Figure 1: Concordia quartet

Behavioural economics offers a useful supplement to happiness economics, which is already prominently present on this portal. This column discusses behavioural economics by means of the book An introduction to behavioral economics by N. Wilkinson. First, the phenomenon of the bounded rationality is explained. Next, several special themes are studied, notably the portfolio management, irrational preference functions, altruism and resentment, and the discounting of time preferences. The conclusion is that the homo economicus in traditional economics is irreconcilable with the psychological insights.

This portal has published many texts about happiness economics, most recently in the column about the empirical results, that this specialization has produced. Happiness economics uses satisfaction measurements in order to determine the well-being of individuals. This type of research has shown, that social factor are essential for the human well-being. People value their family, their friends, and morals. These findings have obviously practical implications, but they also have theoretical consequences. Notably they undermine the traditional neoclassical theory, which depicts man as a homo economicus. The homo economicus is a rationally thinking individual, that is completely informed, and always egoistically attempts to maximize his own utility (self-interest).

Behavioural economics, just like happiness economics, aims to correct and add nuances to the traditional picture of the homo economicus. However, the methods of these two specializations are different. Happiness economics bases its studies on interviews with a large group of people. It aims to measure the average utility, which the groups experience in the various domains of life. Thus the human preferences are statistically determined. Behavioural economics, on the other hand, performs experiments under laboratory conditions with test subjects. In these experiments the behaviour of persons in a given situation is studied. Only the behaviour can be observed, and so the opinions of the persons remain unknown. Now behavioural economics tries to yet deduce the opinions, attitudes and feelings of the test subjects from the observed behaviour.

It may be clear, that behavioural economics shoulders a gigantic task. For, the motives behind a certain behaviour can be of any nature. Nevertheless, behavioural economics succeeds in developing convincing theories. It turns out, that man is a highly complex being, that reacts mechanically on the events, that he experiences. Apparently, the homo economicus is merely an abstraction, which in the end is not very realistic. Here it must immediately be added, that its altruistic counterpart the homo politicus is also a fiction. Both the neoclassicial and Leninist paradigms employ an unsound picture of man. Indeed, behavioural economics attempts to develop models, that are psychologically credible. Therefore it is multi-disciplinary, with contributions of economics, psychology and neuro-biology.

The theories of behavioural economics are obviously not able to predict the choice of the individual in a perfect manner. Each person is unique, and reacts in its own way in situations, that occur. There is an enormous spread in the patterns of behaviour. But behavioural economics, just like happiness economics, succeeds in measuring the statistical averages of the human attitude, that express the preferences of the human nature. Often these preferences are merely weakly present, for instance when a certain behavioural pattern is chosen by 60% of the test subjects, whereas then apparenly 40% chooses one or more alternatives. Nevertheless, as long as the measured average is statistically significant, an essential part of human nature has been revealed.

The increased popularity of behavioural economics is mainly caused by the efforts of the Nobel price winner Daniel Kahneman. The present column describes several saliant results of behavioural economics, which are explained in the book An introduction to behavioral economics by the English economist Nick Wilkinson1.

The preceding text makes clear, that happiness economics and behavioural economics supplement each other. The first one measures the human needs, and the second on registers the human behaviours. Entirely in the tradition of the Dutch economist and marxist Sam de Wolff, both specializations study the feelings of pleasure and pain. Yet Wilkinson makes some comments on happiness economics, that are worth repeating here. First, he believes, that pain is not simply a negative pleasure. In other words, he states (contrary to De Wolff), that they can not be simply added. Pleasure and pain (also: utility and disutility, or: happiness and discomfort) differ, because they are registered by separate parts of the brain. Wilkinson does acknowledge, that the most intense of these two feelings can weaken her counterpart. They affect each other2.

When an individual compares pleasure and pain, then this can be called an intrapersonal comparison. According to Wilkinson it is uncertain whether such a comparison can be quantitative (cardinality). Nevertheless, he accepts a cardinal method, because in politics such judgements are inevitable, and they are indeed made. Besides, he states on p.66, that according to studies also the interpersonal comparison is possible, with regard to the intensity of (dis-)utility for different individuals. Therefore he disagrees with the standpoint of traditional economics, which rejects both the intrapersonal and interpersonal comparison of (dis-)utility.

Wilkinson warns, that happiness economists must avoid the so-called anchor effect in their interviews. On p.53 (and again on p.426) he gives an interesting illustration: suppose that the individual is first asked whether he has a girlfriend. Next he is asked about his happiness. Then the individual will base his estimate of happiness on his relation with a girlfriend. The first question anchors the second one. Therefore the ideal is to change the order of these two questions. The reader may now understand better what was meant previously by the mechanical nature of human behaviours3.

The framing of the question can also influence the answers. Nowadays this phenomenon is generally known as the framing effect. A positive question seduces people to give a positive answer. On p.74 Wilkinson compares the two questions "Must parents be forbidden to hit their children?" and "Must children be protected against violence, just like adults?" The majority gives a negative answer to the first question, and the answer is positive for the second question4. The anchor- and framing-effects show, that the formulation of the questionnaire must proceed with the utmost care and precision. The measured indicators must be objective and reliable.

Finally, on p.425 and further Wilkinson elaborates on the desirability to calculate the individual and social well-being by means of utility. For, the conscious reflection on happiness may have the disadvantage, that various small discomforts are revealed. Wilkinson mentions as an example the apparently funny joke, which on reflection turns out to be rather mild. It is regrettable, that Wilkinson has not elaborated on this argument, because it deserves attention. Indeed people tend to equate convenience and happiness. It may well be true, that a sincere and durable happiness can exist merely in combination with a certain challenge and discontent. Thus the Leninist sociologist Stollberg believes that the active attitude towards labour is a more useful indicator for the happiness at work than the passive job satisfaction5.

Similarly, the Dutch economist Graafland gives the example of the compulsory education, which forces young people to educate themselves, and thus increase their later happiness. He calls this rule-utilitarianism. Hedonism must not degenerate into boundless enjoyment. The future happiness must be taken into account. Incidentally, Wilkinson also acknowledges this as a fact, and he even devotes a significant part of his book to the intertemporal choices. Therefore it is strange, that he also supposes, that the hedonistic pursuit of the maximal well-being would be a self-destructive endeavour. Incidentally, he is uncertain about the causality: perhaps especially the unhappy people tend to pursue an increase of happiness. This latter interpretation seems plausible and wise to your columnist. All these controversies illustrate that behavioural economics is complex and many-sided. All in all, Wilkinson apparently does appreciate happiness economics.

The concept of rationality has been discussed many times on this portal, because it is an essential assumption and foundation of the traditional neoclassical economy. Thus a column refers to the views of the Dutch economist P. Hennipman in his principal work Economisch motief en economisch principe6. Hennipman supports the neoclassical paradigm, but states that the individual himself selects (subjectively) his or her origins of satisfaction. Subjective needs are not necessarily rational or reasonable. In another column such an attitude is called bounded rationality, or also irrational rationality. In practice such an approach has naturally only value, as long as some order can be observed in the irrational human behaviours. This is exactly the challenge, that is addressed by behavioural economics (and Wilkinson).

Wilkinson presents an extensive study of irrationality, and even devotes the complete chapter 9 to it. He identifies no less than seven causes of irrational behaviour. Your columnist will mention only the most appealing causes from this list. An important factor are the impulses, that is to say the lack of self-control. People tend to engage in short-term enjoyments, and therefore must give up long-term happiness. Hennipman thinks that this is a respectable choice. However, according to Wilkinson it is (rightly) undesirable, when the total possible happiness during a lifetime is undermined by "myopic" behaviour. Another cause is the desire of people to limit the number of decisions, so that they become "animals of habit". The transaction costs of decisions appear to be too high. Consider for instance the yearly change to a new energy supplier or health insurance (these examples originate from your columnist). However, habits can easily become irrational.

Akin to this laziness is the unwillingness of people to adapt their normes and values to their practical experiences. They prefer to preserve an obsolete norm, even though this may reduce happiness. Wilkinson calls this the cognitive dissonance. A similar phenomenon occurs, when people base their choices on simple rules of thumb (with a difficult word: heuristics)7. A fourth cause of irrationality are the emotions, such as anger. Incidentally, the influence of anger is two-edged (see p.410), because although it is true that it hurts the individual, it also punishes the culprit. Emotional people get the reputation of being very assertive. It may be useful to remind the reader, that the neoclassical homo economicus does not experience emotions.

According to Wilkinson the failing memory is another cause. In fact this is the phenomenon of the preference drift, which has already been discussed in a previous column. That is to say, people expect too much happiness or utility from the property of a certain good. As soon as the desired good has been acquired, the property becomes normal. Wilkinson calls this minimization the ordinization. People can not be euphoric for a long time. This phenomenon also occurs for discomfort, such as the dismissal or the loss of a partner. In fact, here the irrationality is simply a myopic behaviour, comparable to an impulsive attitude. For instance, a television is bought, which on reflection disappoints. Or reversely, an individual hopes to enjoy the excessive consumption of alcohol, because the misery of the last hang-over has been forgotten.

All these causes show, that man is not a rational being, which continuously attempts to maximize its happiness. Wilkinson states on p.387, that people in fact try to maintain a sufficient level of happiness. The drop below a certain minimal level is avoided. The use of simple rules of thumb and of fixed norms and values is generally well suited for guaranteeing such a sufficient level of happiness. They are based on previous experiences. Since two situations are rarely identical, this strategy is somewhat risky8.

Wilkinson describes in his book an enormous amount of models and theories. Behavioural economics experiences in this regard an uncontrolled growth, which is worsened by the fact, that the models are ad hoc and thus restricted in their applicability. Wilkinson acknowledges this on p.442, but he blames it on the pioneering stage. He expects that the unsound models will be abolished, according as behavioural economics gets settled. This is obviously not certain, so that here Wilkinson gets lost in wishful thinking. Nevertheless, behavioural economics has unmistakably done pioneering discoveries. Your columnist has selected several of these discoveries, that have impressed him most. They will be described in the following paragraphs.

The first discovery concerns the management of a portfolio of capital investments. This theme is described in a previous column, based on the common economic theory. Individuals can save their capital in various forms: money, savings accounts, bonds, shares, real estate, rare metals, valuable objects, etcetera. The homo economicus believes that these investments are perfect substitutes for each other, so that the manager of the portfolio will simply maximize its profitability. However, on p.161 and further Wilkinson shows, that the reality is different. For instance, individuals prefer a monetary gift as an increase of welfare above an identical increase of their block of shares (paper profit, see p.162). And the buying propensity of individuals increases, when they pay by means of a credit card instead of cash.

The credit card is a seducive currency. Individuals borrow by means of their credit card, even when they dispose of savings balances elsewhere (p.162). Sometimes the reason is, that savings have a fixed destination, for instance the future scholarship of their children. Incidentally, even the professional investors sometimes behave irrationally. It turns out that they usually manage the parts of their portfolio (bonds, shares etcetera) as separate portfolios, which can not exchange capital. This is perhaps caused by the different risks of the various parts. Nevertheless, the managers tend intuitively to diversify their portfolios (p.177). Furthermore, investors are unwilling to take losses on their effects. They prefer to wait, hoping for a future rise in quotations (p.168). Enterprises are also unwilling to accept losses, and secretly try to shift them to the future.

Such a behaviour can be observed in many situations. For instance, individuals prefer to trade in their used car, when they buy a new one (p.170). And when someone loses his theatre ticket, he or she will hesitate to buy a new one. Reversely, the profit from speculations is often used for new speculations (p.172). In general investors are somewhat "myopic" in their aversion against losses (p.174). In other words, they have difficulty with keeping securities, that are profitable in the long run, but fluctuate in value in the short run. This can partly be attributed to the fact, that the managers must report yearly to their capital providers. Interesting is also, that individuals and groups tend to overestimate their own qualities (self-serving bias, see p.400). This explains the greed of portfolio managers.

In fact speculation resembles a lottery, because the outcome is uncertain. Each part of the portfolio has an outcome, which is unknown in advance. Thus the expected utility (also called preference function) of the part is described by the formula

(1) W(p, x) = Σj=1N pj × u(xi)

The formula 1 describes a lottery with N possible outcomes. The possibility j (j=1, ..., N) has a chance pj of occurring, and then leads to an outcome xj. The utility of the outcome xj is u(xj). For the sake of convenience, pj and xj can be represented by vectors p en x, each with N components. Note, that the lottery has already been discussed in a previous column. It would seem, that thanks to the formula 1 people can easily determine the most profitable lottery. Wilkinson shows, that yet in practice this sometimes fails9.

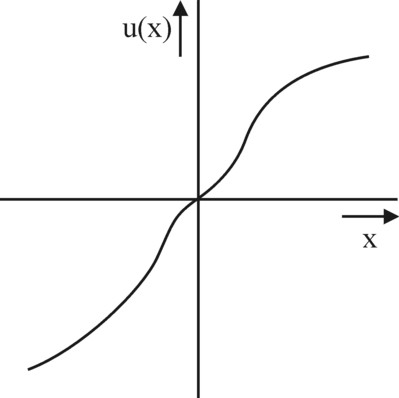

It is obvious that it is desirable to know the form of the utility function u(xj). In the mentioned column it is assumed, that people exhibit a risk-averse (risk-phobic) behaviour. The corresponding utility function is concave. Some experiments create the impression, that this presentation is too simple. Thus H. Markowitz has constructed the utility function, that is shown in the figure 2 (see p.109-110). Note, that Markowitz utility function allows negative values of xi, that is to say the loss as a possible outcome. It is clear that now the utility function is convex for small positive and negative values of xj. The reader may be reminded again of the mentioned column, where the Dutch economist Bernard van Praag applies a similar utility function as Markowitz (without the loss part).

The utility function of Markowitz finds some confirmation in the results of experiments. The convexity for small positive values implies a risk-seeking behaviour, which is indeed present in the human tendency to "take a gamble". The convexity for small losses implies, that in such cases individuals feel much discomfort. Here they act risk-avoiding, such as becomes apparent in effecting an insurance. However, when the losses become very large, then the utility function assumes a concave shape. This means that in case of a large loss the individuals become somewhat numb. Then a further increase of the loss is taken in a resigned and apathic manner. Here the individuals become again risk-seeking. They prefer to risk all in order to reduce the loss.

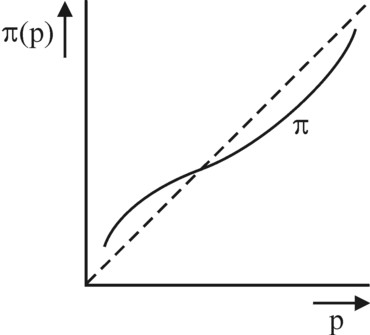

However, the Markowitz utility function alone can not describe the expected outcome of a lottery. This is notably true, when the chances pj are not exactly known. Namely, it turns out that individuals make systematic errors in the estimates of the chances pj. In other words, individuals attach their own weighing factor to the estimated chance pj, and thus change it into π(pj) (see p.95). For instance, individuals underestimate the chance to die due to often occurring causes of death (heart failure, cancer) and they overestimate the chance of an unlikely accident, such as a crashing plane. This implies tha the decision weight π(pj) obtains the shape, that is shown in the figure 3. Various models reach this conclusion, such as the rank-dependent expected utility theory (p.96 and further) and the prospect theory of Kahneman and Tversky (p.115 and further).

The combination of the Markowitz utility function and the weighing factors leads to an advanced model of human preferences. For, the model now separates risk aversion and risk seeking, on the one hand, and the possibilities with a low and high probability on the other hand. Moreover, it turns out that this model gives a fair description of experiments, in any case better than the traditional theory of the expected utility (see again the mentioned column). On p.123 and further Wilkinson shows that Tversky and Kahneman give an experimental proof for their weighing function π(p). It is interesting, that now the human inclination to "take a gamble"can also be explained with the weighing function. For, individuals tend to systematically overestimate the small chance in gambling.

Furthermore, Wilkinson supports the model with the argument, that state lotteries are especially popular in large states. He attributes this fact to the distribution of large prizes. In a large state the individual chance of winning the first prize is obviously smaller as well, but the individuals overlook that fact. An in horse races there is excessive betting on outsiders, which have a small chance of winning. This effect is even reinforced by the preference for risk-seeking with small money sums. All in all this advanced model is one of the most interesting finds of behavioural economics.

In a previous column it has been argued, that individuals value social phenomena, such as collaboration and justice. Wilkinson illustrates this on p.327 and further with many examples. Your columnist will not repeat them here, because then the size of this column would become disproportionate. It may be helpful to reiterate that the homo economicus, which is the main figure in the common economic theory, lacks such feelings of altruism and spite. Therefore the common theory can not explain much human behaviour, and she conflicts with the science of psychology.

On p.333 Wilkinson gives an interesting example of spite, which occurs in the so-called ultimatum bargaining games. In this game with two players A and B, the player A must distribute a certain amount of money G. However, if B refuses the offer of A, then neither A nor B receive anything. The homo economicus will naturally accept any offer, because it will make him richer. However, in practice half of the B-players turns out to refuse an offer of 0.2×G, because they believe that it is unfair. Here, their refusal functions as a punishment of the greedy behaviour of the A-players. Incidentally, most A-players expect this reaction, and therefore 60% to 80% of them make B an offer of 0.4×G or even 0.5×G. The willingness to cooperate increases, when the two players know each other personally (see p.341 and further). The willingness to cooperate also grows, when the game is repeated. Then a process of learning becomes possible.

In behavioural economics several models have been developed for the description of altruism and spite. They are based, either on the assumption that individuals reject inequality, or on the assumption that individuals develop a sense of reciprocity (see p.354 and further). Although all these models are worth studying, here your columnist will focus on the reciprocity model of Rabin (see p.359 and further)10. This model analyzes the social preference of an individual A, when he engages in a transaction with an individual B. The individual A will exhibit a behaviour (strategy) SA, and he expects a strategy SB from the individual B. Thus A expects that the transaction will produce an outcome XA(SA, SB). However, the expected utility UA does not simply equal XA, because the transaction herself can cause an immaterial pleasure or discomfort.

Reversely, the individual B will acquire an outcome XB(SA, SB), at least in the expectations of the individual A. Suppose that the altruism function of A is given by f(SA, SB) = f(XB). This function f has a higher value, according as XB is larger. For, then A acts in a more altruistic manner. However, the individual A must also consider the strategy S'A, that the individual B will expect of A. If B expects that the individual A will employ an altruistic strategy, then B will probably react in a reciprocal manner. In other words, the outcome XA depends on S'A, and obviously on SB. Therefore the altruism function of B, as expected by A, is given by g(SB, S'A) = g(XA). The function g obtains higher values, according as XA is larger. Then B acts in a more altruistic manner. When the functions f and/or g have a negative value, then the individual A expects that he and/or B will act egoistically.

Based on this argument, Rabin proposes the following utility function for the social preferences of A:

(2) U(SA, SB, S'A) = XA(SA, SB) + α × g(SB, S'A) × (1 + f(SA, SB))

In the formula 2, α is a parameter, that expresses the strength of the social preference. When α=0, then A does not dispose of preferences. Evidently, A feels happier, according as g is larger and therefore A expects more altruism from B. That feeling can still be strengthened, when B has also acted in an altruistic manner (reciprocity). Perhaps A will conclude, that B will act egoistically. Then g is negative. In that case A will increase his utility by also acting egoistically, and thus make f negative. This is reciprocity as well11.

Especially at the start of this column the conflicts between utility in the short run and utility in the long run have been addressed. The self-control of individuals is limited, so that they are vulnerable for short-term seductions. Wilkinson suspects, that the impulsive behaviour was once useful in the human evolution. However, the modern society increasingly requires, that individuals can control their urges in favour of a better future. This is apparent, among others, from the willingness of banks to pay interest over the balances of their depositors. According as the saver continues his balance, he will even receive interest on interest. The famous economist P.A. Samuelson has applied this idea on the discounting of the utility of consumption. He tries to determine the aggregate utility U of the consumption c(t) at times t=0, ..., T. In other words, how must the individual distribute his consumption in order to realize an optimal utility?

Samuelson proposes the following formula for the aggregate utility (see p.193)

(3) U = Σt=0T u(c(t)) / (1 + ρ)t

In the formula 3 u(c(t)) is the utility of the consumption at time t. The factor ρ is the discount rate, which is used by the individual in his assessment of the utility of consumption. Since ρ is positive, the individual experiences the consumption as less useful, according as she is shifted to the distant future. The individual will only curb his present consumption c(0), if this makes the utility of the future consumption u(c(n)) significantly larger. Here n is the number of time steps into the future.

Behavioural economics has discovered, that individuals do not apply a constant discount rate ρ. Notably, ρ turns out to be larger in the short run than in the long run (see p.227). Therefore the decision utility in the present deviates from the expected utility, which is realized in practice according to the rational formula 3 (see p.54). In other words, ρ itself is a function of t. It could for instance be assumed, that one has ρ(t) = t1/t − 1, for all t>0. This manner of discounting is called hyperbolic. However, in practice better results have been obtained with quasi-hyperbolic discounting. Then it is assumed that one has:

(4) ρ(t) = -1 + 1 / (δ × β1/t)

The formula 4 merely holds for t>0. For t=0 it is conveniently supposed that ρ=1. The parameter δ must satisfy δ<1. Now choose also β in such a manner, that β<1. Then β1/t will approach the value 1, according as t becomes larger. In the limit of large t-values the relation ρ = -1 + 1/δ will hold, and thus δ = 1 / (1 + ρ). This is a return to the formula of Samuelson. Strictly speaking there is no rational reason for the assumption of a time-dependent discount rate. It concerns here just an experimental observation, which once more expresses the irrationality of human attitudes. When individuals become aware of the irrationality, then they can impose artificial restrictions on themselves, which allow them to resist seducive impulses.

From the psychological perspective, the conflict between happiness in the short- and long-run is the clash between weakness and virtue. There is a multiple self (p.232). Awakening is the memory of the regrets about past moments of weakness. Individuals can choose to purposely reduce their own options. A trivial case is the decision to place the alarm-clock outside one's reach, and thus impede sleeping on. Prodigality can be curbed by effecting a life insurance. This may also explain, why individuals prefer to have a rising salary during their career. Incidentally, an alternative explanation is, that individuals are unwilling to decrease their consumption. Experiments show, that individuals reject a falling wage, even when this would increase their total earnings during the career (see p.208)!

Your columnist lacks the expertise to give a solid judgement about behavioural economics. It does become clear, that the models of behavioural economics are not suited for the development of a general economic theory. The uncertainties are too large, and the models are too diverse. For the present, the value of behavioural economics is mainly due to its revelation of failures in traditional economics. The conclusion is inexorable: the homo economicus does not exist. On the contrary, man is apparently a mechanical being, which again and again repeats his absurd choices and behaviours. And this is a disillusioning observation, which leads to modesty. Behavioural economics is mainly descriptive, and not normative ("thou shalt save"). Yet individuals, enterprises and the state can learn from it, and they must take into account its results. Policy makers must apply the ideas of behavioural economics. They indeed do that, by using their "common sense".