Figure 1: Belgian pamphlet BWP

In this column the theory of money is discussed. The functions of money are summarized, and the various types of money and liquidity masses are defined. The operation of the money- and capital-markets is described, and the role of the Central Bank is explained. The exchange rate is explained with a few simple theories, such as the theory of the parity of purchasing power. The meaning of the money quantity is explained with the equation of exchange (Fisher's equation, or in German: Verkehrsgleichung). Finally the theory of monetarism is succinctly analyzed.

The following text is a almost literal copy of the paragraphs 12.1 up to and including 12.6 in the provisional reader Vooruitgang der economische wetenschap, which your columnist issued in 2011 with the publisher E. de Bibelude, a part of the Sociaal Consultatiekantoor. The reader is meant to be an introduction, and that is certainly true for this monetary part, which is superficial in substance - and thus hopefully easy to read. For the sake of completeness it must be remarked, that many citations in the footnotes originate from rather radical left-wing sources. They are more partial and dogmatic than your columnist now (three years older and wiser) finds desirable.

In the preceding columns on this portal the money has played a secondary role. It was merely used as a measure for the value of products, and as a means to facilitate the effecting of transactions. Without money, products could be obtained only by the direct exchange of goods and services. Then the supplier of the product must have a need for the goods, that are offered in exchange. So the use of money makes exchange processes simpler. The money has the additional advantage, that the selling of the product and the buying of other products can be effected at different times. In the neoricardian theory and the neoclassical theory the role of money is limited to these two function, of value measure (numéraire) and means of exchange.

In marxism and the Kaleckian-Keynesian theory money has an additional function, namely as a means for saving. The money can be continuously accumulated, and thus form a treasure. The role of the saved money is commonly instrumental in continuing the production of consumer- and capital-goods. The accumulation of wealth in the dynamic theories allows the savers to invest, so that more modern and efficient machinery can be bought. In this manner the producers want to gain a technical advantage over their competitors. Besides, the savings are mobile, because the banks use them as a security for their loans.

This portal has hardly discussed the price of the factor money capital. In most theories it is merely assumed, that the invested capital must have a certain profit rate r, and that the producer prefers the production technique with the largest r. The producer has probably financed his investments by borrowing capital, and a part of his profit must be shared with the capital lender, in the form of interest. However, the height of the interest rate remains undetermined. Only in the neoclassical paradigm a definite price of money capital is derived, in the form of the marginal product of capital. However, here the problem is, that a price change of the money capital has unpredictable effects.

Interest as the price of money capital is not the usual regulator of demand and supply, in the manner that is observed on product markets. The economic theory of monetarism even defends the view, that the money is the dominant factor in the macro-economic developments. Yet as an ideology this opinion relates to the neoclassical theory, and therefore at the start of the twentieth century she is part of the economic mainstream1. Also the economist Keynes, who is formed according to the traditional economics, has during the elaboration of his conjuncture theory performed extenstive studies about monetary phenomena. This has not been discussed on this portal, since in the columns about the conjuncture mainly the ideas of the theoretical free-thinker Kalecki have been presented.

However, the meaning of money and its derived magnitude capital, as well as the theory of monetarism, are too important for the functioning of the economy to ignore them. Therefore attention is yet paid to several monetary theories2. In particular this column aims to give the reader sufficient insight into the role of money, that he or she is able to judge the reliability and the limits of the previously discussed economic theories. The themes are mainly selected with respect to their relevance for the previous columns. Therefore this column consists mainly of definitions of concepts and institutions in the financial sector (although later also a model will be discussed). It is not attempted to be complete, since then due to the large quantity of studies and publications a separate portal would be needed.

In summary, the following functions of money can be distinguished:

The course of history shows a large diversity of money forms. In the past several thousand years the metal money coins, often of rare metals such as gold and silver, developed into the dominant form of money. Since the seventeenth century, in Europe an increasing use was made of securities, such as bills of exchange and bank-notes. Originally any bank could issue her own notes, but in the nineteenth century this activity was centralized and monopolized in all states. From that moment onward the Central Bank had the sole right to issue bank-notes. The coins and bank-notes together are called the chartaal money in Dutch.

The metal money has been essential in the monetary history, even after the arrival of the paper money. The metal money looks trustworthy, because it is a material product with a proper value. Originally the nominal value, indicated on the coin (for instance the British Pound Sterling, which refers to the weight of silver), approximately matched the real value of the rare metal in the coin.

After the gradual introduction of the paper money the states continued to hold large gold reserves, so that the public could always exchange the paper money for gold. This system of exchangeable paper money is called the Gold Standard. For centuries, the rare metals (usually gold, sometimes silver) were the only accepted means of payment in the international trade, because foreign coins (currency, valuta) were not trusted3. The Gold Standard was maintained even after the Second Worldwar, although the exchange of paper money for gold was restricted to the American dollar. Only in 1971 has the coupling to the gold been abandoned, without any serious problems4.

In spite of the emergence of the Central Bank the private banks have kept their role as money-creating institutes. For, the customers can loan their chartal money to the bank, which in return opens a transfer account for the customer. The bank is obliged to pay the giro-money in chartal money on request, so that the giro-money is also completely liquid. This is in itself not yet the creation of money, because the chartal money is simply replaced by the giro-money. However, an important task of private banks is the supply of bank balances to customers, who temporarily want to transform their fixed assets into liquid means. Then the customer does not deposit liquid means, but offers his fixed assets (usually real estate) as a guaranty for the transfer account. He borrows money from the bank, who in this way has created money.

For, in his turn the bank guarantees the deposit in the giro-account, when the customer uses it to make payments to third parties. In fact such a giro-balance is a mutual acceptance of debt: namely, the bank guarantees the expenditures of her customer. The created money is in principle covered by the assets as a guaranty, although the valuation of their real value is always affected with some uncertainty. However, the Central Bank forces the private banks to maintain a prescribed quantity of reserves in chartal money. In this manner the Central Bank disposes of the power to determine the total quantity of giro-money in the circulation. The chartal and giro-money together form the primary liquidities. The quantity of primary liquidities, that is possessed by the public (and so not in the cash of the money-creating institutes), is called the primary liquidity mass or as a symbol M1.

Besides the banks have developed many forms for saving, that are short-term and almost liquid. An example of such an investment is the short-term deposit. The customer lends his superfluous liquidities to the bank and in return receives a compensation in the form of interest. All these forms of saving together, with a currency of two years or less, are called the secondary liquidity mass5. The sum of M1 and the secondary liquidity mass is called the domestic liquidity mass6, or M3 as a symbol. So there are various categories of money, which mutually are distinguished by their mildly different liquidity. In the monetary policy of for instance the Central Bank the magnitude M3 appears most frequent of all these categories. Further on a short discussion will be presented about certain securities, which are considered to be "near money".

The diversity in the categories of money, that are available, is extended further by the trade in various types of asset titles. An asset title is a judicial claim on a certain property. That can be a claim on someone, or a security, such as shares or bonds. The currency of the asset title can be limited, but that is not obligatory. For instance, a share has in principle an endless validity. The demand or excess of liquidity determines whether the market traders will transform their long-term asset titles into short-term and vice versa (portfolio management). The market traders commonly base their demand for a certain degree of liquidity on the plans, that they have made for the long term.

The economist Keynes has pointed out, that the people are inclined to keep more liquiditity than is strictly necessary. He mentions two causes. The households and other market traders prefer to dispose of cash, in other words liquid means, because they can pay unexpected expenditures with it, such as defective appliances. Keynes calls this the precaution motive. Another cause for the preference for liquidity is the speculation motive: the market traders want to be able to buy possible unexpected "windfalls". The actual content of these cashes is subjective and thus a source of uncertainty. According to Keynes, in unfavourable conditions especially the speculation cashes can stifle the economic activities7.

The money market concerns asset titles with a currency of two years or less8. Small market traders rely for their transactions on the private banks. They pay or receive for respectively a credit or a debit the interest, which is prescribed by the bank, as a compensation. Besides, there exists a wholesale market for money, which is accessible by the banks, the government, the investment funds, and the insurance companies. The height of the interest rate is determined by three factors:

Especially the first component of the interest compensation has always been the subject of heated debates, because it does not originate from the costs of the banks. It is simply the income, that is acquired due to the accumulation of money. The preceding text has already cited the statement by Keynes, that this reward is indispensable for overcoming the liquidity preference. In the neoclassical view the height of the interest rate is determined by supply and demand. It is simply the equilibrium price, that must not be interfered with. This equilibrium is fixed by two factors, namely the propensity to save and the productivity of the available investments9. On the other hand, Keynes praises the interest rate as a useful instrument, that indicates the profitability of investments. It helps the state to correct instabilities in the free market10.

Marx believes, that capitalists will acumulate money by necessity, in order to invest in even smarter and more productive machines. A capitalist, who stops accumulating, can not survive, because his enterprise will be pushed from the market by more productive competitors. Therefore the money market can always (without compensation) dispose of accumulated money, that is kept apart temporarily for doing future investments. Then the cause of the mentioned first component of the interest compensation is simply the brutality and power of the accumulating capitalist.

The preceding columns have already referred to the controversy concerning the long-term future of the interest rate. According as the stock of capital goods continues to grow, less profitable investment possibilities will remain. The capital becomes less and less productive, because it suffers from the law of the falling surplus value. In the marxist theory this takes on the form of the tendency for the rate of profit to fall. For this reason, the neoclassical economists predict a falling interest rate, unless the decline is compensated by the progress of the technique and the new investment properties. On the other hand, Keynes calls the interest rate an obstacle, that prevents the execution of investments with a low productivity.

It has just been mentioned, that the private banks must maintain reserves with the Central Bank, that allow them to absorb the fluctuations in the demand for liquid means. For, the banks supply more giro-money than they have liquid money in cash. Within certain limits this is reasonable, because the account holders will never together transform their bank balance into liquid means. Therefore the Central Bank dictates, that the private bank must deposit a fraction α of each deposited unit of chartal money on the transfer account at the Central Bank (α<1)11. This is the cash reserve of the private bank. She is less a safety margin than an instrument for the Central Bank for controlling the quantity of money. The bank is permitted to loan the remainder 1–α.

This mechanism allows the money quantity to increase in a cumulative manner, with the magnitude α in the role of money multiplier. For, the loaned part 1–α will flow gradually to the accounts of other banks, and these banks have permission to loan another part 1–α as a giro-account. When the deposit at the first bank has a size G, then this will facilitate new bank loans BL of in total

(1) BL = (1 – α) × G + (1 – α)² × G + ...

It is known from mathematics, that this series can be rewritten as

(2) BL = G / α

The capital market is the market for property titles with a currency of more than two years. A distinction is made between the private and public (or open) capital market. On the private market transactions are done between two parties, such as the contracting of a loan or mortgage, or the investment in real estate. The public capital market or stock-market is located at the stock exchange and is accessible for all. The trade mainly concerns bonds and shares. A bond is an "I owe you", that is issued by the state or an enterprise in order to finance its activities. Bonds are also called government stocks (in German Staatspapiere). The bond has a nominal value (price), and a fixed rate of interest (the coupon interest) is paid.

A share is a certificate of participation in an enterprise, that is owned by a company (partnership). The share has a nominal value as well, but actually it represents simply the property right of a fixed part of the enterprise (indeed literally a share). The nominal value is based on the estimated value of the enterprise at the time, when the shares were issued. The yearly compensation to the owner of a share is called the dividend, and it consists of a share in the profit. Incidentally, the profit is not completely distributed, because commonly a part of the profit will be retained by the enterprise for the accumulation of capital reserves, so that future investments are possible. In bad times no dividend will be paid to the shareholders12.

The nominal value of a bond or share could be interpreted as its recommended price. However, the actual value is determined by the demand and supply on the stock exchange, which is so volatile, that it is called the quotation. This incited Marx to call the capital, consisting of asset titles, fictive (imaginery). The quotation of the asset titles is calculated with the method of capitalization. When at a certain time the average efficiency of capital equals r, and the yearly compensation to the owner of the asset title is P euro, then the capitalized value equals P/r. The experienced profit of the bond can apparently deviate from the coupon interest, that itself does not depend on the quotation. Besides, in the evaluation of the profitability of bonds it must be remembered, that during the redemption at the end of the currency the owner will receive the nominal value and not the quotation value.

The bill of exchange (in German Handelswechsel) must also be mentioned. It is the certificate of a loan between two parties, usually traders13. A well-known example is the drawn bill, where the merchant X gives a loan to another merchant Y. Then the merchant X obliges Y in a contract to pay the sum at a given time to the beneficiary Z. In this construction the merchant X is called the giver or drawer of the bill, merchant Y is the drawn, and merchant Z is the taker of the bill. The bill becomes the property of merchant X. An example can illustrate this: a producer of corn has supplied bales of corn on credit to a bakery. The producer of corn can not really dispense with the borrowed money, because he wants to buy a scythe from a metal producer. Then the producer of corn does not pay the scythe himself, but reminds the baker of the credit. He commands the baker by means of the bill to pay the money for the scythe at an agreed later time. An alternative and more common situation is, that the taker Z of the bill is a bank.

The bill of exchange has a certain currency14. It is used as a means of payment, namely when X needs liquid means already before the date of drawing of the bill. He can transfer his rights as a creditor to another person U. Also U can use the bill again for payments. Thus bills become a part of the money circulation. The transfer of the bill is done by means of the endorsement (indossament). This means that merchant X makes a note on the bill, that his rights have been transferred to U. When later during the drawing the merchant Y can not repay his debt, then U and subsequently X can both be held accountable. According as the bill has been signed by more endorsers, it becomes more reliable. A special case of the transfer of a bill occurs, when the merchant X sells his bill to a bank, and in exchange gets the disposal of a giro-account. Since the bank can not directly transform the bill into money, she will charge a discount tariff on the liquid giro-account of the merchant X.

Furthermore, the trade in derivatives at the stock exchange must be mentioned. It concerns derived products, because they merely fix in a contract an option on the later delivery of a certain good. The buyer of the option expects, that later the delivery will turn out to be a profitable trade, or at least not cause a loss. They are sold among others, because the entrepreneurs want to insure themselves agains price fluctuations. In the past the derivatives were mainly related to the prices of material goods. Nowadays they are applied in a wider sense, such as an insurance against fluctuations of the rate of interest or the exchange rate.

For instance, a buyer can take an option on the exchange of x dollars for y euros, in the expectation that the rate of exchange will rise in the mean time. When the currency of the option ends, then her owner can claim its realization, or leave this under momentary unfavourable conditions. This is also called the currency futures contract. Derivatives are a useful product, because they can mitigate the uncertainties in the trade due to price fluctuations. However, a problem is, that the derivatives can be used to speculate, so that the market is influenced by means of tricks15. The impression exists, that at the moment the trade in derivatives indeed develops in an unsound manner16.

Traditionally each state has its own currency. The international trade has always tried to find a global money. This used to be gold, and in addition the currencies of the superpowers were widely recognized, such as in the nineteenth century the British Pound Sterling and in the twentieth century the American dollar. Nevertheless, there comes always a moment, when the foreign currencies (also called valuta) must be exchanged against another. At that moment the question of their relative ratio of value arises. It is called the rate of exchange, and is finally determined by the trade on the currency market17. The rate of exchange of freely tradable currencies expresses the expectations about the future growth and competitiveness of the concerned state. Just like the derivatives, the exchange of currencies can also be manipulated by groups of speculators, that pursue their own interests18.

Two interesting explanations of the occurrence of rates of exchange are the Keynesian expenditure theory and the spending-power parity theory. The Keynesian expenditure theory considers the balance of X-M. Here X is the value of the export and M is the value of the import. There difference is sometimes succinctly called the export surplus EX. A state with a positive EX satisfies the foreign spending power, so that there is a large foreign demand for the currency of the exporting state. Therefore, the relative value of the currency will rise. Reversely, the foreign currencies are depreciated.

The spending-power parity theory assumes, that the prices of a given product are identical everywhere on the global market. For, if this would not be the case, then the product could be exported from the cheaper state x to the more expensive state y. This is accompanied by a flow of currency from the state y to the state x. Therefore the rate of exchange of the currency of state x will fall (depreciation), so that it becomes more expensive for the state y to buy from the state x. Thus, the rates of exchange are the mirror of the global price equilibrium.

A variant of this theory is able to predict the consequences of inflation on the rates of exchange. This variant is called the relative spending-power parity theory. When the inflation in the state x exceeds the inflation in the state y, then the exchange rate will fall to the detriment of the state x. Namely: let ix be the inflation in state x, and iy the inflation in state y, with ix<iy. Then after some time the price ratio px/py of a given product will have changed into (px/py) × (1+ ix) / (1+ iy). In other words, the new price ratio has fallen, so that apparently the currency of state x has risen in value relative to the currency of state y. The currency of state x is appreciated. This generally implies, that differences in inflation affect the nominal rates of exchange19.

It has just been stated that the Central Bank has the task to manage the money quantity. The so-called Verkehrsgleichung is:

(3) P × T = M × U

P is the price-level, T is the number of (exchange) transactions, M is the money quantity, and U is the so-called circulation velocity of the money. The number of selling actions T is much larger than the GDP, because money is also used for, for instance, wage contracts and the trade of shares and government stocks at the stock exchange. However, these are not included in the GDP, and therefore the national income is less than P×T. There does obviously exist a strong relation between Y, the GDP and T.

Now suppose that the private banks create so much money M, that there are no longer meaningful expenditures T. According to the quantity theory of money (which states that U is constant) this will cause P to rise, which has the consequence of inflation in the economy. The reverse situation occurs, when the private banks hesitate to give loans. Then the money quantity is too small, so that the prices will fall and there is deflation. Both inflation and deflation can not be reconciled with a durable economy. Moreover, the deflation can cause a suspension of consumption, because future price decreases will be expected.

It must be noted here, that the quantity theory oversimplifies the reality20. For, it turns out, that the circulation velocity U is not constant, but depends on the interest rate rk. According as the interest rate increases, saving becomes more attractive, with as a consequence that the households will dispose of less chartal money. In the case of a constant number T of transactions, U must then increase. That is to say,

(4) U = U(rk)

The dependency is such, that one has ΔU/Δrk > 0.

The main justification for the existence of the Central Bank is perhaps the control of the money stability. The Central Bank tries to regulate the money quantity by means of the interest rate. When the banks give too much loans, then the Central bank can raise her basis-refinancing interest (sometimes called discount rate). The banks are compelled to pass these extra costs on to their clients, so that borrowing becomes more expensive. It is expected that this will discourage the demand for loans. The Central Bank can also increase the fraction α of the cash reserves, so that the money multiplier will decrease. And finally, the Central Bank always disposes of a large stock of government bonds. If desired the Central Bank can increase the money quantity by buying extra government bonds on the public capital market, by means of chartal money. She can decrease the money quantity by offering government bonds for sale21.

During the twentieth century the Central Bank has also been used for the reduction of unemployment. When the investments of the commerce and industries lag behind, then a decrease of the interest rate by the Central Bank can give a positive stimulus to the entrepreneurs.

The monetarism is an economic current, with an origin that can be traced back to the late Middle Ages. It was influential until the beginning of the twentieth century, with leading spokesmen such as the economists G. Myrdal, K. Wicksell and (more radical) F.A. von Hayek. The monetarism fell into oblivion by the Kaleckian-Keynesian theory. In the seventies of the last century the inflation became such a problem, that the study of the role of money gained in popularity. Besides, due to the economic globalization it is increasingly difficult to develop a policy of Functional Finance. Especially the economist M. Friedman has contributed to the renewed interest in monetarism. Nevertheless the (post-)keynesians have remained critical with respect to the monetarist ideas. For, it has already been remarked, that they prefer a money-less description of the economy.

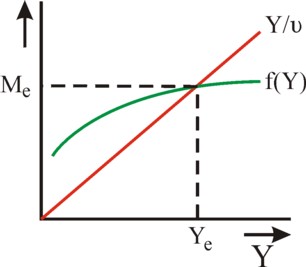

The monetarism states, that the size of the national economy Y is directly related to the money quantity M. The underlying idea is, that the households determine their cash reserves of money by means of the available income. They want to possess sufficient money in order to buy their daily things, but not so much that they needlessly miss the interest. The monetarism assumes, that the money demand L of the households can be written as the equation

(5) L = Y / ν

The parameter ν is called the income velocity, and in the simplest form of the monetarism it is constant. The households depend on the private banks for the supply M of money, since these create money by offering giro-accounts. The shape of the money-creation function f(Y) is not exactly known, but the willingness to create money will fall according as Y becomes larger. For, the banks must take into account their cash reserves, which limits their money multiplier. In the end Δf/ΔY will almost equal zero, so that for large values of Y the money-creation function f(Y) is almost horizontal. This guarantees that f(Y) will finally intersect with the demand function L. The figure 5 depicts this situation in a schematic manner. The point of intersection, where the money demand and supply are in equilibrium (L = f(Y)), determines the natural quantity M of money. This point is called the monetary equilibrium. The formula 5 obtains the form

(6) Y = ν × M

The constant parameter ν is also called the monetary multiplier, because it indicates the effect of a changing M on Y. In a mathematical formulation the marginal form is ΔY = ν×ΔM. The similarity of the formulas 3 and 6 is striking, and implies the relation:

(7) ν = U × (Y / (P×T))

Apparently a constant circulation velocity U and a constant income velocity ν are two sides of the same medal22. The monetarists state, that the natural relation in the formula 6 must not be disturbed. They demand, that the state and the banks let grow the money quantity M in proportion to Y. The disturbing effect of a faulty external intervention becomes clear in the following example: suppose that the national income Y (and thus T) are stable, and the Central Bank still decides to increase the money quantity M by issuing extra banknotes. Then, according to the Verkehrsgleichung (formula 3) the price level must rise. The rising prices will wrongly suggest to the producers, that the demand for their products has increased. They will make additional investments and therefore create a situation of overproduction. In other words, due to the external intervention of the Central Bank the price level would no longer be an indicator of the scarcity of products23.

The strong disciplin, that the monetarists want to impose on the money-creating institutes, makes it impossible to strive for full employment by means of the Kaleckian-Keynesian policy. For, she sometimes requires that the state and the banks create the financial space for additional investments. The policy of the price stability occurs at the cost of the policy for full employment. At the moment, the anti-inflationary policy appears to moderate mainly the wage level, whereas on the other hand the profit rate still increases. Therefore, the post-keynesian economists reject the ideas of the monetarists. They argue, that the money quantity M will commonly adapt to the existing needs in the real economy. When for instance the Central Bank would indeed add too many banknotes to the circulation, then the consequence would be a reduced creation of loans (giro-accounts). Therefore the price level will not change.

For the same reason the post-keynesian economists question the shape of the money-creation function in the figure 5. They argue, that in the case of a rising national income Y the Central Bank will make more room for money creation by the private banks. For instance, in that situation the Central Bank can raise the number of banknotes. Then the cash reserves of the private banks can rise, so that the money-creation function f(Y) will not flatten. In this dynamic situation a monetary equilibrium does not occur. This implies, that the post-keynesians reject the dogmatic idea of the natural money quantity. An additional argument to question the formula 6 is the fact, that some capital owners will always keep large cash reserves. Then a part of M is temporarily idle. During a possible growth of Y this speculative cash can be activated first, without immediately creating new money.

The preceding exposition makes clear that the monetarists and the post-keynesians adhere to entirely different ideas. Unfortunately, the theories both use variables and arguments, that can not easily be measured and verified by means of experiments. Therefore the controversy can not be settled by reverting to comparisons with the reality.