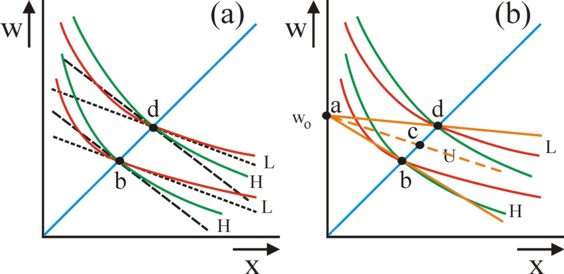

Figure 1: Indifference curves for L and H, and the insurance line x=w

(a) iso-income lines; (b) the insurance lines of L and H

and the universal insurance U (dashed)

An analysis of the welfare state can only succeed, when insight with regard to the income distribution exists. The present column presents a model for describing the social insurance. People appreciate security. Unfortunately, such insurances are amenable to adverse selection and moral hazards. Practical experiences are discussed, with small funeral funds, the insurance companies De Centrale and Bond Moyson, initiatives by the christian movement, and unemployment funds. Private initiatives are merely partly able to offer social security.

In a previous column the income distribution within a certain group or state has been described. In the welfare state the political adminstration takes care, that all citizens can provide in their basic needs. This is a complicated intervention, because it leads to a changed behaviour of the citizens, sometimes in an undesirable manner. The individual autonomy benefits most from voluntary insurances. When this option fails due to human shortcomings, then the state can make the insurance obligatory. If need be, the state itself can pay for the provisions out of the collective means, so from the yield of taxes. In the latter case any illusion of free choice is absent, although the citizens retain their influence due to their democratic right to vote. The present column describes the possibilities to realize the security of existence by means of insurances. This theme is essential for the analysis of the welfare state.

The primary income distribution YP mirrors the harsh economic reality, because certain groups lack an income. The state pension, and the benefits for the sick, the handicapped, the unemployed, students and other unproductive people are missing in YP. In principle the supplementary pension is included, as an income from capital. Thanks to the social transfers yet everybody disposes of an income, which is expressed in the secondary distribution YS. At the same time, this is a curious affair, because a simulataneous performance for the pensions and benefits is absent. The formula u(e, w) = v(w) − c(e), which expresses the individual utility as the sum of the pleasure of the wage w and the displeasure of the effort e, is irrelevant for the transfers.

The transfers have emerged, because the workers wisely have insured the possible loss of their income. A previous column has discussed a model (of overlapping generations), where the workers indeed save for their pensions. Pensions and employment insurances are actually a delayed wage. Sometimes this serves to moderate the fluctuations of income during the life span1. On the other hand, benefits as social assistance principally do not have a service in return by the beneficiary. Anyway, it is clear that the employment insurances are essential for the distribution of incomes. Unfortunately it turns out that this type of insurances has many problems, more still than the usual insurances against damage to objects.

The social insurances are an essential part of the social security. The workers can insure themselves against an unexpected and undesirable reduction of their own income. A good understanding of this institution requires an analysis of insurances in general. For this purpose the present paragraph consults the book The economics of the welfare state (in short EW) by Nicholas Barr2. Suppose that an individual k has an income y. Consider a certain event, which reduces the income, such as (within the context of this column) unemployment, sickness, disability, or old age. Let ζ be the value of the lost income, and let pk be the probability, that this event happens to the individual k (p.103 and further in EW). Then his expected loss is E(ζ) = pk×ζ. Sometimes pk refers to the yearly risks, such as unemployment or sickness. The probability can also refer to a single event, such as disability and weakness due to old age.

In principle the individual k can accumulate his own savings for covering the incidental losses ζ. Thus funeral funds partly have the function of a savings-bank. But the coverage by means of individual savings can be insufficient, for instance when exceptionally often a loss ζ is endured due to extreme bad luck. The savings will also be insufficient in the case of an accident on the job or dying at a young age. However, even when the savings do guarantee a minimal existence, then yet people prefer to insure themselves. Namely, people are risk averse. They experience the uncertainty in their expected income y − E(ζ) as a burden. Each individual k is prepared to give up a sum ηk of his income, provided that he will certainly receive the remainder. This human inclination is a source of incomes for the insurance company.

An insurance company can insure the individual k against the concerned event. The insurer uses the actuarial method to calculate the costs of the insurance. This is to say, he collects information about both ζ and pk. When many people join the mutual fund, then the extreme bad luck of one person is compensated by the luck of others (risk pooling, p.105). The risk becomes collective, and the average loss of the participant can be calculated in advance. Therefore the insurer is risk neutral3. The premium πk of the insured person k does not need to cover ζ, but evidently it must minimally be E(ζ). However, the insurer also appropriates a part of ηk. Therefore the premium of the insurance is (p.107 in EW)

(1) πk = (1 + α) × pk × ζ

In the formula 1, the positive factor α is a markup to pay for the costs of the organization, as well as perhaps the profit. It is obvious that the individual k will only voluntarily insure himself, as long as one has α × E(ζ) ≤ ηk. Unfortunately it is difficult to insure certain circumstances. For instance, a problem exists, when the probabilities pk of the insured persons are mutually correlated (coupled). Consider an insurance against unemployment (p.174) or agains a flood. Furthermore, ζ and pk must be known in order to calculate πk. This is difficult for long-term insurances, such as pensions. And in the case of an insurance against health costs the clients are tempted to conceal their physical disabilities. Therefore the insurer misses information. This phenomenon is called the adverse selection. Even more problematic is the situation, where the client himself can change the probability pk or ζ, for his own advantage. This is called a moral hazard.

The cases of adverse selection and moral hazard deserve a separate attention, because they lead to market failure. Such situations can make the private insurance unachievable. First consider the adverse selection (p.109 and further4). This problem appeared about two years ago for the first time, in the column about applicants. Here the model will be applied to the insurance of health care. Suppose there are two groups of workers. One group is healthy, with a probability of pL of becoming ill. They form a fraction λ of all workers. The other group is vulnerable, and has a probability of pH > pL of becoming ill. Suppose that the insurer can not distinguish between the groups L and H, due to the asymmetry of information. Then there is the danger of adverse selection. When the insurer decides to have a universal premium π, then one has

(2) π = (1 + α) × (λ × pL + (1 − λ) × pH) × ζ

The choice in the formula 2 is called a common (pooling) equilibrium. Define p = λ × pL + (1 − λ) × pH, then obviously one has pL < p < pH. So in this equilibrium the group L pays a higher premium, than is actually necessary for her. Thanks to the insurance the income is always constant, both during working and during illness. The income of H is obviously increased by this insurance, because its premium is too low. The group L will feel exploited, and will try to find a way to signal its good health to the insurer. In principle here policies are conceivable, which do not completely compensate the loss ζ, and then also charge a somewhat lower premium. Now this will be studied in steps. Let w be the income during good health, after subtraction of the premium, and x the benefit during illness. Now x is not necessarily equal to w.

The figure 1a shows in the (x, w) plane the indifference curves of the groups L and H. The behaviour of the indifference curves requires an explanation. This argument is partly the same as in the column about profit sharing by workers. The expected income is EYL = pL × x + (1 − pL) × w for L, and similarly for H. The figure 1a shows this equation as straight lines in the (x, w) plane, both for the group L (dotted) and H (dashed). The line of H is obviously steepest. These could be called iso-income lines.

When the workers would be risk neutral, then the lines would also be their indifference curves. However, due to the risk aversion the workers prefer x=w. This so-called insurance line is also drawn in the figure 1a. When for L or H one starts on the insurance line, in the point b or d, and moves in the upper-left direction across the iso-income line, then w>x holds, so that the utility decreases. Therefore on the insurance line (b or d) the indifference curve must be tangent to the iso-income line, and bend upwards in a convex manner as soon as this point is left. The same argument holds for w<x.

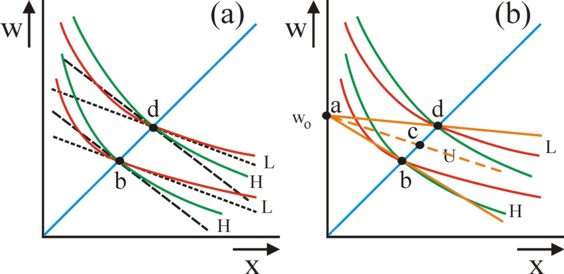

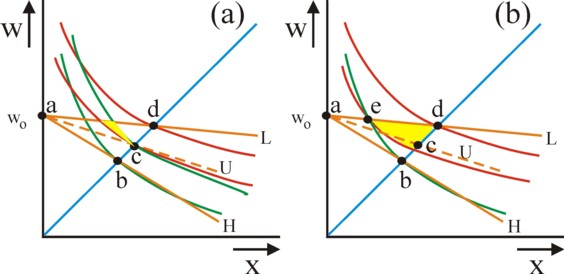

Next consider the possible insurances. Assume for the sake of convenience, that the enterprises choose α=0. Suppose that w0 is the wage level, and that uninsured individuals do not have an income (x=0) during illness. This is the point a in the figure 1b. The premium must guarantee a positive x, which may be less than w. Therefore π is no longer coupled to ζ. The group L has insurance policies with πL = pL×x, and w = w0 − πL = w0 − pL×x. This is the insurance line of L, and also the isoprofit line of the insurer. In the point x=w the premium must be πL = w0×pL / (1+pL). The insurance line a-d of L is shown in the figure 1b. The optimal policy, with a complete covering, is the point d on the insurance line. In the same manner one finds the insurance line a-b of H, and the insurance line a-c of the universal policy. They are steeper than the one of L. The optima are respectively the points b and c in the figure 1b.

Now the combination of the figures 1a and 1b will show that a stable policy is impossible. First consider the optimum c of the universal policy. The yellow area in the figure 2a is enclosed by the indifference curves of L and H, passing through c5. All policies (x, w) in this area are more attractive than c for the group L, but less attractive for the group H. So a new competitor can offer policies in the yellow area, which entices the group L away from the universal policy. The λ in the formula 2 will fall, so that the premium of the policy c no longer covers the costs. The premium of the universal policy must rise, so that c shifts downward and finally will coincide with b. But in this way the utility of the group H will fall to such an extent, that it is also attracted by the new policy in the yellow area. The new insurer can not distinguish between his clients, so that the group H can join without restrictions.

At this moment the policy will create losses. The insurer must return to the universal policy, and the whole cycle will repeat itself. There is market failure. It has just been remarked, that the group L would like to prove its good health to the insurer. This is called a separating equilibrium6. Consider in the figure 2b the policy b of the group H. The indifference curve of H through b intersects the insurance line a-d in the point e. Therefore all points on the line piece a-e (to the left of e) are less attractive for H than the policy b. These points are possible policies for the group L. Apparently they realize the desired separation between L and H. However, consider the indifference curve of the group L through the point e. All policies in the yellow plane above this curve are more attractive for the group L than those on a-e. This includes also the universal policies. So the insurer with policies on a-e loses the competition with the supplier of universal policies.

Apparently separation also leads to market failure. In this model the private suppliers do not succeed in offering an insurance for the costs of health care, which covers the costs. Therefore the state will have to enforce the universal insurance, with an obliged membership for all. This still maintains the problem, that the policy is hurtful to the group L. In this sense the insurance is not efficient.

Now consider the moral hazard (opportunism) due to asymmetric information. Here pk or ζ are not given externally, but they can be controlled by the insured persons. A well-known example is the excessive use of medical services, both by patients and doctors, because the costs are paid by a collective (p.112). Neither the patient nor the doctor have significant costs by this action7. In fact ζ is unnecessarily increased, which is obviously inefficient. The existence of the insurance is based on the assumption, that the insured persons benefit from a small ζ, or pk. The influence on pk is mainly exerted by means of the guaranteed covering, which is offered by the insurance, so that efforts of prevention are reduced (pk will increase, p.111 in EW). In such a situation the private insurance remains possible, as long as the insured person can not really benefit from his carelessness.

But sometimes the insurance is truly beneficial for some groups. Individuals who dislike work, insure against unemployment, and couples with a child wish buy an insurance against pregnancy. The loss ζ is desired, as it were, so that pk approaches 1. The insurance attracts a specific group, and it becomes impossible to calculate the required premium π actuarially. Private insurance becomes impossible8. The state does have the possibility to introduce a universal insurance, where the costs of the desired event are paid by the collective. The claim can also be discouraged by an individual contribution in ζ, or by a lower premium for insured persons with no claim (p.112). In addition, control and supervision are possible, but these are often expensive.

The preceding argument shows, that the choice between a private or a public insurance is mainly technical in nature (p.170 in EW)9. Sometimes there are good reasons to make an insurance obliged. An important reason is, that the loss ζ can lead to a miserable existence for the uninsured person. His misery causes discomfort in his environment, so that his choice creates a negative external effect (p.173). This gives the state the right to intervene coercively. Besides, the uninsured person can have children, who must not suffer from the wrong choice of their parent10. The insurance against unemployment is particularly problematic. Just like with the insurance for health care, it is difficult to separate people with a large probability pH of unemployment. The group L of popular workers must pay extra due to the universal "policy" (p.175). It turns indeed out, that private unemployment insurances are rare.

Furthermore, it is difficult to insure the permanently ill persons. Here the problem is, that the future developments are unpredictable. For instance, it is conceivable that the life expectation will increase significantly. Such an event leads to correlated probabilities pk (p.178). Then the only solution is an incomplete contract, which usually must be regulated by the state11. Then this is no longer an insurance in the commercial meaning of the word (p.181). A vertical redistribution (between poor and rich) by means of insurances is in principle undesirable, because then the insured persons can not make their own choice (p.179). The vertical redistribution must preferably be done by means of direct transfers of income.

Your columnist disposes of an impressive library concerning the history of the West-European labour movement. In many of these books the workers' insurances are also addressed, although mostly in passing. The first attempts to establish insurances, during the nineteenth century, were all private initiatives. Your columnist believed that it was worthwhile to search in his library for reports about such initiatives. For, one would expect, that here the problems of adverse selection and moral hazard are clearly visible. The present paragraph summarizes several conclusions from the consulted sources. Here the reader may consider, that the Gazette has not been established for studying private insurances. Therefore the material presented here is fragmentary, incomplete, and perhaps biased, with (too) much attention for the position of workers. However, something is better than nothing12.

The book De Centrale centraal (in short DC) by the historian J. van Gerwen contains an interesting description of the Dutch funeral funds during the nineteenth century13. There was a national consensus, that a decent funeral is important (p.31 in DC). Therefore almost all poor people (half of the population) joined a funeral fund. Here adverse selection can obviously occur, because mainly the older people want to join. However, until halfway the nineteenth century this was not a problem, because the funds are still small, and the joining is done on the basis of trust. The solidarity within such funds is large (p.44). They are mutual funds, although the exploitation is often done by a professional manager. The form of organization is the cooperation or limited liability company. Yet in 1880 there are 370 funds. Many funds are only active at the local level.

The management of the fund usually has full powers (p.34). The rules are unsound (p.30), and the premiums are quite diverse (p.33)14. Sometimes a policy allows for payments to the next of kin (life insurance), sometimes they do not. The costs are estimated on the basis of experience, without using the actuarial method. But after 1850 the modern insurance companies emerge. They offer popular insurances for covering the costs of a funeral. There is a wave of mergers and take-overs.

Yet the small mutual funds continue to exist until the turn of the century, because the insured persons are attached to them (p.38). Finally they are no longer able to compete, precisely due to the internal solidarity. The insurance is within the personal familiar group, and in this manner the individual risks become correlated (p.44). On the other hand, the big modern enterprises spread their risks. The theory of adverse selection is confirmed here. For the sake of completeness it must be added, that some advocate even now the small-scale together-efficiency. This return to the small circles, united in a social network, is called neo-socializing. The advocates claim, that this is cost-efficient. The debate continues.

In 1904 the Centrale Arbeiders Verzekerings- en Deposito-bank (workers' insurance and deposit bank) is established, commonly called De Centrale. The present paragraph analyzes this bank, by consulting the book De Centrale centraal (in short DC). It is different from the other modern insurance companies, because it has the mission to financially support the labour movement. This is explicitly stated in article 19 of the regulations, which makes a payment of 55% of the pure profit to the labour movement obligatory (p.79 in DC). De Centrale sells popular insurances (payment after death to the next of kin) and capital insurances (payment at a certain date during life)15. Various reasons are mentioned for its foundation. There is a need for a reliable bank and insurer (p.53). And the bank can offer jobs to socialist agitators, who sometimes are dismissed elsewhere (p.55)16.

De Centrale prospers, by promoting its socialist orientation (p.91). In 1910 it has 38.500 policies, and in 1920 already 151.000 (p.86). This makes it the nineteenth insurer in size. Then it is also profitable, and merely 35% of the received premiums are spent on organization costs (p.128). After 1921 profit is indeed paid to the labour movement. This is used to support among others social and cultural associations. Especially the Instituut voor Arbeiders-Ontwikkeling (in short IvAO) receives a lot of money.

Incidentally, already after 1910 De Centrale begins to offer favourable mortgages and rent-contracts to socialist organizations (p.162). Conversely, now the SDAP and NVV begin to promote De Centrale (p.157). Such publicity from third parties is of course highly valuable17. During the interbellum De Centrale continues to expand quicky. Finally, 50% of the social-democratic rank-and-file have bought a policy. It is worth mentioning, that in 1935 De Centrale founds the Instituut voor Sociale Geschiedenis (in short IISG), and completely funds it (p.180). Henceforth, this institute receives the largest share (46%) of all supporting subsidies, paid by De Centrale (p.173).

This donation is in essence a form of advertising, which apparently has effect. It also limits the approachable clients of De Centrale to mainly the socialist pillar. The clients purchase a policy, because the agents and inspectors are a part of the red family, just like them. Therefore De Centrale appeals to the identity of the insured persons, and gets trust. The policies of De Centrale are by no means cheaper than the policies of the competitors (p.99). The purchase of the policy is not a rational, economic decision. It is true that the activities of De Centrale lead to selection (for instance the sales of expensive capital insurances is relatively low), but this is desired and not adverse. Apparently the private companies can offer and sell this type of insurances, without noticeable problems. Naturally it supplies merely a small part of the social security.

Since the start of the twentieth century Belgium has a tradition of prospering cooperations. In this respect the city of Ghent has played a leading role within the socialist pillar. The activities within the pillar provide for the basic needs of the workers, and are mutually intertwined. Even sick-funds are a part of this network. Originally the sick-funds are rather fragmented, but in 1889 19 sick-funds in Ghent merge into the socialist Bond Moyson18. The insured persons are obliged to also become a member of the Belgian Werklieden Partij (BWP, Labour party), of the socialist trade unions, and of the cooperation Vooruit. Incidentally, in practice the Bond Moyson has often waved this statutory obligation19. At the start the Bond Moyson has 2.700 families insured against illness, and it grows to 12.000 families in 1913. Since the beginning the Bond has its own medical-pharmaceutical service.

The Bond Moyson realizes the danger of adverse selection, and only accepts applications of people aged between ad 45 years (and their families). The payment during illness has a duration of a year at maximum20. Soon various popular pharmacies are established, and in 1903 even a popular hospital. In this manner payments can partially be in kind (medical care and medication). In 1894 Bond Moyson introduces a life insurance, which in 1913 already has 27.000 insured persons. In 1896 an insurance against disability is introduced. In 1907 the BWP founds the national Sociale Voorzorg. From this moment onwards Bond Moyson merely offers popular insurances, for the common workers, with a relatively low premium21.

The supervision against abuse of the sick-fund (due to moral hazard) relies strongly on the social control among the workers22. Moreover, in the socialist pillar a family feeling emerges. The workers in Ghent become members out of habit, incited by their parents or colleagues. There is trust, which forms a social capital. Finally it must be mentioned, that after 1897 the cooperation Vooruit guarantees a pension to its consumer-members, as well as an insurance in case of pregnancy. However, the payment consists of shop-cards, which are only valid within the cooperation itself!23 This binds the Vooruit members, who do not want to lose their established rights.

Since halfway 2016 the Gazette has often analyzed the protestant-christian view on political economics. It is worthwhile to study its moral ideas about insurances. In agreement with the principle of sovereignty in the personal circle, private insurances are preferred. Between 1879 and 1889 the workers' association Patrimonium tries to realize its own pension fund24. Unfortunately, the attempt fails. Apparently the members of Patrimonium do not want to spend their money for it. This must have been a discouraging experience for the christian leaders, because henceforth they reluctantly accept state interventions25. So this standpoint emerges without references to market failure. It is paternalism. The state must make the insurance an obligation, but the execution must be done by industrial organizations(corporatism)26. The insurance is a delayed wage.

In all consulted christian sources only C. Smeenk, the chairman of Patrimonium, elaborates on the function of the insurance27. He emphasizes, that individual savings offer insufficient protection against risks. Savings must be collective. Smeenk also understands, that interventions by the state are indispensable for the social insurances. For, they must be obligatory. Regulations are indispensable for the labour market, because behind the factor labour is a human being. Here Smeenk points to the negative externality of poverty. But within the framework, which is dictated by the state, the industries themselves must realize the insurances28. Smeenk was probably aware of the moral hazard, as an expression of sin, but yet he relies on the grace of God.

Striking is also the special value, which the christian-democracy attaches to the family allowance. Apparently it realized at an early stage, that the comparison of incomes must be based on households, and on adult-equivalences29. Immediately after the First Worldwar many state introduce the family allowance for their civil servants. Enterprises include the allowance in the collective agreements (CAO)30. Sometimes the family allowance is combined with a pregnancy insurance. It is curious that at the time the socialist federation of unions NVV rejects the family allowance. The allowance would be an obstacle to hiring the child-rich workers31. But the NVV is wrong here, because the inclusion in the CAO solves this problem.

Incidentally, protestantism is also not free of sin. Smeenk argues extensively against some Calvinists, who reject the social security on moral grounds. The conflict concerns the meaning of Gods Father-care32. God has a plan of ordinances, which is also a predestination. According to the Calvinists the social security boils down to doubts about the Father-care of God - and this is not allowed. Smeenk objects, that statistics is a part of Gods' plan with the world. This holds for various human activities, such as doing good. A religious person must eliminate suffering, so that passivity must be rejected. And a certain welfare furthers the individual religious life. Your columnist is not enthusiastic about this christian-social debate. As an excuse it may be remembered, that at the time the Calvinists are already a tiny sect.

At the start of the twentieth century the trade union movement starts making propaganda in favour of social security. Jan Oudegeest describes this in his book De geschiedenis der zelfstandige vakbeweging in Nederland (in short GV), notably part 233. The socialist federation NVV has always propagated the state pension. However, the political support is missing. In 1921 the insurance against disability is legally enforced. The old people can also claim this. The introduction of the insurance for health costs is awkward. According to Oudegeest, some workers do not understand the necessity (p.177). However, around 1920 this insurance has already been included in many CAO's. However, a law is missing until 1930. Although the entrepreneurs pay the full premiums for the disability- and health-insurances, the executing organization is partly led by the unions.

During the First Worldwar the trade union movement initiates an insurance against unemployment, based on the Danish system34. Here the workers pay a contribution, and the authorities (municipality and state) contribute the same sum to the insurance fund. The initiative commonly originates from the local section of the union (p.205). The first insurances appear in 1906 (p.202). In 1914 there are 32 municipal unemployment funds (p.203). Then there are 70.000 insured workers, also in the municipalities, which do not contribute to the insurance fund (p.209). During the war time the number of insured workers gradually grows, with already 109 municipal funds in 1915. Then the unions centralize the administration of the insurance (p.212). During the war years the number of insured workers doubles35. This system will continue to function until 1941.

There are also signals of abuse, and the trade union movement does not address these sufficiently (p.232)36. Apparently the system indeed suffers from a moral hazard. Since the state pays at least half of the costs, the insured workers are less motivated to supervise the system37. It is a problem that Oudegeest and the NVV principally reject the existing order. The workers are portrayed as victims of capitalism. The NVV explicitly takes sides with them, against the state, which must finance the payments. Oudegeest indeed openly admits, that the payment is a right, without any contribution, as long as the worker is willing to work (p.205)38. Also curious is his argument in favour of the insurance against unemployment. It must protect the unemployed against the temptation to work for a lower wage, as a "scab" (p.189)!

Historically payments in the event of death and during illness are developed by private initiatives. This also holds for the pensions, although it is difficult to sell policies to the working poor. In these case adverse selection and moral hazard can be identified, but they occur in special circumstances. In these early insurances the insured persons are still embedded in their community. The mutual trust and the social control are strong. They do not act as rationally calculating citizens. This has the advantage, that the transaction costs between the insurer and the insured person remain low. Sometimes the tie is so strong, that the insurer has a monopoly. Under these circumstances the insurer evidently is hardly incited to optimize the efficiency. It is not certain, that the insured persons really benefit from such an "obliged" truck-system.

The insurance against unemployment has actually been a state affair from the start. Here the market does not offer an alternative. Here the trade union movement plays an ambiguous role, because it begins to engage in rent seeking with the state. The family allowance has also always been a task of the state. The stimulation of family formation is seen as a collective and general interest. Inventiveness and regulation are indispensable, when such supplements to income are left to processes on the private market.