Figure 1: Pin union federation KAB

Institutions are a popular theme in the Gazette. The present column discusses two currents of the new economic institutionalism. Oliver Williamson takes the neoclassical paradigm as his starting-point, and Douglas North develops an evolutionary theory. Both analyze the transaction costs. Cases are studied of adverse selection, self-enforcing contracts, and moral hazard. Time-inconsistency, the principal-agent problem, sunk investments and learning-processes (innovation, immitation) are discussed.

Until the seventeenth century the European economy was rigourously socially embedded. The economists call the then system mercantilism. However, the performance of this system was disappointing, so that traders and scientists tried to find better systems. Adam Smith, at the time a founder of economics, assumes that commodity markets are self-regulating. There exists a natural order. He calls this graphically the "invisible hand". Therefore the society does not need to coordinate these market processes by means of purposive steering and interventions. In fact, a policy of intervention in the operation of markets will only cause damage to the effectiveness of the economy. This idea implies, that the specific structure of the society is irrelevant for market processes, as long as it respects the autonomy of markets.

The idea of the invisible hand, which controls life behind the back of the people, fits well in the then society, that was dominated by the christian churches. There is a divine sovereignty, which dictates the natural order. The world is organic. There is hardly a sense of control. This view on the world is reproduced in the classical economic paradigm, and also in the neoclassical paradigm (in short NCP), its successor. However, according as science advances, there rises doubt about the natural order. Thus during the nineteenth century a group of German scientists founds the Historical School, which sees the markets as social constructions. The Gazette has elaborated on the principles of this economic current in two columns. The Historical School becomes dominant in Germany, partly thanks to the energetic efforts of Gustav von Schmoller, and becomes authoritative also elsewhere.

The Historical School believes, that first the economic reality must be studied, before models are developed. This is called the inductive approach. Thus a strong impulse is given to empirical research. However, she does not succeed in developing her own universal model. The publications are stray notes. Therefore she has a weak position with respect to the NCP, which does dispose of a powerful universal model. The NCP assumes that individuals can optimize their utility by weighing the effects of marginal changes. Thus the neoclassics produce elegant mathematical theories, such as the Edgeworth box for exchange processes.

In the United States of America a congenial current of the Historical School emerges, namely the Institutionalists. They describe the social system as a collection of institutions (rules), which are propagated by the corresponding institutes (organizations). Although individually the Institutionalists become persons of significant authority, also here not much coherence can be found between their ideas and works. Since the thirties of the twentieth century, the NCP is actually without controversy, although after the Second Worldwar it must reconcile with the Kaleckian-Keynesian macro-economic models. Nevertheless, science fortunately does not halt, so that since the seventies the institutionalism exhibits a revival.

The present column wants to give a description of this New institutional economics (in short NIE). The NIE is a curious thing, because she is rather a compilation of various different ideas. She studies organizations, enterprises, property rights, problems of control, information, contracting, economic evolution, and game theory. A part of the new institutionalists prefers descriptive studies, where a general theory is not the aim. This NIE misses the claim on universal validity, which does accompany the universal model of the NCP. Thus economics would become as undetermined as the other human sciences. Therefore many want to maintain the NCP, also in the analysis of institutional problems. They want to reform the NCP from within, and do not long for an institutional revolution1.

In short, it is difficult to obtain a clear view with respect to the NIE. In this column it will turn out, that the Gazette has often discussed themes from the NIE, without explicitely labelling them as NIE. For instance, important parts of the NIE have been presented in the columns about the rational choice paradigm of the sociologist J.S. Coleman2. In any case it is certain, that the NIE derives her reason of existence from the phenomenon of transaction costs. Each transaction on the market causes costs, among others due to the search for the most suitable trading partner, and the conclusion of a sound contract. The NCP ignores these costs, which for instance becomes clear from the mentioned Edgeworth box. That simplification is a mistake, because the transaction costs can make an exchange unprofitable, and thus block it.

Economists try yet to take into account the transaction costs in two ways. The first way remains within the framework of the NCP. It tries to find smart contracts, which keep the transaction costs to a minimum. Here the principal-agent model is often used. In the literature the name of the economist Oliver Williamson is attached to this approach. The second way leaves the framework of the NCP, and refers to sociology and social psychology. Now the assumption is, that smart social institutions can result in low transaction costs. This group studies the emergence and development of institutions, and here applies among others cognitive learning-models and evolution theories. This approach builds on the Historical School and the American Institutionalists. In this case the economist Douglas North is a leading scientist.

This column wants to give a general impression of the NIE. Your columnist has invested quite some time in the analysis of the matter. The discipline is so gigantic and difficult to survey, that your columnist by necessity must select. Many passages in the column are copied rather literally from the consulted literature3. The text would become not very readable, when again and again a reference is made to the concerned source. Therefore this will not be done. Your columnist hopes to avoid with this revelation, that he will be accused of plagiarism. So although the text is not original, errors in the personal interpretation are conceivable. Therefore your columnist remains responsible (but not liable) for the contents.

Economic institutions can be studied at three levels: the enterprise (the company or firm), the market, and the state. Although the neoclassical institutionalism has elaborated on all three, your columnist will limit himself to the first two. The structure of the enterprise and of the market can be connected. For instance, when the enterprise acquires a significant market share, then an oligopoly is formed or even a monopoly. Therefore some state, that the whole discipline of the industrial organization belongs to the NIE4. The choice for the form of the enterprise not only depends on the direct production costs, but also on the transaction costs5. According to the economist Coase the transaction costs on the market are mainly caused by searching, for instance for sound suppliers, and by the conclusion of contracts. These costs can be eliminated by integrating all activities whith a single enterprise6.

The economist Williamson calls the organization within the enterprise a hierarchy7. However, the organization as a hierarchy causes her own transaction costs. For instance, the interests of the personnel will never coincide completely with those of the management and perhaps the shareholders. This conflict of interests leads to opposing goals, and thus to what is called the principal-agent problem. This creates a two-sided problem for the management: it is the mediator between the personnel and the owners of capital (unless it is itself the owner). Both the owners and the direction must choose a certain manner of governance. The governance employs institutions, that is to say, rules or agreements. The institutions can be formal (contracts and the like), or informal (such as the culture of the enterprise). The presence of institutions creates costs.

The stakeholders in the enterprise (the owners, direction, and workers, or in more abstract terms: the production factors) each have their own knowledge and information with regard to the actual state of affairs. Each uses its information for promoting its own interests. Information is withheld, if necessary. Incidentally, individuals dispose of merely a limited capacity for processing information. The economists Alchian and Demsetz believe, that the enterprise can be represented simply by a network of relational contracts. The contracts are formulated centrally by the direction8. But due to the asymmetric distribution of the organizational information those contracts must necessarily remain incomplete. In other words, the agreements merely broadly outline the behaviour, so that many possible situations remain unspecified. These are indeed called incomplete or implicit contracts.

Contracts must contain the right incentives, so that they optimally further the goals of the enterprise. The contracted individual can be motivated by meeting his interests. Then the individual feels obliged to perform well. This is called self-enforcing. Nevertheless, contracting has various problems. Ex ante (preceding the contracting) an actor can withhold information. The result can be that another actor agrees with a contract, that hurts him (adverse selection). Ex post (after contracting) the contracted actors often engage in opportunistic behaviour. For instance, sometimes a good supervision of the provided performance is impossible, so that the contracted actor can escape from his obligations. Opportunistic behaviour is a moral hazard.

Loyal readers of the Gazette will perhaps recognize the phenomena in these contract theories. For, in a previous column the situation is described of a direction (principal), which wants to acquire information about the productivity of its applicants (future workers, so agents)9. The direction wants to distinguish between the more and less productive applicants, in order to thus prevent the adverse selection. This is an ex ante problem of contracting. The column shows, that the number of certificates is a good indicator for the individual productivity. Now the direction formulates the labour contract in such a manner, that education becomes rewarding for the more productive applicants. So in this case the applicant uses his certificates as a signal to convey a reputation. Apparently, two institutions are used here: education and education-related wage scales.

The relation between management and the worker can also be used to illustrate the ex post problem of contracting. This has already been explained in the column about the worker, who can not be supervised sufficiently by management (the principal)10. This occurs for instance, when the outcome of work is partly determined by fluctuating external factors. There is the danger of ex post opportunism. Then management can offer the worker a contract, which couples the wage to the realized profit. Since the worker is commonly risk averse with regard to his income, management must insure his wage against the accidental fluctuations of profit. This means that the wage will be higher than in a situation of perfect supervision. Apparently, in such a situation management is forced to make additional costs.

During the nineteenth century the owner of the enterprise was also its director. However, during the twentieth century another company structure became dominant, where the ownership and the management became separated. Often this takes on the form of shareholder-capital (also an institution). It even becomes common, that the directors become wage-earners. The reason for this separation is the differing nature of ownership and management. Namely, ownership has a claim on the profit, which is the productive residual Π, which remains after paying for the production factors (labour and money capital) out of the total operational result. Therefore the ownership bears the commercial risk. On the other hand, the direction (the managers) brings in her human capital. The human capital consists of technical and economic knowledge, and of qualities of leadership. This human capital is not able to itself bear the financial risks of the enterprise.

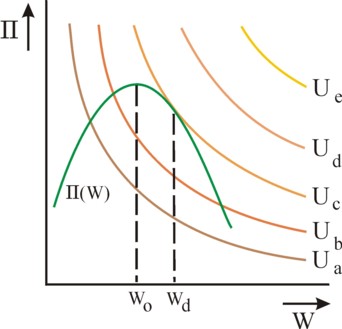

Williamson, and later Jensen and Meckling, have shown, that the changing capital structure of the enterprise causes a principal-agent problem11. Namely, let Q be the sales of the enterprise, let W be the total wage sum, and let K be the other costs (equipment, buildings, and the like). Suppose for the sake of convenience, that the quantity K is fixed. Then the enterprise has a profit Π = Q − K − W. The owners (share-holders) evidently demand the maximization of the profit. Suppose that the income of the direction is also partly coupled to the profit. However, the direction also has an interest in a large wage sum W, because notably the staff personnel (servants, secretariat, consultants and the like) make life more pleasant. Therefore the utility function of the direction has the form u = u(W, Π). The figure 2 shows the corresponding indifference field of the direction. This utility function even holds, when the direction is the only owner.

Let L be the number of workers. Suppose for the sake of convenience that the individual wage is simply W/L. The marginal productivity of the factor labour is ∂Q/∂L > 0. For large and increasing vales of L the marginal productivity is falling. The maximization of the profit for a fixed K requires solving ∂Π/∂L = 0. In other words, workers are hired until one has ∂Q/∂L = W/L. In this optimum the profit has its largest value Πo, in the point Wo. The function Π(W) is also shown in the figure 2. However, the optimum of the direction is elsewhere. Namely, her optimalization problem is:

(1a) maximalize for all Q and W: u(W, Π)

(1b) under the condition: Π(W) = Q(W) − K − W

It is clear from the figure 2, that the optimum of the direction is indeed located at a larger Wd than Wo. The direction has an interest in hiring much personnel. This hurts the efficiency of the enterprise, because the profit is no longer maximal. The direction will prefer Wd, even when she is the only owner and share-holder. However, the effect becomes stronger, as soon as external share-holders will participate in the enterprise. For, then the direction receives a smaller part of Π, say a fraction α<1, which has the consequence that her indifference curves in the figure 2 become steeper. Then the direction obtains a different optimum Wd' > Wd. This change is unfavourable for the external share-holders, because the total profit falls further to Π(Wd'). Moreover, the asymmetric information is favourable for the direction, because the external share-holders fail to observe the wasteful behaviour of the direction12.

The discussed case shows, that the structure of property is an institution with significant consequences for the economic behaviour. However, the institutional effects are not limited to the internal functioning of the enterprise, because they also affect the consumers. The column about reputation signals gives two examples of this, which both refer to time inconsistency. That is to say, the enterprise makes a promise to its consumers, and subsequently at a later time breaks its promise. The first case is price discrimination by the enterprise13. The second case is the central bank, which is tempted to increase the money inflation14. In both cases the enterprise (producer or bank) benefits from time inconsistency, in the short run. However, in the long run opportunism will hurt the enterprise, because it loses its credibility in the eyes of its clients.

Opportunism of the enterprise by means of time inconsistency is called the "milking" of the consumer. Such behaviour could be called unethical. However, in neoclassical institutionalism the individuals rationally defend their own interest, so that in principle milking is a normal action. Therefore, the enterprise must weigh rationally what in the short and long run are the benefits of milking. Thus the enterprise estimates its discount δ, which determines how the lost utility in the coming time period can be converted into lost utility in the present. The human nature is such, that one has δ<1. Under certain conditions it may be worthwhile to maintain a good reputation. These examples show, that institutions can be integrated in the NCP.

Your columnist can not desist from again discussing a model, where the consumers risk getting milked15. In this case time inconsistency is again the problem, now in connection with the quality q of the offered product. The consumer can discover the quality only during its use, that is to say, during the ex post phase. The supplier knows ex ante the quality, but can choose to conceal it. The production costs are c(q), with ∂c/∂q > 0. The enterprise can completely sell its production for a price p(q). Suppose that the minimally acceptable quality is q0. For that quality one has p(q0) = c(q0), so that the enterprise does not make a profit. A higher quality will make his profit Π(q) = p(q) − c(q) positive. This situation occurs for instance, when the consumers have a utility function u(q, β) = β×q − p(q). Here the constant β represents the taste.

Suppose that at t=0 the enterprise announces, that it will supply a quality q1, with q1>q0. The consumers must necessarily believe this. Then the enterprise can choose its line of action. It can keep its promise until eternity, and then can expect a total profit of

(2) Πω = Π(q1) × Σt=0ω δt = Π(q1) / (1 − δ)

In the formula 2, δ is again the discount, which converts the future profit to the present. The symbol ω means, that the summation continues until infinity. However, the enterprise could also decide to immediately break its promise, and supply a product of quality q0. For once, that guarantees a splendid profit of Π(t=0) = p(q1) − c(q0). The consumers discover the deceit after their acquisition, and subsequently will suppose for all following time periods, that the quality equals q0. The enterprise can no longer make a profit, because its reputation is ruined. The comparison of Πω and Π(t=0) shows, that milking pays as long as one has

(3) Π(q1) < (c(q1) − c(q0)) × (1 − δ) / δ

The formula 3 can be interpreted in such a manner, that the right-hand side is the reputation premium. Only when the profit exceeds this premium, the enterprise will be honest about his product quality q1. Furthermore it is questionable whether the consumers will believe the promise of the enterprise at t=0. When the enterprise is a newcomer on the market, then the consumers will perhaps assume at t=0 that the quality is q0. Then at t=0 the newcomer makes a loss Πn = p(q0) − c(q1) = c(q0) − c(q1). During the following periods the newcomer will be trusted, so that after t=0 he makes a profit Πω − Π(q1) 16. Entrance on the market is only worthwhile, as long as Πn + Πω − Π(q1) > 0. Apparently the condition for entrance is

(4) Π(q1) > (c(q1) − c(q0)) × (1 − δ) / δ

The formulas 3 and 4 can also be interpreted in such a manner, that a renowned enterprise with product quality q1 must equate his profit Π(q1) exactly to the right-hand side of the inequalities. In that situation an honest reputation is just worthwhile, whereas there is not yet an incentive for the entrance of newcomers. In reality, long-lasting relations and mutual trust are usually essential for economic transactions. They help to keep the transaction costs down.

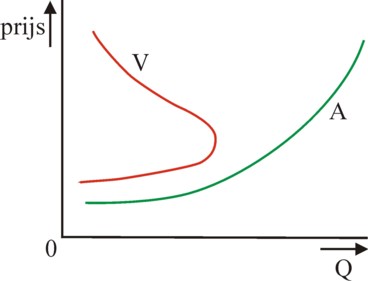

The described model of quality production is rather optimistic. Namely, suppose that the renowned enterprise decides to leave the market within several periods. Then the reputation premium is lost, so that the enterprise can choose to produce the quality q0. Suppose that the consumers know, that the enterprise wants to leave their market. Then they will expect, that the enterprise will supply q0. Now suppose also that the consumers do not want the quality q0. In terms of their utility function this implies u(q0, β) ≤ 0. They simply believe that the price p(q0) is too high. In these circumstances the market can no longer survive! See the figure 3. The economist Akerlof has sketched this situation for the market of second-hand cars (lemons)17. Such a market can only survive with the help of institutions, for instance a product guarantee with enforceable rights for the consumer.

Several situations have just been sketched, where the consumers are in danger of becoming the victim of a moral hazard. But the neoclassical institutionalism is also concerned with the mutual trade between enterprises. It has already been mentioned, that Coase distinguishes between two fields of exchange: the market and the hierarchy. Williamson adds the mixted form, which he calls hybrid. Examples are the independent chain store (franchising), the strategic alliance (joint-venture), or an industry-parc. An important cause of the diversity of organizations is the problem of the specific costs, also called sunk costs. These are expenditures for production factors, that have actually merely a single use. When that application disappears, then the factors can not simply be employed elsewhere. This is called a lock-in.

The specific investments are commonly done for the benefit of a single buyer. They are goods made to measure18. In that one application they are much more profitable than in alternative applications. That extra efficiency is called the quasi rent. It is obvious that the investor wants to conclude a contract with his client, where both are legally obliged to support the specific application. There exists a problem, when the result of the investments is difficult to predict in advance. For, then there will necessarily be an incomplete contract. Only after the completion of the investment there will be clarity, and then there will be re-negotiations. Here the client has the more powerful position, because the investor has become dependent. Therefore the client can try to appropriate a part of the quasi-rent. This ex post behaviour is opportunistic, and a consequence of the moral hazard. It is graphically described with the word hold-up.

Also in this case a model can clarify the problems19. Let there be a seller v, who has just one client or buyer k. Suppose that they agree about a product price of p. The seller must in advance invest a sum I, and makes production costs c(I). Therefore his profit is Πv = p − c(I) − I. Suppose that the product has a value of U for the client. Then his profit is Πk = U − p. Now the socially desirable level of the investment I can be calculated. The problem is

(5) maximalize for all I: Πv + Πk = U − c(I) − I

The solution is ∂c/∂I = -1. However, the buyer k defends his own interest, and not the social interest. Therefore, he will demand a price p' during the re-negotiation, with p'<p. The result will be a Nash solution. She is partly determined by the exit options of both contracting actors20. Suppose that the seller has just realized an investment Iv. In the re-negotiation he must write off this expenditure as sunk costs. According to the formula 5 there is now a surplus of U − c(Iv), which must be distributed among both actors. In the re-contracting it is fair to distribute the profit equally on the basis of reciprocity. The outcome is Πv = Πk = (U − c(Iv)) / 2. In this case the seller must calculate Iv from the problem

(6) maximalize for all Iv: Πv = ½ × (U − c(Iv)) − Iv

Now the solution is ∂c/∂Iv = -2. In other words, now the investment I must yield a larger savings of c than in the formula 5. Since the marginal savings fall with I, Iv will be less than the socially desirable investment volume. In the social perspective there is an under-investment.

The problem of the under-investment can be combatted by making a smart choice for the property rights. Property rights are an important theme in the neoclassical institutionalism. This has just been shown for the case of the separation of ownership and management. The owners are more motivated than the direction to make the operations efficient. In the present case of specific investments it is beneficial, when at the start the incomplete contract gives the investor the sole right to exit the transaction. Then he is no longer endangered by the opportunistic behaviour of the buyer. This can also be interpreted in such a manner, that the operations of the buyer are partly integrated in the organization of the seller. More generally, it can be stated, that integration of the contracting actors in a single enterprise reduces the problem of specific investments.

This case also illustrates, that the NIE does not have a unique definition of efficiency. For, the production factors must be used efficiently, and besides the organization structure herself must be optimal. This is a difference with the NCP, which ignores the structure. In other words, innovations can concern both the technique of the production and the organization of the production. Both allow to improve the effectivenss, but the costs of the improvements themselves undermine this. Efficiency requires insight in the future, but the collection of that information again creates uncontrollable costs.

With this case the paragraph about the neoclassical institutionalism reaches its end. Your columnist wants to make some concluding comments. First, the Gazette has paid much attention to the theoretical planning, notably the macro-economic control in the spirit of Tinbergen. Although the modern NIE textbooks ignore it, this is truly institutional economics. Second, the Gazette has published various analyses of the public branch organization (PBO). This is a practical example of the hybrid structure, which tries to bring the investments on the socially desirable level. However, the structure causes many political costs. It may well be true that precisely the disappointments with the practical institutionalism, with as the dramatic culmination point the collapse of the Leninist regimes, has lead to the theoretical revival of the NIE21.

North places the institutions in their historical context, and tries to analyze their development22. The institutional change is interpreted as an evolutionary process23. He denies the hypothesis of the rational decision, which is so typical for the neoclassical instititonalism. He does maintain the methodological individualism, which sees the individual motives as the propelling force behind all developments. Besides, it is assumed, that cognitive processes are always the basis for the decisions. The social psychology is applied amply. The motivation is commonly derived from the individual utility maximization. Individuals want to improve their fate. However, much of their behaviour consists of heuristics. Transactions often have a routine-like character. The society is the result of earlier experiences.

The human behaviour is embedded in the informal social institutions. The embedding in groups brings about, that the individuals acquire a shared mental model in many matters24. A cognitive structure is established. The informal institutions limit the possible actions, and thus make society more predictable. Precisely thanks to this consensus, cooperation is possible and stimulated. Shared targets and interests are formed. According to the evolutionary institutionalism this is desirable, because the coherence leads to lower transaction costs. Nevertheless, the mental model is dynamic, because collective learning results in an individual feedback. The learning process is a cycle, where new solutions can be invented for the social problems. Such innovations begin with an individual. When it turns out that the innovation is a success, then it will be spread within the group be means of imitation.

This perspective on the developments offers a logical explanation for the operation of markets. Formally, enterprises offer their products on the market. However, in fact they invent solutions for the problems and needs of the consumers. The enterprise can produce its solutions only by hiring production factors, and by subsequently coordinating their efforts in the organization. The finally produced solution is offered on the market for a certain price. Then it is the task of the consumers to judge the quality of these solutions, and next to reward them appropriately. The competition on the markets gives a material incentive to learn, to enterprises and to consumers. All of these activities result in an order, and contribute to the shared mental model.

Nevertheless, the informal institutions do not suffice, notably not in the modern mass societies. For, these are characterized by anonimity, so that the mutual social control diminishes. The collective morals weaken, the individualism emerges, and the diversity increases. The anonimity is partly combatted by means of signalling, such as investing in the individual reputation. But the temptation of opportunistic behaviour remains large. Therefore the modern society needs various formal institutions. The mutual coherence obtains the form of the organic solidarity. The formal institutions are often simply the recording of the informal ones. That is desirable, because then they have a large social support. However, there also exist rationally designed institutions25. Thanks to state laws, the enterprises can enforce the observance of contracts.

Thus the state emerges as an evolutionary process. The rulers are exposed to temptations of opportunism, such as the exploitation of the citizens. This behaviour is also restricted by an institution, namely the Constitution. Philosophers such as Hume and Lock indeed interpret the state as a social contract. The assumption of evolution implies that institutional changes follow a historical path. It is impossible to build institutions at will. They must fit within the grown society. Notably, formal institutions must not deviate strongly from the informal ones. And some paths are better than others. In this regard, your columnist reminds of the work of D. Acemoglu, who distinguishes between extractive and inclusive institutions. Furthermore, note that institutions change merely slowly, certainly when this is measured with the time scale of market processes. It is this aspect, that suggests an evolution.

According to North, the institutions are instruments of power. The rulers are able to influence the institutions in such a manner, that it serves their own interests. In this manner the institutions have an ideological role. Incidentally, this idea of North is controversial. Others believe that institutions result from endeavours to improve efficiency. Furthermore North states, that institutions change by means of innovative shocks. Such shocks change the ratio of prices, and the institutions must adapt to these26. North also notes, that thus the economic growth develops more or less in an arbitrary manner. The path-dependent institutions restrict the behaviour, and in the last instance determine growth. North appreciates the western institutions. Economic freedom and property rights further the efficiency, and therefore are essential for economic and technical growth. On the other hand, the Third World suffers from poor institutions27.

Your columnist ends with a personal revelation. The NIE makes an incoherent impression as a separate discipline. It is true that there are common themes, such as methodological individualism, the transaction costs, and the regulation. Nevertheless, it is notably artificial and problematic to integrate the neoclassical models and the historical descriptions. This excessively accentuates the difference between the deductive and inductive approach. Your columnist prefers to see institutionalism as an improvement of the NCP. But perhaps that preference is partly caused by his lack of appreciation of the inductive method28.