Figure 1: organization

This column describes again the origin and the ideas of the old and the young Historical School. Next it is sketched how the Historical School influenced the American Institutionalists, and in particular Thorstein Veblen. In an evaluation of these ideas an analysis is made of the historical, ethical and antropological aspects in modern economics. Finally it is explained how the neoclassical paradigm has been revived in the Washington Consensus, and again has produced disappointing results.

A previous column has already described the circumstances, that lead to the rise of the Historical School. The present paragraphs elaborate on those arguments1. At the time an important motive is the development of the classisal theory, which starts with the works of Adam Smith and David Ricardo. Their followers, such as the Frenchmen Jean-Baptiste Say and especially Frédéric Bastiat, transform the theory into a dogma. In England the degenerated ideas are defended by, among others, J.R. McCulloch and N.W. Senior. The classical theory, which then has changed into a rather primitive abstraction of reality, was presented as the ultimate truth. She attributes a hedonistic and utilitarian state of mind to man.

However, the reality differed so much from the classical paradigm, that its credibility was affected. Bastiat predicted an economic harmony, whereas at the same time in Manchester the proletariat was ruined in the factories. Moreover the classical scientists did not succeed in advancing their paradigm. A reaction was inevitable, and she came from Germany, where the discrepancies of the classical paradigm became strikingly obvious. For instance in Central Europe the classical theory of free trade had little practical relevance.

In the nineteenth century new economic powers emerged, besides the existing trade empires of England and France. The newcomers, such as the German states, reject the cosmopolitan attitude. They recognize that an emerging economy can only succeed, as long as she applies trade restrictions at the start, in order to protect the native industry against the established big industries. Due to this experience the old Historical School of Wilhelm Roscher, Karl Knies, and Bruno Hildebrand turns its attention to the phase models of the economic development. She tries to build up economics from historical knowledge and from practical observations. Their main publications appear around 1845.

Roscher elaborates on the studies of the German cameralists, who mainly want to improve the operational management. In his view the culture, the laws and the politics determine the economic system. The legislation and the tax system get a prominent place. This multi-disciplinary approach is a hallmark of the Historical School. In fact the old Historical School uses nearly all social sciences, albeit applied in particular to the economic themes. Thus the economics obtains a national imprint. The analysis focuses on the national economy.

Hilderbrand interprets the economy within the framework of the evolution of civilization, even more than Roscher. For instance, he distinguishes between three time phases of circulation, namely in kind, money and credit. He does not like the universal natural laws, which dominate the classical theory of Smith. Knies even states, that the belief in the natural sciences restricts the human freedom. He propagates a historical method, which wants to learn from the similarities in history. Due to the excesses of the predatory capitalism it is logical, that the historians appeal to the ethics and to the morals2. They are interested in the competition between nations and states, and belittle the competition between individuals.

The old Historical School has not succeeded in truly developing its own doctrine. Actually that is not surprising, because the aim of the multi-disciplinary approach is precisely to study the details. But since the classical paradigm does not present a clear perspective, in 1870 the historical approach is revived again by a new generation of German scientists, lead by notably Gustav Schmoller en Karl Bücher. Meanwhile the resistance against the ruthless Manchester capitalism grows, and the social question dominates the political agenda. The young Historical School denies that any economic laws exist. Therefore the empirical studies abound, targeting the developments in time and space.

Expressed in the jargon: the young Historical School wants to use the method of induction, and rejects the deduction of the classical paradigm. In retrospect the Historical School has taken a too one-sided stand in this regard. This is explained by the necessity to undermine the petrified classical doctrine, which requires a fierce style of polemics. At the same time in Germany the Verein für Socialpolitik is founded, in 1872. Also here the multi-disciplinary approach is adopted.

Within the movement there is a strong current, which pleads in favour of the introduction of state socialism. The economic ideas follow the political controversies. Here the French economists Gide and Rist note, that nevertheless this socialism is not a part of the Historical School3. Conversely many of the state socialists do not belong to the Historical School (for instance the well-known economist Adolph Wagner). In fact the School mainly wants to give economics a more realistic foundation. The past must be studied in order to understand the present. Thus the institutions and organizations are carefully analyzed, and the statistics is improved.

The Historians prefer relativism. The economic insights are formed in a historical process, and therefore they are never completed. All knowledge is temporary and conditional. It is clear that this relativism furthers a positive attitude towards the social reforms, which at the time were so bitterly needed. There is always an alternative. It is the merit of the Historical School, that the economics has become more factual. Already during the haydays of the Historical School the neoclassical or marginal theory emerges, which draws attention to the human psychology and subjectivity.

The Historical School criticizes the egoistic image of man, especially from the classical theory, but also from the marginalists. In that image, man is driven exclusively by his own individual pleasure and utility. Knies already notes, that the human motives are diverse, and a separation between them is impossible, even in the purely economic actions. Man is a remarkable complex of both greed and altruism. Here Gide and Rist assert, that even classical economists like John Stuart Mill (1806-1873) acknowledge the presence of altruistic motives4. Of course they are right here, but it can not be denied, that in final instance the (neo-)classical economists still tend to abstract from altruistic motives.

Gide and Rist disapprove of the preference for induction by the Historians. And indeed science is only fruitful, when induction and deduction are combined. However, the scientific situation in 1870 did warrant a correction, and efforts to create a collection of historical and statistical data, like Schmoller demanded. In economics the deduction is often applied too eagerly and frequently. The Historical School has contributed to the maturity of economics. New terrains of research have been opened, such as the econometrics and the analysis of institutions (the so-called institutionalism).

In a broader framework the evolutionary approach of the old Historical School remains valuable. The economic development is intimately connected to the social forces. This requires an interdisciplinary research. Various human interests affect the economic markets, and must be reconciled in an ethically responsible manner. A part of the field of work of the School is now taken over by the sociology. It must be admitted, that the Historical School did not succeed in revealing economic laws. On the contrary, she tried to avoid this. Therefore the Historical School has pulled back, after her results had been acknowledged and accepted.

Incidentally, according to Gide and Rist the sociologist Aguste Comte (1789-1857) has done preparatory work for the Histocial School. In summary, again, the three hypotheses of the Historical School are:

Since this portal is devoted to Sam de Wolff, the ideas of Marx will naturally be considered, whenever the opportunity arises. As an economist Marx bridges the gap between the classical economy and the historical-ethical movement. His theory is transitional. On the one hand, Marx argues clearly in a deductive manner, for instance when he uses labour time as the measure of value, or in his hypothesis of the normal rate of exploitation. But Marx is evidently also the main economist with regard to the social question. He turns the class struggle into an abstraction, and relates her to the distribution of property. In this respect he is both inductive and deductive.

The historical materialism of Marx is a law, which however leads to a theory of historical phases. Thus the various historical forms of production can be related to each other. Here a mixture of induction and deduction is applied in order to predict the revolution towards a regime of collective property. Note that the main works of Marx were already published before the year 1870, when the young Historical School emerges. The rise of marxism and of the Historical School develops as a cross-pollination.

For many decades the young Historical School has a large international authority. For instance, it is generally stated, that the searching study of Beatrice and Sidney Webb has been inspired by the scientific ideas of the Historical School5. Even more important is the influence on economics in the United States of America. There the movement is called institutionalism.

In fact the framework of the institutionalism is even more vague than the one of the Historical School. An early representative of the institutionalism is J.R. Commons6. Commons criticizes the neoclassical theory. He states that the economy is a part of society, with her own laws. Labour is not merely a productive factor, but must also serve the human welfare. Therefore Commons stresses the importance of the trade union as an institution. Also W.C. Mitchell is ranked among the early institutionalists. His work concerns statistics, and mainly focuses on the empirical behaviour of business cycles.

Thorstein Veblen is undoubtedly the leading person of the early American institutionalism. The work of this economist is difficult to judge, especially since your columnist has not read any of his books. Just like many in the Historical School, Veblen criticizes the behaviour of the capital owners, the capitalists. At the time this group exhibited in America a disgusting behaviour of parasitism. Now Veblen contrasts this group with a truly productive group, namely the leading technicians, and in particular the engineers, within the companies.

Whereas Marx states that the working class is the driving force for social reforms, according to Veblen the leading engineers will perform this task. Indeed since Marx the production process has changed its character. The mechanization has advanced further than Marx had ever imagined, and has even become scientific, with assembly lines etcetera. Thus the productive relations between the factor labour and capital change. Since the engineers themselves benefit from capitalism, they prefer a policy of reform instead of revolutions.

The largest merit of Veblen is probably his acknowledgement of this social change - which also changes the balance of power. The degenerated morals of the rentiers, who live upon the interest, are opposed by the zealous morals of the higher technicians. Unfortunately Veblen tries to justify his analysis by using socio-biological arguments. This find is understandable, since the popular works of Darwin had stimulated the interest in all kinds of processes of natural selection, also in the human society. Thus Veblen believes that man has an ethical instinct for work (in the English language workmanship). This is a speculative concept, and therefore not very convincing7.

Moreover Veblen also applies an antropological analysis, which ascribes a money culture to the capitalists. This must explain why they lapse into their disgusting behaviour of laziness and consumption. Next Veblen attacks the neoclassical theory, because she accepts merely the income motive, and ignores the pleasure of work and satisfaction. His finds are all intriguing and original, but your columnist believes that their scientific level is lower than the level of the Historical School.

However, the idea of the class of engineers does produce results. The institutionalism has performed best in this line of thought. Already during the Second World War the political scientist James Burnham states, that the actual power in the economy has fallen into the hands of the managerial class (the so-called managerial revolution). And in the sixties John K. Galbraith develops a model of industrial companies, that gives all power to the so-called techno-structure. These classes or groups prefer to manage their personnel in a humane manner, so that capitalism loses its ugly character.

The Historical School is still influential, even though few people are aware of this. This is illustrated well by the arguments of the economist H.-J. Wagener in his interesting book Konjunktur und Wirtschaftswachstum8. Wagener shows, that indeed appropriate social laws can be formulated with regard to the economic development. Natural causes, such as the geography and the climate, can not explain the differences in welfare. Wagener points out, that in the society various groups compete for power9. It is essential for the growth of the economy, that the bourgeois power dominates, and not the bureaucracy or the nobility.

For, a strong economy requires, that the culture is positive towards the spirit of enterprise. The capacity to innovate determines the economic growth. The urban middle-class and her institutions create the conditions, that allow entrepreneurs to prosper. The institutions and their networks are an important social capital. Europe owes her prominent position in the global economy to this development.

Wagener contrasts the European development with those in Asia. Originally Asia had an economic lead. For instance, China disposed of the art of printing before Europe. And China had an active merchant fleet. But in the Asiatic tradition the traders were despised. The rule was absolute, and it repressed the freedom of speech. Therefore the societies lacked an international and ideological competition. Tradition was important, and richness was wasted on luxury goods and on armies. There were no economic investments. The result was that the Chinese and Japanese economies stagnated for many centuries.

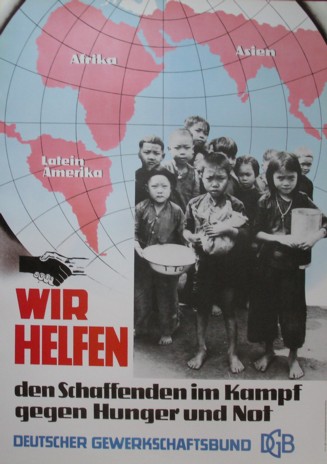

At the time Arabia, India and China failed to develop the institutions for the economic regulation. The Indian caste system does not accomodate the homo economicus, but the homo hierarchicus. Neither is the Leninist homo sovieticus a support for the civil society. Wagener also refers to South-America, which had a quasi-feudal structure for many centuries. He holds her responsible for the arrears with respect to the North-American economy.

In this way Wagener presents a convincing theory of phases. He does point out, that in present-day China grow occurs without the establishment of the democracy. It appears that several paths of growth are conceivable. Interesting is also the argument of Wagner in favour of the protection of the national markets in emerging economies. He argues that the established foreign enterprises have an advantage of scale, and therefore can block the entrance of new enterprises. Neoclassical economists tend to ignore this aspect.

A fascinating aspect of the Historical School is her image of man, which maintains properties such as altruism within the economical behaviour. Economic actions require more than the individual calculation or the will-less surrender10. There is room for social morals. This implies, that man in his decisions takes into account his fellow-man. The person combines the individual and social interest. The individual is rationally and socially reasonable. He forges rights and obligations within his own group. So he can call to account and be called to account. Therefore the knowledge from the anthropology must be integrated into economics. By definition, the anthropology applies induction.

The presence of the morals and ethics makes abstractions supicious in advance, because they can hardly be modelled. For instance, the morals introduce all kinds of discontinuities into the economic actions, because humans will never cross their ethically determined boundaries. For, the values are absolute. Think about human rights. People can not be exchanged and substituted. The indifference curves of the individual become dependent on the utility of the others, in a complex manner. Those "others" can even be elusive, such as in the solidarity between generations, which party are still unborn.

At the micro level the human relations can be modelled as a network. The personal network restricts and increases the personal freedom, and moreover it offers stability. But this is difficult to translate to the macro level. Contrary to the belief of the neoclassical theory, the information is distributed over society in an asymmetric manner. In such a situation it is almost impossible to formulate policy targets. A mandate must be given to a hopefully democratic government, which must make the optimal decisions and not betray the trust of the people11. In the preceding text it has already been explained how Veblen derives the theory of the elite. Indeed such arguments form the basis for the present-day popularity of the meritocracy.

An interesting consequence of the preceding arguments is, that they undermine the economic equilibrium. For, rights and duties can not be exchanged on a market, and therefore they will become unbalanced for certain individuals or groups. Indeed, here the opportunities for manipulation are imminent. The struggle for power breaks out.

Thanks to the Historical School and its heirs it is now known, that economic growth can occur merely under favourable social conditions. Besides, the supporting government policies must always be tailored, with a multi-disciplinary mix of measures. Unfortunately on the global scale the institutions are absent, which could execute such a policy. The International Monetary Fund (IMF), the Worldbank, and the World Trade Organization (WTO) are all focused on a tight economic course, without an accompanying social policy.

It is true that criticism is easy, and it will indeed be done, but one must not lose track of the nuance. Three quarters of the literature about anti-globalization is tendentious and misleading12. Your columnist has consulted the work of J. Stiglitz, who has a sound reputation as an economist13. In the nineties of the last century many developing countries could no longer bear their national debt. They asked for help from the international institutions, and these then invented the Washington Consensus. This approach forces states in difficulties to execute programs in order to adapt their economic structure.

The Washingto Consensus aims to minimize the role of the state, and stresses the need for privatization, free trade, and deregulation. This policy has been propagated by the IMF. It monitors mainly the inflation and the price stability, but ignores the economic growth and the social and political stability. Therefore the IMF does save the banks, but not the states. The Washington Consensus fails with regard to equality, employment, a fair competition, and the transition measures. The IMF dictates a universal recipe. Stiglitz calls this policy market fundamentalism.

In practice the free trade does not result in growth of the developing countries. Apparently the markets do not naturally create efficiency. An equilibrium is needed between the state and the market. Economic efficiency requires some market regulation by the state. Besides, the opening of markets is not symmetrical. Poor states miss the infrastructure, which is needed to bring their products to the world market, and the product quality is too low. And due to the stagnating growth the developing countries do not succeed in paying their national debts. A relief of the debts is therefore necessary compulsory.

Indeed the Washington Consensus was a failure for many states in Latin America. In Africa the IMF dictated excessively harsh austerity policies to the developing countries14. Finally, in 2003 the IMF acknowledged itself, that the liberalization of the capital markets in the developing countries does not create growth. Next the stringent conditions for the adaptation programmes were loosened.