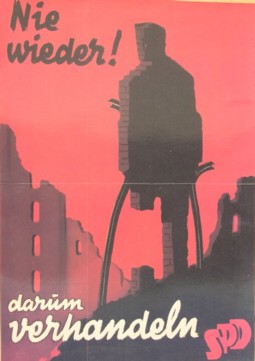

Figure 1: SPD poster

For the time being the European Union is globally the most powerful trading block. Moreover, the united European market is not yet finished, but in full development. That process creates uncertainty, but it also offers chances. The present column tries to sketch this fascinating phenomenon in rough lines. The information is notably copied from Industrial organization in context by Stephen Martin, and from Économie, sociologie et histoire du monde contemporain by Alain Beitone. In addition Economic planning and policies has been consulted1. Next it is sketched how the Great Recession since 2007 influences Europe.

In the following arguments the development of the European market will be explained mainy by means of the economic situation in Germany, France and Great Britain. In the past century the economies of these three states dominate Europe. Moreover, since the early start Germany and France have formed the core of the the foundation of the united European market. This is less so for Great Britain. That state does want to contribute to the realization of free trade, but is dislikes the establishment of a united, regulated European market.

The European market did clearly not start as a system of free trade. On the contrary, from the sixteenth to the eighteenth century the common economics of the mercantilists believes, that the state must intervene in order to protect the national economy. Wealth should be accumulated by means of protectionism, huge restrictions on import. Thus during the seventeenth century the French state under the rule of Louis XIV has studied the needs of France. Subsequently the state has furthered the foundation of more than 400 factories. Here the French statesman Jean-Baptiste Colbert is the driving force. He states that the only real welfare originates from the industrial production by the nationals of the monarch2. During the eighteenth century the school of the physiocrats elaborates on the ideas of the mercantilists.

However, under the physiocrats liberalism is also introduced. The French economist R. Turgot draws the attention to the orthodox slogan laissez faire les hommes, laissez passer les marchandises. Turgot believes that under mercantilism a regulation has been introduced, that favours the incumbent corporations, and at the same time hinders the economic growth. He states that the state monopolies discourage the industry, and leave the commerce to a tiny elite. He pleads among others for women's labour and for the abolishment of the apprenticeship. After the French Revolution of 1789 liberalism dominates in France. Great Britain also embraces the liberal paradigm. After 1815 the well-known classical economist David Ricardo combats the corn laws, which hinder the import of corn. It is striking that at that moment in Germany Friedrich List starts to propagate the ideas of Colbert.

During the nineteenth century Great Britain dominates the global trade, thanks to its strong navy and its many colonies. In this empire liberalism also becomes the common paradigm, and thus Great Britain plays an essential role in the emergence of free trade. This trade benefits the state, because the British industry has a technological lead with respect to its international competitors. The British dominance forces the emerging states such as Germany (united since 1866) and the United States of America (independent since 1776) to protect their domestic market against the British imports (protectionism). France has liberal laws during the nineteenth century, which prohibit any economic organization. However, in practice these are mainly directed against the organizations of labour, because industrial combinations (trusts, cartels) are allowed, under certain conditions.

Since 1848 the national economies become intertwined to such an extent, that the crises become global. In 1873 a long global depressions starts, which again leads to a revolution in economic thought3. Traditionally, the British policy of free trade prohibited the collusion, that is to say, the formation of combinations. However, since 1885 in Great Britain the collusions become allowed. The mutual agreements of the cartel can even be laid down in a "contract", although such a contract has no legally validity. In Germany the cartels also become more popular due to the depression since 1873. Contracts between industrial partners are only forbidden, when they act agains the good morals. A cartel is allowed, when it is necessary in order to moderate the cut-throat competition. The legislation accepts the argument, that otherwise the product prices would durably fall below the production costs during a crisis. In such a situation the contract of the cartel can even be enforced by law, in cases where a member breaks the agreements.

Although it is not yet generally realized, now the second industrial revolution is imminent4. During the seventies the chemical, electrical and automotive industries emerge. They require huge investments, and thus stimulate the popularity of the concentration in the industry. Furthermore, science is applied more as a means to increase the production efficiency. Especially Germany and the USA benefit from the second revolution. In the USA the era of the robber barons begins, a class of extremely aggressive entrepreneurs. In Germany the big industries are supported by the banks. The banks attach importance to security, and therefore are the driving force behind the cartels. This is a phase of unbridled globalization, which due to the lack of international political institutions incites conflicts. It is obvious that during the First Worldwar there is no longer free trade and competition, not even within the national boundaries.

Thus in the interbellum actually the whole of Europe is convinced, that the collusions in the industries are a useful and valuable phenomenon. There is a rising appreciation for economic ordering. This opinion is in stark contrast with the policy of the United States of America (in short USA), where in 1890 the Sherman antitrust act was passed as a reaction to the national robber barons. In this period Great Britain also makes the cartel contracts legally enforcible. When subsequently in 1929 the irresponsible granting of credits leads to the Great Depression, the European states almost naturally resort to protective measures. Great Britain protects its market with customs tariffs, and entrenches itself within the Commonwealth. Nevertheless, in 1932 the global production has fallen with 35%.

Figure 1: SPD poster

The interbellum is also the period, where various new political currents gain terrain. Several large European states are ruled by Leninist and fascist regimes. Socialism maintains its strong position, which it acquired during the aftermath of the First Worldwar. The catholic church propagates since the encyclical letter Rerum novarum the economic corporatism. In the Netherlands the foundations are laid for the economic order of the public branch corporations. It is striking, that precisely in Germany the ordoliberalism emerges (also called the School of Freiburg), which wants to spread the economic power. It pleads in favour of a return to the free competition, because economic efficiency requires sufficient individual liberty.

The result of the Second Worldwar is, that in all European states a war economy is formed, where the state dictates the production. Immediately after the war the scarcity is everywhere so large, that in the beginning during the reconstruction the production must be ordered rigidly. At the same time the experiences with the economic order in the interbellum are so disappointing, that many actually prefer to abolish it. The presence of the North-American liberation power gives an additional stimulus to the regained appreciation for the free trade. The USA occupy a position of power, because they must supply the means, that are needed for the European reconstruction. In 1948 the Marshall plan starts, which serves to finance the reconstruction. At the instance of the USA the Organization for economic cooperation and development (in short OECD) is founded, which propagates the free trade.

The position of power of the USA is already expressed before, in 1944, when at the conference of Bretton Woods a new international monetary system is introduced. In the agreements of Bretton Woods the American dollar becomes the central monetary unit. All other monetary units obtain a fixed exchange rate with respect to the dollar. The International monetary fund (in short IMF) is established as the institute, that supports states financially, when they struggle to maintain the exchange rate. In such an atmosphere it is not surprising, that the European states are inclined to copy the American preference for the operation of free markets. Besides, in the previous years all nationalities and political currents had united in the common struggle against fascism. Thanks to that rapprochement is has become easier to open the national borders.

The North-Americans seize their chance, and bring about that in 1947 the General agreement on tariffs and trade (in short GATT) is accepted. This agreement furthers, that the 23 joining states gradually diminish the customs tariffs. Thus competition rises everywhere, and the enterprises can benefit from the advantages of efficiency, that are realized due to the production at a larger scale. It is striking that the Congress of the USA blocks the foundation of the International trade organization. Worth mentioning is also the formation of the Council of Europe in 1949, at the initiative of Great Britain. The council is merely a platform for deliberations. That fits with the opinion of Great Britain, that free trade must be stimulated, but the cooperation in a federal association is rejected5. Incidentally, the rehabilitation of the free trade does not imply, that all states want to return to an unbridled private economy6.

On the contrary, thanks to the scientific ideas of the economists Michal Kalecki and John M. Keynes the general conviction is, that state interventions are inevitable in order to stabilize the economy. However, henceforth the interventions are at the macro-economic level, and not any more at the micro level of the enterprises and branches. Here there are significant differences between the ideas of the various European states. Great Britain and France welcome the budgetary policy, that has been proposed by Kalecki and Keynes. But the German ordoliberalism is sceptical with regard to that policy. France still employs the industrial planning, that is to say, the economic policy at the branch level. In 1947 this becomes an institution, by means of the establishment of the Commissariat du Plan. France even uses four-years plans, which are firmly supported by the state, although in principle they are merely an indication7.

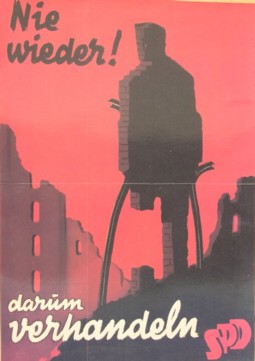

In view of the cultural and political differences it is a small miracle, that in 1951 in the Treaty of Paris the European community of coal and steel (in short ECCS) is formed by six European states, namely Germany, France, Italy, and the Benelux states. The Frenchman Jean Monnet is often called the intellectual inventor of the ECCS. The heads of state prefer economic integration, because the political integration can not be achieved at that moment. The new institution ECCS has the primary goal to further the European peace, because the basis-industries coal and steel are essential for armament. The ECCS has a High Authority, which can enforce certain measures on the member states. Due to the federal and supranational character Great Britain refuses to enter the ECCS. Next the treaty has been formulated in the French language.

The ECCS is a radical reform of the European economic policy, because it prefers with an unprecedented firmness the operation of markets8. The Treaty forbids the formation of collusions in the coal and steel branches. Mergers require the preceding permission of the High Authority. She will only allow the formation of combinations, when they further the operation of markets. Strictly speaking this is not a pure antitrust law, because it merely is a check on abuse. This option has been included at the insistence of France. Neither is Price discrimination allowed. This prevents, that enterprises use low export prices, and compensate these with high domestic product prices. State property is allowed, but not state support. The product prices are determined in negociations, so that the customs tariffs can be abolished.

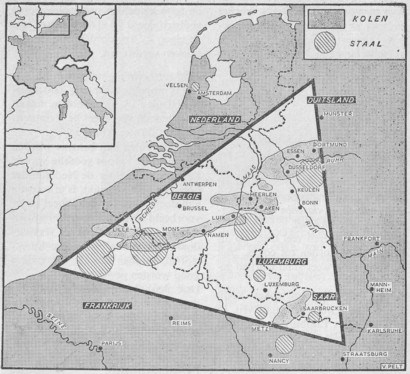

Incidentally, the treaty quickly loses its significance, because the coal and steel branches wither. Partly for this reason in 1957 the six memberstates of the ECCS found in the Treaty of Rome the European economic community (in short EEC)9. Its goal is to form a complete customs union. In other words, the customs tariffs within the community will disappear for all markets. The High Authority is merged into the European Committee (in short EC), the executive administrative apparatus of the EEC. Besides, the community establishes common import tariffs in her outer borders. In principle the import tariffs are a form a protection, which artificially keeps the product prices within the community high. Therefore at the insistance of the liberally minded Germany the import tariffs are kept low. For the time being, France rejects the procedure to decide in the EEC by means of a majority vote.

In the mean time the relation with Great Britain has become somewhat troubled. France does no longer allow its membership of the EEC, because its ties with the USA would be too intimate. In 1960 Great Britain accepts this as a fact, and establishes in the Treaty of Stockholm a free trading zone, namely the European Free Trade Association (in short EFTA). Apparently the traditional competition and hostility return, according as the European relations normalize. France hopes to remain a player at the world stage by using the EEC. However, even within the EEC the integration is slow. For instance, in 1957 Euratom is founded, which should result in a common development of nuclear energy. In practice Euratom develops merely into a platform for discussion.

Fortunately, in 1962 yet another step is made on the road towards integration, namely the formation of the common agricultural policy (in short CAP), where the Dutchman Sicco Mansholt plays a leading role as a euro commissioner. The CAP has the result that a common market is added to the EEC, after the coal and steel branch. Thanks to the CAP the prices of agricultural products become equal in all member states of the EEC. In other words, a certain fixed price is guaranteed for the agricultural products. This has the advantage, that the branch of agriculture in each memberstate (notably France) is incited to become more competitive. A European agricultural fund is formed, which must guarantee the price level of the agricultural products. The CAP has the important consequence, that henceforth the exchange rates of the various monetary units can no longer fluctuate. For that would undermine the price policy.

The system of fixed exchange rates is controversial among economists. For, it blocks for the concerned states the possibility to devaluate the domestic monetary unity, and thus to recover its own international capacity to compete. The Nobel price winner Robert Mundell has shown, that an economic zone can not at the same time combine a free capital flow, fixed exchange rates and an autonomous national monetary policy. This is called the triangle of incompatibilities10. Since the final goal of the EEC is to create a true common market, in the long run the capital flows and the labour mobility will have to be freed. According to Mundell the consequence is, that a member state can no longer at will employ an autonomous Keynesian anti-cyclical policy.

Nevertheless, the fixed exchange rates also have advantages. For, they offer certainty to the entrepreneurs about the size of the export revenues and the import costs. In particular they prevent that malevolent speculators excessively disturb the exchange rates in order to make a profit. Moreover, variable exchange rates seduce the states to devaluate in order to improve the domestic capacity to compete. For all these reasons the member states of the EEC have actually always accepted the system of fixed exchange rates. And for the moment the fixedness of the exchange rates is indeed still guaranteed by the Bretton Woods system.

In retrospect it is surprising that the German and French systems could tolerate each other. It has just been remarked, that after the Second Worldwar Germany builds up a social market economy. That is a rigorous break with its pre-war policy. The ordoliberalism principally rejects the economic planning by the state. The state restricts itself to the regulation of the market, with the aim to support the competition11. All unnecessary industrial concentration is avoided and combatted. In other words, the concentration is not accepted as an inevitable development. Oligopolies are brought under state control. Administrators can be a member of just a limited number of supervisory boards. Several large companies, such as Volkswagen, are privatized. Despite all these measures the German banks keep their traditional position of power in the industry (see the book of Hilferding).

There is a supporting policy for the small-scale industry, with respect to formation, consultation and investments. This is necessary, because German banking avoids the small-scale industries because of the risks. As far as state interventions are needed, they must have a limited duration. Due to the war damage and the resulting housing shortage the state keeps control over the housing market. Germany gives more priority to the price stability than to the employment. In 1969 the SPD seizes power, with the liberal FDP as partner. Although since her program of Godesberg of 1959 the SPD accepts the operation of markets, now the Keynesian policy is also introduced in Germany.

The situation in France is totally different. That state has since Colbert and Bonaparte a tradition of the active state within the national economy. The French state does not have a proper policy to combat industrial concentrations. On the contrary, the state stimulates the mergers of large enterprises. Although president De Gaulle is by no means a socialiest, after the Second Worldwar France adopts a highly planned economy12. It has previously been remarked, that even four-years plans are introduced. In principle a plan can contribute to price stability. However, in France the planning is a political process, where state investments are essential. The policians and trade unions attach less value to price stability. Therefore France must in 1958 yet devaluate its monetary unit.

Since the sixties the micro-economic planning becomes almost impossible due to the progressing opening of markets within the EEC. Then the plans increasingly obtain a general and indicative (guiding) character. During this period France stakes heavily on social investments, aiming at themes such as the labour market, the social security, and the regional development. Despite the intense dialogue the trade unions, which in France are rather radical, reject the various plans. Therefore an income policy is not realizable. Gradually the notion emerges, that planning functions in a mediocre manner, and is too rigid. Nevertheless, during those years France advocates a European planning. Indeed European plans are developed for the long term, but they are hardly more than the bundling of the national policy documents. They are purely informative. They do contain prognoses and attempt to stimulate the harmonization of policy.

Unfortunately the Bretton Woods system is increasingly pressurized by the exorbitant expenses of the USA, notably for paying the war in Vietnam. At that moment the government headed by president Nixon doen not respect the European interests, and in 1971 she unilaterally denounces the agreement. Consequently the exchange rate of the dollar starts to float. The EEC has obviously foreseen this development, and during the seventies she eagerly tries to find new ways to at least stabilize the mutual exchange rates. These attempts are thwarted by the occurrence of the oil crises in 1973 and 1979, which push up the oil price and thus stir up the inflation13. During that period the Keynesian policy loses her dominant position, because she is not able to combat the stagflation (stagnation in combination with inflation).

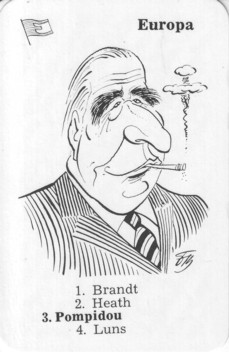

Nevertheless, the EEC continues to develop in a favourable manner. In 1973 Great Britain, Ireland and Denmark join the community. This ends the competition with the EFTA. The membership of Great Britain became possible after the succession of president De Gaulle by Georges Pompidou. Great Britain is evidently a significant power, but it can easily be incorporated in the EEC, because its economic system is a mixture of the French and German systems14. In 1981 Greece joins the EEC, and in 1986 Spain and Portugal follow. Furthermore, the European Act (of a united Europe) is signed in 1986. It prepares three measures: the liberation of the capital flows, the coordination of the monetary policy, and the introduction of a common currency. These measures are necessary in order to enter in the development "free trade → customs union → common market" the final and third phase.

Liberalization must cure the stagnation. In 1981 the social-democratic president Mitterrand of France still tries to oppose the new ideas, and he nationalizes various important economic branches. It is a last twitching of the collective currents (corporatism, socialism, Leninism, fascism), that have so much shaped the twentieth century. But his ultra-left policy fails. After this experience France reluctantly copies the liberal policy of Germany. The political parties abolish their traditional ideology. The Dutch prime minister Wim Kok calls this in 1995 "the shaking off of the ideological feathers". In the mean time in 1989 the East-European power block of the Leninist parties collapses. These developments destroy the already feeble confidence in the centrally planned economy. Everywhere in the world the states deregulate and liberalize their economy. The market economy has won the competition between the systems.

In 1992 the European Union (in short EU) is established in the Treaty of Maastricht, and at the same time the EEC is dissolved. Then the ECCS disappears as well. The power of the European Committee is expanded significantly, in order to be able to sufficiently regulate the common market. Now the European capital flows are indeed gradually freed. And the personal mobility across borders is also liberalized gradually15. In 1995 the former EFTA states Austria, Finland and Sweden also join the EU. A year later the European Stability- and growth-pact is signed (in short SGP). It coordinates the European monetary policy, by imposing upper boundaries on the national budgetary deficit (maximal 3% of the gross domestic product), and on the national debt (maximal 60%). Politicians should not get too much latitude.

Now the developments occur at an accelerating rate. In 1999 the European Central Bank (in short ECB) is founded. After a period of transition the new monetary unit euro is introduced in 2002, at least in those member states that join the euro zone. In the mean time the EU continues to expand rapidly, to for the present 28 member states in 201316. All these reforms and agreements profoundly change the economic character of the European market. Notably the liberalization of the capital flow is a significant limitation of the power of the separate member states. The state obviously continues to make economic plans, perhaps even more then before, but it can no loger enforce these on the private markets17. The European states do not object to their loss of power. In France the Commissariat du Plan remains in existence for some time, but meanwhile it has significantly reduced its ambitions.

The enormous growth of the EU requires a new administrative structure. In 2009 she is fixed in the Treaty of Lisbon. Henceforth in legislation the council of ministers must increasingly share its power with the European parliament (in short EP). The Treaty of Lisbon continues the provisions for preventing the formation of monopolies, that had already been included in the EEC treaties18. The first member of article 101 prohibits agreements, that limit or disturb the competition, because they are irreconcilable with the common market. The third member makes an exception for situations, where the agreements serve the general interest. Article 102 prohibits enterprises with a dominant market position to abuse their position. Thanks to the expanding markets the enterprices benefit from positive scale effects, whereas the regulation prevents the concentration.

Natuturally, the price differences between the member states remain, due to the costs of transportation. But yet the economists expect, that the product prices within the EU will converge. Indeed the convergence appears to occur during the period 1990-200319. The financial markets have been integrated. The stock market grows, and the transaction costs diminish. Thanks to the progressing integration of markets the market performance increases. Since 1990 the state support is reduced everywhere in the EU, and traditional monopolies are abolished. Henceforth the product requirements are formulated by the EC, and no longer at the national level. Now, thanks to the coordinated policy the transformation "common market → economic union" occurs. Within the euro zone there even exists a monetary-economic union. The Lisbon strategy is an agenda of reform, and actually a modern way of planning. In the mean time she has been replaced by the strategy Europe 2020.

The progressing economic integration leads to a demand for more social security. Since the Treaty of Maastricht the EU disposes of the option to formulate directives about the fiscal and social policy. Thus the Lisbon strategy contains an agenda with regard to education, youth policy and ICT. These are often minimal requirements. The European social fund serves to correct the social arrears within the EU. Here programs are developed, which is again a form of planning. However, their execution is left to independent organizations.

In 2007-2008 it turns out that the North-American subprime loans, which have been furnished on a large scale, are unsound. The loans have caused a speculative bubble of real estate, which bursts asunder and leaves behind a large quantity of dubious securities. The liquidity of the banks is destroyed, also in Europe. and the financial crisis is complete. The falling consumer confidence results in a decreasing spending power, so that in 2009 also a productive crisis begins. The nation-states must save the collapsing banks as well as stimulate the spending power. These circumstances together lead for several European states to a crisis of public debt. Notably the southern member states have fallen behind as a result of the various crises. It is obviously interesting to analyse how the EU reacts to this challenge. The developments are still ongoing, so that this paragraph can merely give a first impression20.

In 2010 the European financial stability fund is formed (in short EFSF), as well as the European systemic risk board (in short ESRB). The ESFS is a temporary relief fund for weakened states, and in 2013 it is replaced by the European stability mechanism (in short ESM). The ESRB is a part of the European system for financial supervision (in short ESFS), together with several other supervisors (of banking, insurances and pension funds, and stock exchanges). They are housed in the building of the ECB in Frankfurt am Main.

Furthermore the European Council decides in 2010 to found the European semester. The European semester is the frame for the adaptation of the economic policies of the member states of the European Union. The semester consists of a series of steps, that are yearly made, from january until july. In the semester the economy of a member state is analyzed in its full breadth, contrary to the SGP, established in 1997. That is concerned specifically with the national budget. The semester is executed by the European Commission, in consultation with the European Council.

In 2011 the Stability- and growth-pact has been toughened, and extended with a six-pack of regulations and directives, that demand a more strict obedience to the upper limit of the public debt. When the public debt surpasses 60%, then the usual upper limit of the budget deficit (3%) is lowered to a more severe regime. Henceforth the upper limit of 3% for the deficit has a structural and conjunctural component. The structural component will be reduced to 0.5%. The other measures in the six-pack are more effective sanctions for violating the SGP, more long-term financial planning, and an early-warning system for all states.

The most recent crisis intervention is the formation of the European banking union in 2014. She is based on three pillars: the supervision, the procedure for banks in crisis, and the deposit guarantee system. The supervision on banking is transferred from the national central banks to the ECB. Besides, a standard procedure is formulated, the Single resolution system (in short SRS), in case that nonetheless a bank gets into financial problems. And finally the deposit guarantee system of European banking has been harmonized.

| jaartal | 1951 | 1957 | 1962 | 1978 | 1986 | 1992 | 2002 | 2009 | 2013 |

|---|---|---|---|---|---|---|---|---|---|

| milestone | ECCS | EEC | agricultural policy | EMS | European Act | European Union | euro-zone | Lisbon strategy | ESM |

| place | Paris | Rome | --- | --- | --- | Maastricht | --- | Lisbon | --- |

The European Union is still developing. It seems that during more than half a century the European market has made an enormous progress. But still, on closer inspection this is a bit disappointing, because the political administration does not succeed in keeping pace with the market developments. Thus the European administration remains defective. The European council of ministers is an unwieldy and divided body, that is not able to perform crisis management. During global calamities the EU is hopelessly and uncontrolably at the mercy of the whims of fate. Furthermore, the EU has expanded to the east with states, that do not have a long democratic tradition. They wrestle with their dicatorial past and with a susceptibility for corruption. Thus the EU remains mainly vital thanks to the market, whereas the political alliance is rudimentary and not always conscientious.

In the past half of a century the population has reluctantly begun to identify with the EEC, and even less with the EU. Which Dutchman knows what Poland or Roumania want with the EU? The continuing expansions obviously make the identification extra difficult. Nobody knows where finally the borders of the EU will be. In principle the EU is an imperialistic project, which forever wants to grow. Russia, North-Africa, Turkey and the Middle East could all become member states21. Therefore the judgement about the EU is mixed. On the one hand she is a fascinating project with huge promisses, also for states that are in her periphery. On the other hand, the EU remains vulerable, both for corruption and for a possible desintegration or an external raid.