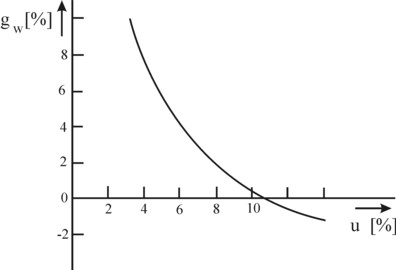

Figure 1: Phillips curve

Since the seventies of the last century the demand side policy has lost much of its popularity. The present column sketches the developments of the political debate at the time. For this purpose, first the views of the then leading persons Den Uyl, Lubbers, Kok, and Wagner are analyzed. Next the rise of the new theoretical ideas are sketched. The demand side policy bases on the Phillips curve. The economists Friedman and Lucas doubt its validity, and stress the importance of the adapting and rational expectations.

Since the Second Worldwar the economic policy makers hoped to be able to control the conjuncture by means of a demand side policy (also called Kaleckian-Keynesian policy). That policy is underpinned theoretically with the IS-LM model. This shows, that the activities can be stimulated by means of an increase of the investments or the money quantity. It is true that for many decades the modern industrial states succeed in avoiding the economic crises and recessions, which until then were a hallmark of the capitalist development. Nevertheless during the sixties the first doubts emerge with regard to the viability of this new policy. And during the seventies the old familiar recessions return as though they had never been absent.

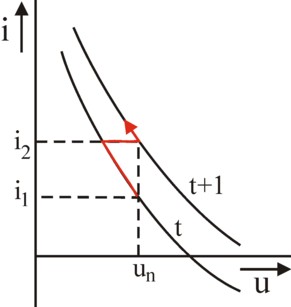

Fairly soon the IS-LM model creates discontent, because it assumes a stable price level. However, in reality during all those years there is inflation, and sometimes even quite severe. The so-called Phillips curve shows that the inflation is logically connected to the economic activities. She is presented in the figure 1. In 1958 the New-Zealand economist A.W. Phillips discovers the curve, when he depicts the wage fluctuations in England between 1861 and 1957 as a function of unemployment u (short for the English word unemployment). Define the symbol w (short for the English word wage) as the nominal wage level, t as the time, then the growth rate of the wages is expressed as gw = (∂w/∂t) / w.

The unemployment u requires a closer inspection. The state has N citizens, who could work, considering their age. At present that time interval ranges between 15 and 64 years. However, a part of this group does not enter the labour market, for instance because they receive education or keep house without pay. The percentage of the N citizens on the labour market is represented by the participation rate τ. Suppose that there are Λ unemployed. Then the unemployment rate u is defined as Λ / (N×τ). That is to say, the unemployment is measured with respect to the group of citizens, that truly want to work. It is remarkable that the employment is measured with respect of the whole group N. It is (N×τ − Λ) / N. In the remainder of this column the participation rate is ignored. In other words, for the sake of convenience τ=1 is chosen.

So the Phillips curve is simply the empirical relation between gw and u. It seems that the sketched behaviour of the function gw(u) is logical. For, according as the unemployment diminishes, the workers can demand a higher wage from their enterprise. Thanks to the Phillips curve changes in the price level can be integrated in the IS-LM model. Then one obtains the so-called AS-AD model. This model describes the productive supply curve and the consumptive demand curve on the national market. Since the model considers the aggregate state, the market behaviour depends on the price level P. The price level commonly tends to rise permanently, and this is called inflation. Mathematically the inflation is represented by i = (∂P/∂t) / P. In other words, suppose that Y is the nominal value of the national production. Then the model shows how the inflation varies with the real product Y/P.

Actually the AS-AD model is fairly simple. Namely, according to the IS-LM model there are usually inactive production factors, and that creates room for stimulating the activities. The entrepreneurs keep some spare production capacity for use during times of prosperity. That makes the activities flexible. However, the Phillips curve shows, that the use of reserves causes additional costs, such as wage rises. They become visible on the market as inflation. Therefore the AS curve rises, according as the activities Y/P increase. The shape of the AD curve can be derived from the Fisher equation P = M×U / (Y/P) (in German: Verkehrsgleichung). In this formula M is the money quantity, and U is the circulation velocity of money. It is clear that the AD curve is falling, according as Y/P increases. For a fixed M×U the consumptive growth is only possible during a falling inflation (des-inflation). Just a single price level equilibrates the demand and supply.

The AS-AD model can in principle be reconciled with the demand side policy, although difficulties arise. More attention must be paid to the control of inflation. Politicians and economists are never pleased by rising wages, because these make the production more expensive. The additional production costs cause a price inflation, unless they affect the profit. And the inflation again affects the national ability to compete. Nevertheless the politicians have always liked the policy of stimulation. For instance, in 1969 Georges Pompidou said: "Entre le chômage et l'inflation, je choisis l'inflation"1. Note furthermore, that any demand side policy is finite. At a certain moment the investments create new production capacity, so that the activities have structurally increased. What remains then, that is the redemption of the borrowed capital.

Unfortunately during the seventies it turns out that the demand side policy is no longer able to generate growth. The present column analyzes the failure of the demand side policy in two ways. First, it is sketched how during the seventies and eighties the Dutch politicians and the social partners react to the return of the recessions. Next several economic models are described, that explain why the policy fails.

In 1973 and 1979 oil crises occur, which push up the oil price and stir up the inflation. Thus the spending power of the people diminishes, and the modern industrial states slide into a recession. They try to fight this development by means of the Kaleckian-Keynesian policy of stimulation, but that does not suffice. The unemployment u remains unacceptably high, compared to the then standards. The policy makers are obliged to reflect on the new situation, and begin to understand that the oil crises have caused a structural damage to their economies. The malaise is not temporary. This paragraph sketches how the views of the various Dutch politicians develop. Typical for the then debate are the views of the social-democrat Joop den Uyl and of the christian-democrat Ruud Lubbers. The views of the entrepreneur Gerrit Wagner and of the trade union leader Wim Kok are representative of the markets, and are also analyzed.

J.M. den Uyl is the prime minister between 1973 and 1977. During that period he develops his political dogma's, which he will propagate until his death. His political heritage is the volume De toekomst onder ogen, which appears in 19862. In the following discussion your columnist mainy consults this work. According to Den Uyl for instance the Organisation of economic cooperation and development (in short OECD) for a long time believed that the recessions after the oil crises were temporary. At the time she advises to stimulate the economy by means of more market operations. However, around 1980 she starts to realize, that the economic growth rate has become structurally less. Den Uyl sees a coincidence of three factors (see p.37).

First, the raw materials and fuels become scarce and thus expensive. This also includes the shrinking option to exploit the environment. Second, the consumptive demand diminishes, because the most urgent needs of the people in the west are satisfied. And third, the decolonization has removed the colonial trade. This is actually a new form of globalization, where the new emerging states change from provinces into competitors. Den Uyl believes that all these changes are so radical, that an automatic recovery will no longer occur. He thinks that the increased unemployment is structural. A restructuring of the economic activities is unavoidable. Now Den Uyl makes the striking plea to introduce more planning. In this manner he surprisingly returns to the plan-ideology, which the SDAP propagated during the interbellum.

At that moment the economy is in a state of stagflation. That is to say, despite the rising unemployment and malaise the wages and the prices continue to rise. The Phillips curve is no longer valid. Den Uyl wants to combat the malaise by means of a policy program of four points (see p.49, 125, 144). The available labour must be redistributed. And the welfare state must be reinforced. The state must manage the technological development. And finally the international ordering must be achieved. Den Uyl hopes that the order will give the state control over the investments. Incidentally, he believes that the redistribution of labour and the curbing of technology is only possible within an ordered system (see p.91). The reinforcement of the welfare state leads to a growing collective sector. Although Den Uyl recognizes that there the labour productivity is rather low, he puts up with that fact.

His argument is essentially ideological. Den Uyl rejects the stepping back of the state in favour of the market, because this would hurt especially the less capable people (p.64). An aggressive society would result. Den Uyl gives a high priority to the protection of the social benefits. Here one recognizes the kind equality of De Beus. The redistribution of work also implies a reduction, with a working week of 36 hours in 1986, 30 hours in 1990, and 25 hours in 2000 (p.136). Still in 1986 Den Uyl pleads in favour of demand stimulation: more education, urban renewal, and cultural services (p.178). And even in 1985 Den Uyl wants to return to the guided wage policy, which was abandoned in 1982 due to the agreement in Wassenaar bij de Stichting van de Arbeid. It is remarkable that he is supported in that wish by the well-known economist Jan Tinbergen. Perhaps he hopes that the inflation can be controlled in this manner.

In that period the inflation is still alarming. Therefore it seems obvious to restructure the supply side of the market, that is to say, to reduce the production costs by means of austerity. However, Den Uyl rejects austerity, because he believes that the situation is comparable to the Great Depression of the interbellum. He is convinced that in this manner the demand side will shrink too much (p.53). Thus the inflation must be curbed in another way. When the state orders the economy, then he can make long-term commitments. Here he opposes the OECD, which advocates more market operations. He is convinced that the order will also at the global level further the global trade. Incidentally, this does not necessarily require competition. On p.98 he returns to the old socialist suggestion, that the Third World can be provided with the production surplusses of the west3.

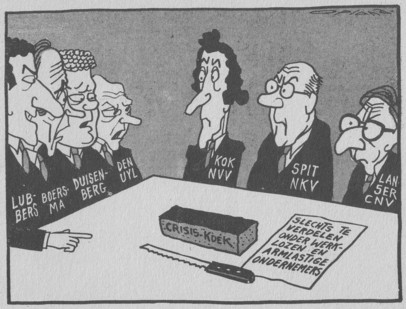

Ruud Lubbers is the prime minister between 1982 and 1994. In 1991 he publishes the impressive volume Samen onderweg, where he explains his views with regard to a wide variety of policy domains4. Your columnist consults this volume for the presented analysis. Lubbers identifies the same causes for the recession as Den Uyl. However, he suggests other solutions, because he wants to combat the recession at the supply side (see p.212). Therefore he wants to make the state more efficient, for instance by reducing the regulation and the bureaucracy. According to Lubbers the (excessive) planning and ordering are a part of the problem. The stimulation of the demand side, advocated by Den Uyl, merely further increases the inflation. The state can economize by transferring some of its activities to the private market.

In any case the collective sector must shrink (p.217. 224). Moreover, the principle of benefit can be applied more often. In other words, those that benefit from provisions, must make an individual contribution. And the people must be made more conscious of their own responsibility. It is interesting, that at the time Lubbers already proposes to demand a service in return from the unemployment benefit (p.218). For instance, the unemployed can help in the quaternary sector. That fits well with the caring society, where everyone feels responsible towards the others (p.231). The principle of benefit can also be applied in deregulation, namely by decentralizing the policy.

Thanks to the shrinking collective sector and the falling social costs the spending power of the employed rises, without the need for a wage rise. That strengthens the competitive power on the world market. And for the time being the benefits are decoupled from the wage development, because the poverty trap must be eliminated. Lubbers advocates a flexible way to redistribute work. He prefers part time employment above a universal reduction to 36 hours per week. And the early retirement is a crisis measure, and not a permanent right. The social security must become a system of solidarity, which concentrates on the truly poor (p.219, 232). It is evident that the political opponents Lubbers and Den Uyl propagate entirely different policies.

Another leading person from that era is Wim Kok, at that moment still the chairman of the Federatie van Nederlandse Vakverenigingen (in short FNV, the federation of trade unions), and later between 1994 and 2002 the prime minister. Here your columnist mainly consults the book Wim Kok - 15 jaar vakbeweging5. Strictly speaking the federation does not propagate political views, because she is politically free and neutral. On p.111 Kok states: "Whether we like it or not as unions, in this case our role is more to react as an interest group than to actively take economic initiatives". But nevertheless the unions are an important social group. Most interesting for the present subject is the automatic price compensation, which since 1965 has been included in all collective agreements. She implies, that the wage rise is coupled to the rise of the price index. Thus in times of inflation yet the real wage remains constant.

The price compensation seems just, but she makes the wage development rather rigid. For instance, during the seventies it turns out, that actually the real wage ought to fall. The entrepreneurs realize this artificially, by raising the product prices, and in this manner erode the spending power of the nominal wage. Thus a wage-price spiral is formed, where the wage- and price-rises alternate. The continuously rising inflation causes confusion on the markets, and undermine the Dutch power to compete. Within a few years she forces the state to intervene in the wage negociations between the social partners., by imposing a wage stop. The trade unions conclude that they are actually powerless. The wage negociations are meaningless, because the compensation proceeds automatically. The state interventions also severely limit the margins for negociations.

In 1979 Wim Kok actually wants to abandon the automatic price compensation, and sounds the employers in the Stichting van de Arbeid. It is true that Kok has a majority for his standpoint in the Federation council, but Cees Schelling, the populist and extremist chairman of the Food union, vehemently protests. Finally, Kok yields to this pressure (see p.94), so that henceforth this is called the "Almost-agreement". It is a moment of weakness, and later Kok regrets this, because it worsens the economic malaise6. But it may be forgiven, because in 1982 he makes a new attempt, which does succeed. This agreement in the foundation has become historically known as the Agreement of Wassenaar.

In the agreement it is arranged that the industry must improve its profits, and as a compensation for the workers the work will be redistributed. According to Kok leisure time is also a wage (p.120). And the wage negociations are again decentralized to the social partners in the industrial branches. Here it is clear that actually Kok prefers the standpoint of Lubbers, and opposes Den Uyl. For, Kok does not like the ordering by means of the automatic price compensation and by the wage policy of the state. Henceforth the unions again take their own responsibility.

Finally in this paragraph the view of the entrepreneurs is analyzed. For this purpose the biography Gerrit A. Wagner by H. van Seumeren is consulted6. In 1980 the cabinet Van Agt I decides to establish an independent commission, which must give advice about the industrial policy. Wagner, the supervisory president-director of Royal Shell, becomes the chairman of the commission. Strictly speaking this type of studies must be done by the Sociaal Economische Raad, or perhaps by the Wetenschappelijke Raad voor het Regeringsbeleid (established in 1972), but at the time both bodies are in a political impasse. They contain too many individuals, that have an interest in conserving the status quo. The commission Wagner is composed of independent experts from all sections of society.

The commission advises in her reports to decentralize the industrial policy7. It is desirable to further the large industrial projects, and for this purpose the commission wants to establish the Maatschappij voor industriële projecten (in short MIP) She will be a kind of bank, with funds originating from the state and the industries. Thus the investment fund is placed at some distance from the state. The commission also advocates to decouple the prices, wages and benefits. Wagner says (see p.187): "In the commission we have strongly emphasized the decentralization, but obviously also pointed to the responsibility of the social partners". Thanks to the changed political-economical atmosphere it becomes possible to conclude the Agreement of Wassenaar.

Wagner concludes (p.199): "The title Elan is chosen on purpose. To suggest, that it concerned the attitude of the peope. I think that this had appeal, a new élan. That other mentality has indeed emerged". Considering all, it is clear that during the early eighties the Dutch social-democracy has entered into a position of isolation. When Wim Kok is chosen as the new political leader the PvdA again integrates into society. That was inevitable, at least if the party is to have a viable future. Thus the question remains, what actually are the scientific arguments to prefer a supply side policy. Why is the alternative of Den Uyl not credible? This subject is addressed in the following paragraphs.

The paragraphs about the theory are based on Volkswirtschaftslehre by Heine and Herr, Politique économique by Bénassy-Quéré, Coeuré, Jacquet and Pisany-Ferry, and Labor economics by Cahuc and Zylberberg8.

Since the Phillips curve is empirical, it is not related to a theory. However, it is possible to identify generally the factors that are relevant for the explanation of the Phillips curve. Cahuc en Zylberberg do this in a profound manner. They propose the mathematical formula9

(1) gw(t) = λ0 + i(t) − λ1×∂i(t)/∂t − λ2×u(t) + λ3×gap(t)

In the formula 1, the λj are constant parameters with values between 0 and 1. The variable gap is the rate of growth of the labour productivity ap. Here ap is defined as (Y/P) / L, with L = N×τ − Λ. The nominal product Y is divided by P, because the productivity must be calculated for the real product. The term λ0 describes the wage change in a static situation, without inflation or unemployment. The inflation terms in the formula 1 show, that both the inflation herself and her change affect gw. For instance, in the case of automatic price compensation gw(t) will rise in proportion with i(t). When the price compensation is based on prognoses, then the effect of the rising inflation will also be included. Here the term of unemployment is made linear in u. And finally the workers or their unions will commonly demand, that the wages follow the rise of ap.

It is sometimes said, that wages have a certain nominal rigidity. For, in practice it is impossible to let them follow all economic changes in a completely flexible manner. The entrepreneurs and unions commonly negotiate about the wage level with intervals of a year or more. Nevertheless it is clear, that a continuous inflation i(t) erodes the spending power of the nominal wage. The real wage (say, its spending power) merely rises with gw − i. The parameter 1/λ2 is sometimes called the rigidity of the real wage with regard to the unemployment. According as this rigidity becomes larger, a rising unemployment u will have a lesser effect on the wage level.

An important variable is the unemployment uI, where the inflation remains constant. For, that situation offers good opportunities for stabilizing the economy. The uI is called in English the nonaccelerating inflation rate of unemployment, or in short NAIRU. For the NAIRU, in the formula 1 the identity i(t) = i(t-1) holds, and therefore ∂i/∂t = 0. In order to find a convenient formula for the NAIRU, a simple model is constructed. Suppose for the sake of convenience that the entrepreneurs calculate their product prices by increasing the wage sum with a constant factor. In other words, one has Y = ν × (w×L), where ν is called the markup. From the definition of the labour productivity it follows that P = ν×w/ap. In terms of growth rates this is simply10

(2) i = gw − gap

Thus the NAIRU is given by

(3) uI(t) = (λ0 − (1 − λ3) × gap(t)) / λ2

Apparently the NAIRU is determined by the technological progress, During the seventies the two oil crises cause a lower productivity, and therefore in a stable situation the unemployment must necessarily be larger than before. The reader remembers, that also Den Uyl and Lubbers draw this conclusion11.

The Phillips curve suggests that the state can realize any desired point on the curve, provided that the policy is chosen appropriately. An increase of the investments or of the money quantity would reduce the unemployment (see the citation of Pompidou). However, since the seventies the economists have become convinced, that the expectations of the people are essential for the economic development. Heine and Herr give on p.286 and further an excellent explanation of the new insight, and she will be summarized here. The illustrious economist Milton Friedman states, that in the long run every society moves towards her own natural unemployment un. In the long run the possible shocks quench, and the inflation also becomes stable. Merely in the short term can unemployment deviate from the equilibrium, namely when people are mistaken about the development of the inflation12.

People continuously adapt their expectations in reaction to the experiences, that they have made in the recent past. But the inflation is difficult to predict for the common citizen. Therefore the real spending power of wages can be estimated poorly, and one suffers from a "money illusion". People are misled by the nominal wage level. The entrepreneurs are more proficient in estimating the inflation than the other citizens, because they are the ones, that determine the product prices. Suppose that at a time t the entrepreneurs increase the wage growth, but are smart enough to make the wage growth lag behind the growth of the price inflation. In formula this is gw < i. Thus the real wage effectively decreases. However, the citizens are seduced by the nominal rise of the wage, and offer more labour on the market. The unemployment falls, such as in the figure 4. In this manner Friedman explains the shape of the Phillips curve.

However, the low unemployment is merely temporary, because soon the workers will correct their false expectation of inflation. Those that have just entered the labour market, will resign again at that time t+1. In this way the society returns to the natural unemployment un. Then the state has failed with its policy of demand stimulation, and is left with an increased national debt. Even worse, there is no reason why the inflation would fall, when the number of unemployed rises again. The Phillips curve is only valid during the money illusion, but not during her correction. The society remains at the higher level of inflation, that resulted from the demand stimulation. This aspect is shown in the figure 4, where the entrepreneurs at the time t raised the wage growth from gw1 to gw2. The red line sketches the covered trajectory.

It is clear from the figure 4, that at the time t+1 a different Phillips curve holds, which is higher than the preceding one at the time t. A wage-price spiral has occurred. The state could again begin to stimulate the demand, but this would merely push the Phillips curve further upwards, without a lasting lower u. It can naturally be asked whether the model of Friedman is universally valid. Your columnist does not have an answer. Perhaps it is uncertain, but the state can naturally not take such a risk. This new view on the Phillips curve has theoretically discredited the demand side policy13.

Cahuc and Zylberberg translate on p.472 and further in their book the just presented qualitative arguments in mathematical formulas. Perhaps it seems a bit overdone, but it is always beneficial to analyze such complex problems from various perspectives. The starting point is still the micro level, where the expectations of the people are decisive. Suppose for instance that the price level is P(t), and the inflation is i(t), then the people expect at a later time t+1 a price level

(4) Pv(t+1) = P(t) × (1 + i(t))

Furthermore, suppose that at time t the people already exactly know the nominal wage level w(t+1). Then the expected real wage level at time t+1 is in their view ωv(t+1) = w(t+1) / Pv(t+1).Insertion of the formula 4, of the approximation w(t+1) = (1 + gw(t)) × w(t), and of P = ν×w/ap leads to an expected real wage of

(5) ωv(t+1) = (1 + gw(t)) × (ap/ν) / (1 + i(t))

Economists commonly assume that the degree of participation increases, according as the real wage level ω rises. On the labour market the supply curve of labour time L is rising with ω. This behaviour can for instance be translated into L = α × ωη, where α and η are positive constants. Note that in this model the people voluntarily choose between a job or unemployment. Friedman assumes that the offered quantity of labour is completely hired by the enterprises. The labour market is in equilibrium. Then the unemployment becomes u = 1 − L / (N×τ) = 1 − α/(N×τ) × ωη. That is to say, one has ω = α' × (1 − u)1/η, with α' = (N×τ/α)1/η. The thus found expression for ω can be inserted into the formula 5, and after some rewriting one finds the result

(6) gw(t) = -1 + α' × (1 − u(t+1))1/η × (1 + i(t)) × ν/ap

In this manner Friedman has derived the Phillips curve in a somewhat other mathematical form. For, according to the formula 6 the people react to the wage growth by preferring a smaller unemployment u. As long as the expectations turn out to coincide with reality, the formula 6 remains valid. However, it has just been explained, that according to Friedman the people are time after time misled by the money illusion. As soon as they realize their mistake, they quickly return to the natural unemployment un.

Halfway the seventies the well-known economist Robert Lucas even rejects the idea of the Phillips curve. His argument is explained well on p.103 and further in the book by Bénassy-Quéré and her co-authors. Your columnist will attempt here to present a summary. According to Lucas the citizens are underestimated, when it is argued that they base their decisions merely on experiences in the recent past. The citizens do think in a rational manner, and can identify certain logical connections. Thus they can predict the future in a fairly accurate way. It is true that they lack the general oversight of the planners and policy makers, but they are very familiar with their own situation. That confronts the policy makers with the problem, that in all their plans they must take into account the rational expectations of the people.

Moreover the citizens are continuously learning. Their behaviour changes due to the executed policy. Therefore a scientific model, that in the past made sound predictions of the social behaviour, will perhaps yield wrong results in the future. Take for instance a consumption function of the type C(t) = c×Y(t-1) + C0, where c and C0 are constants. She supposes that the citizens react slowly and conservatively, in this case in their consumptive behaviour. In reality they often limit their consumption already at the moment, when they expect a shrinking national income Y. Then models, that use the rigid consumption functions, present a distorted picture of reality.

Or suppose that the state increases its expenses in order to stimulate the economy. Then rational citizens understand, that later the state must pay off its debt. That causes an increase of the taxes, which are imposed on the citizens. Therefore the spending program can have the consequence, that the citizens themselves begin to make extra savings for the future. Due to this behaviour the attempt to generate a centrally controlled prosperity will fail14. Of course, in reality the citizens do not always behave rationally. On the contrary, the behavioural economics shows, that people exhibit a subjective behaviour, and are easily affected by emotions. But nevertheless the modern society strongly stresses rationality, and the policy makers need to take this into account.

Therefore Lucas warns, that the state should not use an unexpected and arbitrary policy. For, each time that a state intervention falsifies the expectations of the citizens, a breach of trust occurs. Thus the state will suffer from a loss of credibility15. Reversely, the policy becomes more effective, according as the citizens develop more trust in the state. So it is desirable, that the state always informs the citizens about its policy. There must be a wide social support for the policy. Next the state must stick to the promises, that he has made. That insight is partly the reason for the decision of the European Union to provide the Stability- and Growth-pact with clear rules16.

During the seventies it turns out that the demand side policy does not offer a remedy for the long-term recession. Besides, the social organizations and the entrepreneurs begin to resent the paternalism of the censorious state. The idea becomes popular, that the state can operate more effectively, and that large efficiencies are possible. In France the socialist experiment, that started in 1981 under president Mitterrand, fails after only two years. Moreover, during the early eighties it becomes apparent, that the Leninist planned economies perform badly, and can not be improved. Then Lubbers pleads in favour of a supply side policy. Now, more than thirty years later, his view is supported widely by society, and many of his then proposals have been realized.

At the time the views of Den Uyl and the PvdA are already undeniably falsified by reality. In retrospect one wonders why the party was so averse to the new insights. Your columnist thinks that the misplaced stubbornness must be attributed to the ideological confusion, that at the time ravaged especially the Dutch society17. Besides, Den Uyl will have suffered much from the sentiment, that the victory of the new matter-of-fact mentality implied the definite end of the socialist ideology. Indeed when Den Uyl finally stepped back, the PvdA quickly abandoned the traditional social-democracy.

The return to the matter-of-fact mentality in the society is accompanied by the rise of new scientific ideas. The new theories and models give a central place to the expectations of individuals. This makes clear, that the state can not simply dictate its own policy to society. It is not true, that therefore the old instruments such as the demand side policy have become utterly worthless. But they lose their claim of universality, which they still had for instance under Pompidou and Den Uyl, and become relative and furnished with nuances by the new ideas. Henceforth the most suitable and promising policy must be selected on a case-by-case basis.