recurring pension crises as a result of an aging population (p.425 in OF). According to Stiglitz, in the United States of America the capital funds are the common pension system (p.358 in EP)17. Immigration can slow down the aging of the population, but it is a temporary solution (p.358 in EP)17. Besides, this would imply the selection of only highly productive immigrants. Elbaum points out, that working old people are relatively expensive workers, with a high wage and a decreasing productivity (p.215 in EPP).

The aging population as a whole causes various additional changes. For instance, retired persons do no longer save, so that the aging population implies a lower rate of saving (p.215 in EPP). Important is also the heavy burden, which the aging population imposes on the health sector (p.239 in EPP). Especially the very old people (80 years and beyond) have relatively high health costs. They can become very dependent on their entourage (p.248 in EPP). At the moment, precisely this groups grows rapidly in size. This is compensated somewhat by the trend, that old people remain fairly healthy for a longer time (p.243 in EPP).

Redistribution and behaviour

The pension system has a levelling effect (p.210 in EW; p.415 in OF). The payg system leads to a redistribution from young to old, because there is economic growth (p.199 in EW). The payg system is usually constructed in such a manner, that there is also redistribution from rich to poor (p.200 in EW)18. On the other hand, the expectation of life is lower for the poor, so that they receive the pension payments for a shorter period (p.200 in EW). For the same reason there is a redistribution from the men to the women, because the life expectancy of men is shorter (p.200 in EW). In principle the system with capital funds does not redistribute, because everybody gets his own contributions back, including interests. This is of course not the case, when the policy does not distinguish between the various categories of insured individuals.

The wage costs increase due to the payment of the contribution to the pension system. When thus the available wage is less, then this can discourage the participation of workers. Incidentally, this discouragement does not occur, when the workers see the contribution as a (voluntary) insurance, which gives them a right on a future pension (p.204 in EW). This latter argument is evidently less convincing, according as the system redistributes more. In general it is desirable, that the height of the pension is related to the previously paid contributions. Otherwise there is a moral hazard of retiring at an early date (p.205 in EW)19. The marginal contribution, which results from a year longer continuing to work, must have a positive effect on the pension height. Indeed an individual can strongly increase his wealth by continuing to work for a few years more. The totally available income for the remaining years of life can double or even triple!20

Support and assistance

In the introduction it has already been stated, that the concept of poverty is difficult to make concrete. In the past poverty equaled need. For centuries poverty was seen as a social destiny. Poverty was softened thanks to private charity, originating from love of one's neighbour. Only around a century ago the discontent about this manner of poverty relief grew21. There was a desire to establish new institutions, which can guarantee the income security. Nevertheless, support and assistance are not insurances, because they are paid from the tax incomes (p.392 in EP)22.

Then it becomes necessary to determine a bottom, which defines the minimal level of existence. However, in a previous column is has already been explained, that the total income has a material and an immaterial component. Individuals make their own choices, for instance an austere life, which satisfies spiritual needs. Furthermore, the income can fluctuate in time (p.125 in EW). In practice the common measure of poverty is a limit on income, during a certain period (p.127 in EW)23.

Absolute measures of poverty

The limit of poverty should be an absolute measure (p.131 in EW). In 1969 the United States of America have indeed defined a measure of poverty, which is absolute (p.114-115 in EP). The measure is based on the minimum quantity of food, which is needed by a family with a certain size. The starting point is, that a family usually spends a third of its income on food. Therefore the limit of poverty must equal the triple of the sum in money, which is required for the minimally needed quantity of food. Since 1969 this limit of poverty has regularly been corrected for inflation, but not for the growth in welfare (for, the measure is absolute). However, this measure has become obsolete, because nowadays families spend at most a quarter of their income on food24. Incidentally, levelling does not per se diminish the (absolute) poverty, because it can discourage efforts, and therefore hurts the economic growth (p.131 in EW).

Relative measures of poverty

Usually a relative measure of poverty is applied. It is logical to define the limit of poverty as a fraction α of the national median income per family25. The European Commission uses α=60% as the limit of poverty (p.368, 492 in EPP)26. Therefore this poverty limit as a sum in money is coupled to the economic growth. Next the fraction β of families can be calculated, which live below the poverty limit. This is the degree or index of poverty (p.113 in EP). The poverty gap is the difference between the poverty limit and the median income of the poor (p.133 in EW; p.368 in EPP). The poverty gap is commonly normalized, and therefore presented as a percentage27. Temporary poverty (say, for a year) is of course less detrimental than permanent poverty.

Multi-dimensional poverty

The school of new public management has contributed to the refinement of the policy indicators and measures. This also holds for the policy of poverty. Since the total income contains a material and immaterial component, poverty can also be caused by immaterial distress. An important factor is the social exclusion, this is to say, not be able to participate in daily activities. Apparently poverty can have various dimensions. Thus the European Union has made a list of nine needs (among others a holiday of a week, a dinner with meat every second day, sufficient heating in the house, possession of a washing machine). Those who lack at least four of these activities, are considered to be poor (p.364, 493 in EPP). The problem is evidently, that such composite indices are difficult to interpret (p.507 in EPP). The policy evaluations often lead to adaptations of the indicators28.

Relief of poverty

The relief of poverty is efficient, because it contributes to safety (protection against crime) and to the health of the population (p.216 in EW; p.392 in EP). Moreover it is just. The private charity, for instance by the church, does not automatically reach the optimal level (p.216 in EW). The state relieves the poverty by giving various kinds of aid to the poor29. The aid can consist of goods in kind (free care and education, and the like) and of (monetary) subsidies30. Some aid is universal, and therefore is supplied for free to the whole population. Aid in the strict sense is conditional (categoral), namely dependent on satisfying certain demands. Testing based on the family income (means testing) is logical, because this "reveals" life below the poverty limit. Assistance is usually supplied only, when the beneficiary is willing to work31.

The aid or assistance consists of various instrumental subsidies: an income in order to cover the primary necessaries of life, family allowance, and also allowances for the costs of renting, care, education, and the like32. This shows, that as an alternative for testing income the condition for aid can be based on properties of groups. This is a policy targeting groups (p.217 in EW; p.400 in EPP). Then the identity of the group must correlate with poverty.

An example is the family allowance, because families with young children often have a relatively low income and high costs (p.224, 229 in EW; p.384 in EPP)33. Therefore the family allowance can be interpreted as a redistribution of income over the course of life, just like the pension or the scholarship. Furthermore, the family allowance is just, because the children themselves did not choose to be materially poor. The allowance increases their chances for unfolding. Besides the family allowance is an (efficient) investment in the future of society (p.392 in EP)34.

Redistribution and behaviour

Figure 3: Quartet game Unicef

The height of the total assistance is a subject of continuing debate (p.219, 226 in EW). Here the principle is, that work must pay35. In practice the various subsidies easily become so generous, that the total income from aid is similar to the lower wage scales. Then individuals do not benefit from an increased income, when they start to work. This occurs for instance, because the allowances for rent and health care are reduced, according as the earned wage rises (p.396 in EPP). This in fact amounts ot a marginal tax of 100% (p.225 in EW; p.387, 393 in EP). In such situations it is essential to look at marginal changes, because these are the basis for individual decisions. Assistance which shrinks equally with the extra earnings from work eliminates the incentives to work! Then the beneficiaries of aid and assistance will exert political pressure to maintain their status. This is called the poverty trap36.

The hurtful effects of the poverty trap can be weakened by reducing the allowances with a delay of, say, a year (p.223, 226 in EW). Then the decision to start working does immediately yield a higher income. The marginal burden due to the decision to participate is temporarily 0%. The disadvantage of this instrument is naturally the extra costs for the state. When the wage exceeds the poverty limit, then the state can also diminish the allowances gradually to such an extent, that a part of the extra wage remains intact (p.221 in EW). But this increases in fact the number of individuals with a claim on (partial) allowances. Moreover, in this manner the marginal rise in income becomes less, so that the incentive to work longer is still weakened (p.223 in EW). Apparently such measures do increase the participation, because the poverty trap is avoided, but they discourage working longer!

The effect of assistance on behaviour is also relevant for the choice between a targeted (categoral) or universal aid. The universal aid has lower costs of execution, but it reinforces undesirable behaviour in the population (p.403-404 in EP). For instance, free health care leads to the moral hazard of over-consumption. An individual contribution of those, who can afford it, reduces such behaviour. This is called the principle of benefit37. Another disadvantage of the universal system is the effect of Matthew38. This is to say, the more wealthy families profit most from some universal facilities. This holds notably for the education and for cultural utilities. But also quite a lot of people with middle incomes rent houses in the social sector. In the Netherlands this phenomenon is called living slantingly. Targeted aid reduces the Matthew effect.

The aid in kind also often leads to changes in behaviour (p.401-403 in EP). Incidentally, universal aid is fairly often in kind. Aid in kind stimulates over-consumption. Consider food vouchers. Houses in the social sector can discourage individuals to move (p.400 in EP). On the other hand, aid in kind has the advantage, that a minimum consumption of the concerned good is guaranteed (p.402 in EP). It is striking, that aid is kind is strongly supported by the organizations in the execution of policies (p.403 in EP)39.

Activation

During the sixties and seventies the assistance was passive, and purely targeted at the insurance of income. The liberals and the christian democrats rejected any state interventions in the market. The social-democracy wanted to create work by the state, but this failed due to the inefficiency and therefore untenably high costs. Since the eighties the notion grows, that the optimal assistance consists in guiding people to the labour market40. The families themselves must be capable of providing for their means of existence. The traditional policy had condemned to be dependent on the state. Therefore, henceforth a policy of activation is preferred, where the individuals are incited to find jobs by themselves (p.393 in EP). In politics this new policy has mainly been realized by the movement of the radical centre (Clinton, Blair, Schröder).

The policy of activation has introduced new subsidies, such as the tax credit for the workers. Workers with a low income get a subsidy instead of a tax levy (p.215 in EW; p.393 in EP). The tax credit is granted by means of self-selection, because the individual benefits thanks to his decision to work (p.218-219 in EW). On the other hand, this credit also suffers from the mentioned deficit, that working longer is discouraged, because in the heigher incomes the credit decreases (p.230 in EW; p.394 in EP). The credit for workers creates such incentives also due to a second cause41. Namely, on the one hand the credit makes leisure time more expensive, so that (more) individuals decide to work (substitution effect). The participation rises. On the other hand the credit increases the income, so that more leisure time can be consumed (income effect). The circumstance determine, which of these effects will dominate.

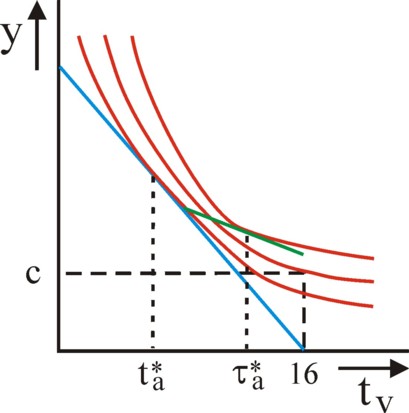

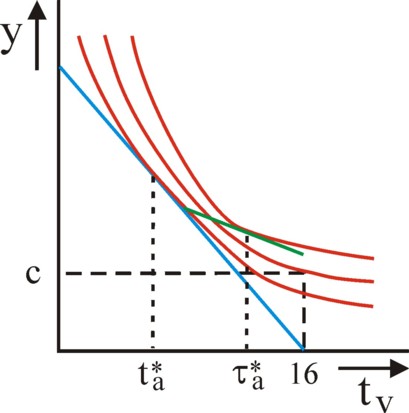

Figure 4: Tax credit

on the wage line for aid c

The tax credit can be illustrated conveniently by the utility field of income and leisure time (p.221 in EW; p.395 in EP). This approach has been described already six years ago in the column about the marginal utility of work. In the figure 4 the leisure time tv is shown on the horizontal axis, and the income y (which determines the (other) consumption) is shown on the vertical axis. Usually tv is at most 16 hours daily. The working time is ta = 16 − tv. When w is the hourly wage, then this is also the price of an hour of leisure time. The figure 4 shows the wage line y=w×ta, in blue. This line touches an indifference curve (in red) at the optimal working time of ta*. Now suppose, that the state gives an assistance c to the poor, as is shown in the figure 4. Now work no longer pays, at least when this eliminates the assistance. It is true that the individual can increase his income by working (y>c), but his utility decreases. One can also say: the state believes that the utility u(ta*) is unreasonably low, and discourages this option with the threshold c.

The state can still activate the individual by means of the tax credit, which has been drawn in the figure 4 as the green line on top of the wage line. Here it has the form k(ta) = k(0) − ω×ta (so k(ta)=0 for ta > k(0)/ω). Since k(0)>c holds, now work does pay. The participation will increase. But as soon as the individual indeed participates, the "taxed" hourly wage is w' = w − ω. In the range 0 < ta < k(0)/ω one has w'<w, so that the tax credit actually discourages working longer. Leisure time becomes cheaper. Therefore the individual will prefer working hours τa* < ta*. Here it must be noted, that the choice of the optimal working hours are in the end determined by the individual preferences, as is expressed by his utility field.

Besides the tax credit, allowances also change behaviour in a different way. Consider for instance a complete subsidy of child care42. When the child care uses an hourly tariff, then subsidy amounts to a wage increase of the working parent. It will increase the participation, but it will not necessarily stimulate to work longer. Namely, it causes a substitution effect and an income effect. The situation determines, which of these two effects will dominate. However, suppose that the child care uses a monthly tariff (lump sum). Then the full subsidy again stimulates participation. But the lump sum of subsidy also implies, that it increases the hourly wage less, according as the working hours are longer. This weakens the substitution effect. Therefore individuals, who already work, will reduce their working hours after the introduction of the subsidy!

- Your columnist has a huge library of Dutch documents from the old socialist labour movement. The texts are devoted mainly to the political struggle for power, and the personal successes, which have been scored. It is curious that not much attention is paid to the then social misery. Here are yet some heartfelt cries. On p.174 in De geschiedenis der zelfstandige vakbeweging in Nederland (1932, N.V. De Arbeiderspers) by NVV-leader J. Oudegeest (known for his firm language): "When the old people, the squeezed lemons, receive a small sum from the church or poor-relief, then this is a relief of the yet heavy burden of the children. (...) Ten thousands of poor people (...) must rely on charity". He adds: "Thanks to the donation to the old people, they [EB: here Oudegeest refers to the capitalists, who would use the church and charity as their instrument] control the children". Oudegeest and his party, the SDAP, advocate the state pension. On p.286-287 in Zestig jaar levenservaring (1963, N.V. De Arbeiderspers) W. Drees describes the motives for the state pension: "Not the family income, but only the income of the old people is taken into account (...) There can be no claim on the children. (...) For many, who still had some income or who were satisfied with the total family income, but who felt dependent on the children, it was a boon and a blessing". The orthodox socialist F. Van der Goes even rejects the social insurance, on p.224 in Uit het werk van Frank van der Goes (1939, De Wereldbibliotheek N.V.): "The factor of class egoism, which begrudges the workers any income beyond the wage, unmitigatedly affects the ambition to provide for this to those workers who need another income - because of unemployment, sickness or old age - at their own costs, and therefore still as a part of their wage, by means of an obligatory insurance, partly or in full". In the christian movement C.S. Smeenk devotes the paragraph 101 in volume 2 of Christelijk-sociale beginselen (1936, J.H. Kok N.V.) to the introduction of the pension. But he does not address the motives. The texts focuses on the choice between the state allowance or the insurance. On p.339 in Met ontplooide banier (1950, N.V. Drukkerij Edeca) by CNV-leader H. Amelink, the clergyman Talma is cited: "The wage consists of two parts: firstly money, which he takes home and which allows him to cover the daily expenditures, and secondly the money, which converted into a contribution allows him to receive an income from his wage, when he becomes handicapped, when he can no longer work, be it due to sickness, disability, old age". So here the description of poverty is also absent. Smeenk, Amelink and Talma see the church (and its morals) as the driving force behind the establishment of the private insurances. Then the bureaucracy of the church plays the role of the state bureaucracy. Nowadays the church is marginalized socially. Therefore only the state is capable of regulating the free markets in the social security. (back)

- This does not hold for the socialists, who of old advocate the state pension. The old people are portrayed as victims of the capitalist system. The workers would be exploited by the industry, at a miserable wage. Since at the time the taxes are mainly paid by the wealthy individuals, the socialists present the state pension as an instrument, which allows the proletariat to take back some income from the capitalists. The socialist politicians themselves hope evidently to acquire a paid administrative function thanks to their political pressure. Typical for this lobby is the newspaper article Pensioen by A.B. Kleerekoper from 1921, which has been reprinted on p.57 in Oproerende krabbels (1933, N.V. Em. Querido's Uitgever-mij). He tells how a farmer retires his servant, and only gives him a wall-board: "The Lord bless and protect you". Soon the servant dies, and next the widow merely receives three guilders from the state, and a penny from the church. Kleerekoper is embittered about the behaviour of the farmer, who he apparently holds responsible as a former employer. (back)

- Even now the support by the family is held in respect in the South-European states. See p.59 in Économie politique de la protection sociale (2011, Presses Universitaires de France) by M. Elbaum. The regulation of pensions is sound in states such as Italy, Spain, or Greece. But health care and well-being of the old people remain mainly a task for the family. On the other hand, the parents remain relatively long responsible for their children (p.393). Apparently such morals can be maintained also in modern life. (back)

- See chapter 9 in The economics of the welfare state (2004, Oxford University Press) by N. Barr, chapter 14 in Economics of the public sector (2000, W.W. Norton & Company, Inc.) by J.E. Stiglitz, chapter 18 in Öffentliche Finanzen in der Demokratie (2011, Verlag Franz Vahlen GmbH) by C.B. Blankart, and Économie politique de la protection sociale (2011, Presses Universitaires de France) by M. Elbaum. On p.362 in his book Stiglitz calls the obligatory pension a merit good, because society as a whole benefits from it. The book by Elbaum contains many empirical data, and not much theory. A relevant but excentric book is Mythen der Ökonomie (2005, VSA-Verlag) by the Austrian left-wing thinktank Beiwegum. This book tries to provide left-wing people with objective arguments. Yet the book is rather biased, due to its origin. Your columnist read this book 11 years ago. The VSA-Verlag is a publisher, who specializes in the publication of work by intellectuals in the left wing of the social-democracy, with a strongly coloured view of life. (back)

- Incidentally, the individual choice is controlled by social factors. For instance, on p.228 in Modern labor economics (2009, Pearson Education, Inc.) by R.G. Ehrenberg and R.S. Smith it is remarked, that the enterprises sometimes insist on early retirement, because older worker become less productive. (back)

- Barr argues on p.193 in The economics of the welfare state, that inflation is caused by society. He believes that individuals can not prevent this. Only the state can couple the incomes and the price index. Stiglitz also states on p.360 in Economics of the public sector, that there is no insurance against inflation. (back)

- Barr, who is a warm advocate of the payg system, states on p.197 in The economics of the welfare state, that the state itself can buy foreign shares from enterprises in growing economies. Thus the state could artificially increase its production. Stiglitz also makes this suggestion on p.377 in Economics of the public sector. Your columnist believes that this is a hypothetical suggestion, because in principle the state must not speculate with money originating from taxes. Then the domain of the state would be stretched too much. Apparently Stiglitz himself has doubts, because he worries about the right to vote, which the state would obtain as a shareholder in the enterprises. (back)

- On p.237 in Onze welvaartsstaat (1969, Het Spectrum) F. Hartog remarks, that the welfare state must be reformed. For, in course of time the welfare state makes some of its own facilities superfluous. Consider the rising wealth, so that henceforth citizens can insure themselves privately. Hartog also states, that pressure groups often object to such reforms. (back)

- Stiglitz notes on p.360 in Economics of the public sector, that a life insurance pays a lump sum K after death. The supplier makes a loss, when the insured person dies prematurely. In an annuity insurance the early death of the insured person is actually profitable for the supplier. (back)

- Barr believes on p.199 and 202 in The economics of the welfare state, that the state must actually guarantee the indexation of the pension for the case of capital funds. It could do this for instance by emitting obligations with a value, which is compensated for a possible inflation. On p.199 he remarks, that in the case of such a state intervention it is logical that the state also supplies the pensions themselves. On p.207 Barr states, that the investments of pension funds abroad can also there lead to a rising inflation, so that the efficiency of capital again diminishes. Your columnist believes that this objection is rather far-fetched. (back)

- On p.133 in Mythen der Ökonomie there is (naturally) also a reference to the conflict between labour and capital. On p.138 one reads: "Einzig für die Versicherungen, Banken, Fonds etc. tut sich ein riesiger gewinnträchtiger Markt auf". The Belgian economist H. Deleeck is also unpleasantly suggestive on p.185 in De architectuur van de welvaartsstaat opnieuw bekeken (2003, Uitgeverij Acco): "The adherents of capitalization are more interested in the financial markets than in the well-being of the old people". This is rather biased. Several authors do note, that the institutional investors naturally must be as efficient as possible. Your columnist believes that it is positive, when workers are also capitalists. Beiwegum, just like Barr, maintains the view, that the capital funds will remain dependent on the domestic economy.

This footnote illustrates the controversial nature of welfare economics. All consulted sources are normative, although the fanaticism varies. Nevertheless, they are also (positively) informative. But those who want to judge for themselves, must always remain alert with regard to such statements, which are purely ideological. Deleeck sympathizes with progressive-christian ideas. He is attached to the traditional welfare state. His book has been revised by Bea Cantillon. Cantillon is among others a member of the visitation commission of the Wetenschappelijke Raad voor het Regeringsbeleid in the Netherlands. This closes the circle. (back)

- Blankart states on p.414 in Öffentliche Finanzen in der Demokratie, that in the system with capital funds certainly more is saved than in the payg system. On p.134 in Mythen der Ökonomie the inclination to save is simply condemned, because it would stifle the consumer demand. Beiwegum prefers the demand-side policy. (back)

- On many places, like here, Barr lenghtily polemizes against the capital funds. Your columnist has the impression, that this polemics sometimes neglects objectivity. This is the case here. For, investments abroad yield a profit in foreign currency. Therefore the retired persons maintain their spending power. This would only not be the case, when they would wait with their foreign investments, until the domestic economy has collapsed completely. On p.183 in De architectuur van de welvaartsstaat opnieuw bekeken it is stated, that payg is better than capital funds, as long as one has gY + gNa > r. Here gY is the economic growth rate, gNa is the growth rate of the professional population, and r is the real interest rate. Apparently this inequality assumes, that the demographic composition of the population remains constant. on p.134 in Mythen der Ökonomie it is stated, that the accumulation of capital by the pension funds will lead to a falling capital efficiency. In principle this idea is similar to the tendency of the falling profit rate according to Marx. Keynes also had such thoughts. Your columnist believes, that for the moment there is globally sufficient demand for capital, especially in the Third World and in the newly emerging states, for maintaining a good profitability. On p.135 Beiwegum complains, that such investments are risky and speculative. This is true, but risks can be spread. (back)

- The present column mainly wants to undertake an analysis. Nonetheless, some empirical data are useful for sketching the seriousness of the situation. In Économie politique de la protection sociale the data are presented for France. Between 2000 and 2040 the share of 75+ will increase from 7.2% to 14.7% (p.227). The ratio of the number of 65+ persons and the professional population will increase from 27% in 2000 to 50% in 2040 (p.228). This undermines the tenability of the system. Incidentally, the development in South- and East-Europe is even more alarming (p.231). The problem is not just the pensions, but also the rising costs of health care. The costs of care for an 80-year old person are three times those of a 50-year old person (p.239). About 11% of the 80-year old persons is in a dependent situation, this is to say, permanently needs help (p.249). (back)

- On p.128 in Mythen der Ökonomie it is argued, that thanks to the falling birth rate savings are possible on the costs of education and unemployment. This argument is weak, because education is a profitable investment in human capital. Furthermore, Beiwegum believes that the aging of the population as a whole can be compensated by more participation of especially women and by a higher productivity. However, it is generally known, that these developments are not enough to compensate the collective aging process. The burden on the professional population would remain excessively, which again would affect the preparedness to work. According to Deleeck on p.178 in De architectuur van de welvaartsstaat opnieuw bekeken, in 2002 the Belgian state has founded the Zilverfonds, which must form a capital buffer for paying the basis pensions of the voluminous "babyboom" generation. In the Netherlands the AOW Spaarfonds has been founded for the same reason. Your columnist ponders, that in this manner the paying off of the national debt is slowed down. (back)

- A personal anecdote: in 2009 your columnist was still active in the trade union movement and in the PvdA. At the time the cabinet Balkenende-4 of the CDA-CU-PvdA coalition decided to gradually raise the age of retirement from 65 to 67 years. Your columnist energetically opposed this, and spoke on a PvdA meeting in Zwolle. He argued among others, that according to Drees (sr.) the pension at the age of 65 years was fair. And it can apparently be paid, as long as the collective will is present. In retrospect so much naiveté makes humble. Incidentally, the various meetings of members in the PvdA approved with a large majority of the increase of the age for AOW. (back)

- Deleeck advocates in De architectuur van de welvaartsstaat opnieuw bekeken a mixed system, with a basis pension (payg; Deleeck calls it a repartition), supplementary pensions (collective coverage with capital) and private supplements (individual coverage with capital). He is irritated by proposals to introduce purely the coverage with capital (capitalization). On p.180: "The continuation of collective turmoil about the future of the pensions is irresponsible". (back)

- On p.235 (and elsewhere) in De prijs van gelijkheid (2015, Prometheus - Bert Bakker) B. Jacobs complains, that the pension is subsidized with taxes. The contributed sum is taxed only when it is paid out, so after a long delay, and moreover usually at a low tariff, because the pension is less than the wage. This subsidy of the old people must de facto be paid by the professional population. Jacobs warns, that in this way the preparedness to work (participation) will diminish. Besides, according to Jacobs it is unjust, that the capital gains of the pension funds are not taxed. According to Deleeck on p.172 in De architectuur van de welvaartsstaat opnieuw bekeken, in 1997 43% of the Belgian poor consisted of old people. This naturally does not imply, that many old people are poor. On the contrary, 75% of them possess their own house (p.174). (back)

- Some people have an emotional dislike of the human picture of the calculating person, because it assumes the mentality of a bookkeeper and thinking in terms of profits. Therefore it is worth mentioning that according to p.24 and 27 in Labor economics (2004, The MIT Press) by P. Cahuc and A. Zylberberg the financial incentives do have a significant effect on the decision to retire or continue working. Nevertheless, immaterial factors are naturally also important in the decision to continue working. Already four years ago it has been explained in a column, that besides the income motive there is a performance motive and a contact motive. But yet it turns out that the income motive is particularly capable of influencing behaviour. (back)

- On p.227 in Modern labor economics a calculation is done for an example, where someone retires at the age of 62. Suppose that he will die at the age of 79. Then he receives for the remainder of his life $141.000. For a retirement at the age of 66 this sum (still for the period 62-79 years) has risen to almost $300.000. For a retirement at the age of 70 this sum is $427.000. The main cause of this increase is the continuing wage, which is heigher than the pension. But the individual also pais (marginal) pension contributions for a longer time, which raises his claim. (back)

- In the political debate the socialists make the social order responsible for poverty. The volume Oproerige krabbels by A.B. Kleerekoper presents on p.64 the newspaper article Steuntrekkenden, published for the first time in 1922. Here Kleerekoper opposes work as a reciprocal performance for receiving municipal assistance. He compares the assistance with incomes from capital, because both do not require labour. He ends with: "When all people who can work, do have a job ... When all people, who want to work, get a job ... then I will attack al those who prefer drawing relief above working, but not before!" Here Kleerekoper probably still believes, that the state must offer jobs. Interesting is also the opinion of A.H. Gerhard, the son of the first Dutch socialist leader Hendrik Gerhard, and one of the founders of the socialist SDAP in 1894. In 1920 he writes the column Ontbering, which is later included on p.192 in his volume Vrijdenker / socialist en opvoeder (1949, N.V. De Arbeiderspers). Then Gerhard states: "The average man always desires to do what he sees other do, that dispose of more wealth. (...) Leisure, amusement, beautiful clothes and delicacies: (...) how much are actually truly felt needs? (...) There is among all 'misery' a surprising lot of selfdeceit and envy. (...) Quite a lot of people feel poor in various material domains, because they are unfortunately spiritually poor. (...) True 'welfare' assumes rising above one's own inclinations". Here Gerhard in fact embraces the protestant morals. His views conflict with the humanistic psychology of Maslow. Another founder of the SDAP is F. van der Goes. In 1908 he writes the article Armoede voorheen en thans in the magazine De Nieuwe Tijd. It has been reprinted on p.200 and further in Uit het werk van Frank van der Goes. Van der Goes argues, that poverty is a typically capitalist phenomenon, because it is caused by the fluctuations of dynamic markets. "Poverty of producers, which were not the result of natural causes, did not occur in normal [EB: pre-capitalist] times" (p.220). And once more, about the pre-capitalist times (p.225): "The destitudeness is more the bad luck of people, who due to non-economic causes were eliminated from the production of commodities for longer or shorter periods". On p.226: "The commercial capital has disturbed the certainty, which benefitted the pre-capitalist societies, in a manner, which is typical for this form of capital". Next he continues in a Leninist style (p.230): "The world is a single market and on the world market the productive capital reigns without competition". Finally (p.230): "Only the modern misery, which is the misery of the capitalist proletariat, (...) has a revolutionary meaning". It is the poverty of a social class (p.232). The socialist arguments were never really convincing, and certainly not nowadays. Here the socialist hostile thinking dominates, which has always handicapped the social-democracy, even in its good times, and which continues into the present. Nonetheless, 17 years ago, when your columnist read this kind of books in large quantities, it all seemed so exciting. The bookshop De rooie rat in Utrecht, which recently failed, had thousands of them. (back)

- It may seem to be a mild joke, but the aid and assistance naturally do not grow in trees. The middle class and the rich elite must pay it from their own primary incomes, via tax payments. The secondary incomes of the poor are mainly taken from the productivity of the higher income groups. (back)

- On p.128 in The economics of the welfare state and p.330 in De architectuur van de welvaartsstaat opnieuw bekeken it is remarked, that the poverty limit could be defined as a subjective feeling. The subjective judgement could be measured by means of questionnaires in opinion polls. In chapter 15 of Happiness quantified (2008, Oxford University Press) by B.M.S. van Praag and A. Ferrer-i-Carbonell this method is indeed used for determining the poverty in Belgium and in Russia. Since the analysis weighs various independent variables of the households, the poverty limit is even found for target groups. However, the approach is still too experimental for real applications in policies. (back)

- See also p.329-331 in De architectuur van de welvaartsstaat opnieuw bekeken. This is called the foodratio- or budget-method. According to Deleeck, Germany also uses such an approach. Due to the cultural differences it leads to another poverty limit for each state. Deleeck remarks, that the method is rather subjective, because the consumer behaviour differs per person. (back)

- The median income is found by ordering the incomes in a population of N families according to their height, and next taking the income of family N/2. In other words, the median income is roughly the income of the individuals in the fiftieth percentile (p.536 in Modern labor economics). In yet other words, the median income divides the income distribution in two equally large parts. Due to the skewed distribution the median income is less than the average income. (back)

- At the national level often α=50% is still used (p.368 in Économie politique de la protection sociale). So the European Union is more strict than its member states. On p.92 in De architectuur van de welvaartsstaat opnieuw bekeken Deleeck complains: "[Eurostat uses] methodological paths so that Belgium suddenly does not have 6 or 7% poor people but 18%. (...) This is both incomprehensible and unacceptable". (back)

- According to p.133 in The economics of the welfare state the poverty gap can be normalized on the poverty limit, or on the median income of the poor people. According to p.368 in Économie politique de la protection sociale, in 2009 the French poverty gap was 19%, based on the poverty limit with α=60%. However, Elbaum does not state, what normalization she uses. (back)

- According to p.364 in Économie politique de la protection sociale, France uses a list with 27 deficits, including the availability of hot water, moisture nuisances, poor clothes, and debts. On p.331 in De architectuur van de welvaartsstaat opnieuw bekeken this is called the deprivation method. When poverty is defined according to the α=60% definition of Eurostat, then deprivation is scarce (p.332). In chapter 16 of Happiness quantified it is proposed to also measure the multi-dimensional poverty as a subjective judgement. The considered dimensions are the financial situation, job, leisure time, health, housing, environment, and life as a whole. On a measuring scale of 0-10 individuals are called poor within a dimension, when their satisfaction u is less than 5. So this subjective poverty is relative. According to the SOEP questionnaire of 1996 merely 5.3% feels poor in the dimension of life as a whole. This can be interpreted as the total individual utility u. The most extreme poverty u=0, 1 or 2 is hardly present. The financial poverty is uf = 6.8%. The degree of poverty is largest in the dimension of leisure time (uv = 17.7%). Van Praag remarks, that it would be impossible to compensate the immaterial poverty financially. Furthermore he points out, that in his analysis the various dimensions of poverty are mutually strongly correlated. Your columnist adds, that this type of research is still in its experimental phase. In particular, the results depend strongly on the questions, which are asked to the studied group of individuals. (back)

- On p.216 in The economics of the welfare state Barr makes the additional demand, that the stigmatization of the beneficiaries must be limited. He als makes demands with respect to the execution of the poverty relief. It must be horizontally efficient, this is to say, the whole target group must be reached (p.220). And is must be vertically efficient, this is to say, not benefit individuals outside of the target group (p.220). Vertical efficiency can lead to the poverty trap, because the individuals lose their assistance, as soon as their income rises above the poverty limit. Universal policies are on purpose not vertically efficiënt. (back)

- In chapter 15 of Economics of the public sector it is noted, that the North-American states give food stamps to the poor people. (back)

- In a previous column it is remarked, that sometimes in Europe a distinction is made between the continental, Anglo-saxon, South-European and Scandinavian system of social security. Especially the Scandinavian system is universal. The Anglo-saxon system aims at target groups. On p.389 in Économie politique de la protection sociale it is shown, that these four systems indeed differ in the level of their social expenditures. The East-European states fit poorly in this scheme. Incidentally, this all says little about the number of households, which live below the poverty limit (the poverty index). For instance, Ireland uses the Anglo-saxon system, and nevertheless has little poverty. On p.400 it is stated, that a universal policy is unnecessary for the middle class, because it has sufficient spending power. In a targeted policy attention must be paid to the horizontal and vertical efficiency (namely accessibility and inappropriate use) (p.402). (back)

- According to p.386 in Économie politique de la protection sociale, in 2009 in France these allowances together formed 73% of the income of the households in the first quintile. Consider the costs of education and the costs of hospital admission. In the Netherlands the renting allowance will also contribute significantly. A part of the support is supplied directly by the municipality. (back)

- Within this group the single-parent families are particularly vulnerable, especially those with several children. According to p.384 in Économie politique de la protection sociale, in 2011 in France 42% of this group lives below the poverty limit. (back)

- Poverty is worse, according as it lasts longer. On p.551 in Modern labor economics it is concluded, that in the North-American income distribution a higher family income will lead in the future to a higher average income of the children. For parents who earn $1 more than another family, the children will earn $0.60 more. In this manner the poverty is reproduced across the generations. However, note that the relation between the cause and the consequence (causality) is unclear. For, it is definitely conceivable, that good parents have the skills to earn more. (back)

- This principle appeals to common sense. Nevertheless, politicians can change their views under the pressure of a social lobby. In this manner the PvdA, D'66 and the PPR (now a part of Groen Links) came in their coalition agreement Keerpunt 1972 to the conclusion (p.19): "The norm allowances in the General Assistance Law are made identical to the nett minimum wage". The same can be read in paragraph 15 of chapter 3 of the PvdA election programme 1971-1975. This also demands, that the minimum wage (and therefore also the assistance!) rises faster than the average wage! According to paragraph 16 the basis retirement pension (AOW) is also made identical to the nett minimum wage. Since then common sense has fortunately gained ground. Yet p.122 in Mythen der Ökonomie seriously asks the question: "Warum werden eigentlich Menschen, die zu Gunsten anderer auf einen Arbeitsplatz verzichten, nicht von der Gesellschaft belohnt?" (back)

- A lot of research has been done with regard to the incentives, that stimulate an individual to offer ta working hours. On p.28 in Labor economics an empirical equation is proposed, namely ta = α1×w + α2×R + Σn=3N αn×Tn + ε. Here the αn are empirical constants, w is the hourly wage, R is the non-labour income, the Tn are N-2 specific properties of the individual (residence, age and the like), and ε is a stochastic variable, which is determined by the other personal properties. Here it is especially striking, that apparently ta depends on the other incomes R, which can include among others aid and assistance. (back)

- It is sometimes suggested, that universal assistance will be more generous, because the middle class itself has an interest in it. See p.404 in Economics of the public sector. Your columnist is not really convinced by this argument. The reverse argument is perhaps equally convincing: a generous system pushes the costs for the middle class up, and even more when it is universal. Then the middle class will prefer an austere system. (back)

- See paragraph 8.5 on p.340 in De architectuur van de welvaartsstaat opnieuw bekeken. (back)

- This is actually quite logical. On p.403 in Economics of the public sector the case of agriculture is mentioned, which is a warm adherent of food stamps. Stiglitz does not judge about this form of rent seeking. But your columnist believes, that the choice for forms of assistance must be made by the needy, and not by the producers. A similar situation is found in the development aid, which is used by donors for stimulating the domestic industries. (back)

- Naturally even during the seventies not everybody was satisfied with the then applied policies, which based on an unsound image of man and on economic misunderstandings. In the Netherlands for instance the economist F. Hartog protested against the government policies. See the reprint of the column Sociaal paradijs op een economisch kerkhof? (1980) on p.163 and further in De economie, de macht en de mensen (1982, Coutinho BV). Incidentally, already during the crisis years of the interbellum the state initiates work expansion and work provision. In fact the work provision is even older, because already during the twenties the province of Groningen supplies work in order to combat the season's unemployment in agriculture. Similar projects have even still been executed in the years immediately after the Second Worldwar. Nonetheless, Mythen der Ökonomie is not enthusiastic about activation. On p.143: "In Bereich der Arbeitsmarktverwaltung etwa flankiert zunehmend ein System der Überprüfung, Überwachung und des Unter-Druck-Setzens von Arbeitslosen die Arbeitslosenunterstützung, mit dem Ziel der 'Aktivierung'. (...) Die Eliten, die materiell unabhängig und abgesichert sind, versuchen mit dem Schlagwort 'Eigenverantwortung' sich selber von ... Verpflichtungen zu verabschieden". This is an odd image of man, which ignores, that precisely the same elite has designed the welfare state. Incidentally, even in the United States of America there was some resistance against activation. On p.412 in Economics of the public sector one reads: "Some in the policy debate worried that there were many welfare recipients who could not function effectively in the labor market. These advocates argued for large exceptions from the work requirement. (...) What would happen to the 'hard-core' welfare recipients, amounting to perhaps a quarter or more of the recipients - those with few skills and little interest or ability to acquire them?". With such "friends" the poor people do not need enemies! On p.407 Stiglitz mentions the negative income tax, which is a kind of unconditional basis income. His main objection is, that it discourages working. Incidentally, the aversion against activation is also found with the American economist J.K. Galbraith, whose ideas are popular among social-democrats. On p.221 in The affluent society (1958; 1999, Penguin Books) he states: "It is impractical to pull the uneducated, the inexperienced and the black workers into the labor force and into jobs. (...) The immediate solution is a source of income unrelated to production. (...) If the individual can not find (or does not seek) employment, he or she has this income on which to survive". Your columnist was slightly shocked when he read this paragraph, forteen years ago. (back)

- See p.237 in Modern labor economics. (back)

- See p.231-232 in Modern labor economics. (back)