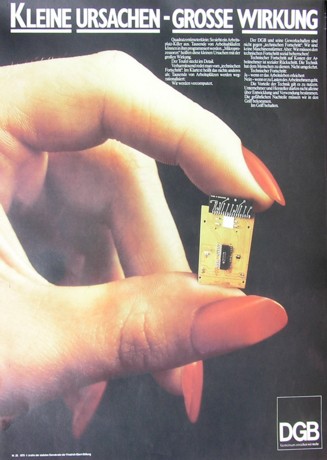

Figure 1: quartet card

Labour (Diocese Den Bosch)

In the previous columns it has been tried to analyze the interaction between innovation and economic growth. Innovation is a difficult and ill-understood phenomenon. The present column presents a survey of some common ideas about innovation and R&D. It starts with a historical review, and then describes the actual scientific ideas. The view of the original social-democracy is also discussed. Finally, a simple mathematical model of research and development is presented.

The book Économie, sociologie et histoire du monde contemporain gives a good historical description of innovative processes in the economy1. The interest mainly concerns periods, where the innovations occur as a wave, and they thus reinforce each other's effects. An important wave is the first industrial revolution, which begins at the end of the eighteenth century, first of all in Great Britain. At the start there are already factories, but they are still relatively small. They are led by the owner, who therefore is also the procurer of capital. At the time the revolution begins in the textile branche, which is mechanized more and more. Other large states, such as France, Germany and the United States of America (in short USA) begin their industrialization merely in the nineteenth century2.

One of the best analyses of capitalism during the first industrial revolution is published by the political thinker Karl H. Marx. He describes that originally small enterprises expand their stocks of capital goods (such as machines, buildings and other equipment). He calls this the accumulation of capital, where capital actually takes on a physical, tangible form. The accumulation aims to increase the labour productivity ap, and thus reduce the production costs, In the analyses of Marx the accumulation, the mechanization of the production, and the increased scale are an endogenous (intrinsic) property of the economic system. For, the entrepreneurs are engaged in a competitive battle, and want to obtain a maximal part of the total profit. Therefore this very circumstance forces them to innovate and reduce costs.

Thus the enterprises become ever larger. Then finally the organization of the enterprise under the direction of the independent enterpreneur does no longer suffice, because the need for capital becomes insatiable. Innovative forms of property emerge. More and more the enterprises are transformed into so-called companies with limited liability, so that the owners are no longer liable in person for the actions of their enterprises. Sometimes they have the form of a shareholder company, where a group op people each take shares in the property of the company. During this phase the first industrial revolution is actually completed. The economist J.A. Schumpeter has labeled this type of entrepreneurs Mark I. They excel in their initiative, courage and insight. However, together with the rise of the collective property a new type of enterprise emerges, which is called Mark II by Schumpeter.

Namely, the owners appoint an employed direction, and henceforth merely interfere with the management at a distance (for instance by means of the supervisory board). The direction is composed of professionals, who apply scientific methods in order to control the efficiency of the production process. The innovative management is indeed inevitable, because due to the enormous size of the enterprises it becomes too risky to rely on the personal intuition. The direction is supported and advised by various staff departments. In other words, within the enterprise an administrative, industrial and commercial bureaucracy is established. Together with the rise of the enterprises Mark II the second industrial revolution begins, say since 1870, which is characterized by the emergence of the railways, the automobile, the chemical industries, and electricity.

The bureaucracy in the enterprise implies that henceforth the direction rarely engages in innovation. Here she differs from the entrepreneur Mark I, who often is also an inventor3. In the type Mark II the innovation is institutionalized, because she becomes the domain of the department of research and development (in short R&D). This changes the innovation from an incidental inspiration into a purposefully planned development. Notably the economist J.K. Galbraith has analyzed this change4. He concludes from this, that the approach has provides the big industries with a competitive advantage in the contest of innovation.

Besides, the innovation is more than merely technology, because she can also affect the organization. For instance, the automobile factories of Henry Ford developed the production at the assembly line. This increases the labour productivity ap, and can significantly reduce the price of a car. At the same time the wages can be raised somewhat. This makes the car affordable for the general public, so that it becomes a product of mass consumption. This production model is called Fordism. It illustrates that innovation is more than inventing a new product or a new machine. Namely, the so-called rationalization is also a kind of innovation. In the rationalization the production costs are reduced, by analyzing the production process in all of its facets. The production factors (labour, capital, environment) are tuned in such a manner, that the efficiency is optimal.

For several decades the preference for large scales remained the common opinion. However, gradually the insight grew, that small scales can be beneficial for innovation as well. For, small enterprises are flexible. And it has been concluded, that the individual creativity is yet important. This notion is particularly clear in the branch of information- and communication technology (in short ICT), where the innovations are often due to starting companies. The rise of the ICT branch during the seventies has changed the economy in such a way, that this period is sometimes called the third industrial revolution.

Nowadays it is tried to combine the advantages of small- and large scales by introducing self-steering teams within the big industries. The aim is to encourage the personal initiative of the workers, and thus increase their motivation. This approach is used for instance by Japanese enterprises, which during the seventies and eighties were very succesful with their export industries. This is sometimes called Toyotism, after the Japanese car builder.

The state has an interest in furthering the innovation in the economy, because she improves the quality of life. In particular the rationalizations allow for an increased gross domestic product (in short GDP). Nevertheless, during the first and second industrial revolution it seemed, as though the innovations are incidental inventions of a few brilliant minds. However, during the Fordism it became clear, that innovations can be artificially made, simply by forming a group of scientists and engineers. This merely requires the collection of sufficient capital for financing R&D. Sometimes the industries will not do this, because the expected profits are still poor. The return on capital is too uncertain.

In such cases the state can decide to pay the investments, because of the importance of innovations for the society. And after the Second Worldwar this has indeed been done, on an until then unprecedented scale5. In the USA this new policy starts already during the war, with the Manhattan project, which aims to develop the nuclear bomb. Thanks to the acquired knowledge, next it became possible to generate nuclear energy for civil applications. Since then the USA have continued their defense research, also in order to perform their role of global police power. These huge research funds have yielded various inventions, which are also quite useful in the civil society (and perhaps even more!).

It is obvious that in many scientific areas an important contribution to research can be made by the universities. Although universities already exist for many centuries, it has only during the twentieth century become apparent, that their knowledge is economically valuable. Since then the funds for scientific research have been increased significantly. Incidentally, the education by the universities produces the knowledge workers, that are needed in the industry. This is called a knowledge economy. Knowledge is a positive externality, because not just the individual gains by it, but the whole society as well. Furthermore, the state makes significant investments in new developments in health care, because these satisfy a need within the population. The state actually attempts with all these initiatives to expand the technology boundary. The technology boundary is the utmost, that at a certain moment can be realized with the existing techniques6.

In addition to the sketched policies, the state tries to create favourable conditions for the emergence of knowledge networks. Such networks of the industry, the universities, and public agencies turn out to offer a fruitful soil for new ideas. Then the state does not dictate a scientific goal, but merely maintains the infrastructure for the exchange of knowledge. Thanks to the networks a collective trust in innovations is created, so that they can be applied on a large scale. Incidentally, the construction of markets is at least as important for an innovative industry. Market institutions can make investments in R&D profitable for entrepreneurs. Consider for instance the granting of patents for new products.

The preceding paragraphs give a survey of the common theories with regard to innovations. The economist Stephen Martin sketches in his searching textbook Industrial organization in context the newest scientific insights7. He starts his arguments with the Mark I and II typology according to Schumpeter. There Martin first discusses the innovations in the production process, which try to reduce the production costs. So these are the mentioned rationalizations. The big industries usually generate a wide assortment of products. In that situation R&D is promising, because new inventions can be applied in various products. Therefore one would expect, that in particular the big industries will invest much in innovation. However, yet the management in the big industries is not very entrepreneurial. It mainly tries to limit the risks, and is inclined to buy innovations elsewhere.

Apparently the Mark II hypothesis, that innovation mainly occurs in the big industries, is not so trivial. It is not simple to validate or falsify the Hypothesis empirically. On the one hand the big industries do indeed relatively often apply for patents. On the other hand the investments in R&D seem to be relatively independent of the company size. Some scientists believe, that in each branch the connection between innovation and company size is different. And a small enterprise can virtually increase his market share by selling licences of its innovation. Furthermore, enterprises can start a collaboration in the domain of R&D, for instance in a joint venture. Martin concludes from his literature study, that the Mark II hypothesis has actually not been proven. Therefore the contradistinction between Mark I and Mark II has somewhat fallen into the background in the scientific debate.

Innovation can be stimulated at the demand side (demand pull) and at the supply side (technology push). For, a strong demand promises large profits, whereas a certain technological knowledge is indispensable for inventors. In any case,the enterprises want to retrieve their investments in R&D. That is awkward, when the market or the nature of the product is such, that the competition can quickly imitate the invention. In this situation a spill-over occurs. The leader can naturally try to protect his invention by means of a patent, but much information can not be patented. Often it is preferred to keep the information secret, but that is seldom possible for more than a year.

Competitors can only imitate the leader, when they dispose of sufficient internal knowledge. This is called the absorption capacity of the enterprise. Even when the investments in R&D are not profitable, they can still be useful for maintaining the absorption capacity. Input spillover occurs, when fundamental inventions are needed for the innovation. Fundamental knowledge can hardly be protected, and therefore is a collective good. It is understandable that the fundamental research is mainly done at universities and state laboratories. These are about 20% of the total R&D expenditures. Conversely, the development of products is mainly paid by the enterprises.

Also Martin concludes, that R&D is more profitable for the society than for the individual company. The estimates of the social profits are somewhere between 25% and 50%, depending on the branch. That justifies a public stimulation of the R&D efforts. Among the policy instruments for the supply side are the subsidies and tax exemptions, whereas the purchase of the innovative products is aiming at the demand side. A problem of subsidies is, that perhaps they seduce the enterprises into diminishing their own investments in R&D. Studies of the actual entrepreneurial behaviour do not give a decisive answer about the gravity and size of this effect. Besides, the state can never determine which innovative products truly deserve to be encouraged. The state is neither an entrepreneurs, nor a speculator.

The enormous American funds for defense research have just been mentioned. Some scientists argue that these expenses have caused an enormous waste8. In any case they attract scientists, so that the private R&D becomes more expensive. On the other hand, some defense research has led to civil applications. In Japan the state agency MITI has contributed to the coordination of R&D activities. Nevertheless, according to Martin it is little more than an agency for the granting of subsidies.

The state can actively influence the market behaviour of the enterprises. For instance, the patent laws in the USA are formulated in such a manner, that joint ventures are attractive. The state hopes that thus the funds are used effectively. A disadvantage is, that precisely the competitive incitations are highly conducive to an innovative attitude. Martin describes vididly, how the American car makers started to collaborate for the development of catalysts, purely in order to discourage other producers of catalysts. Incidentally, patents are sometimes applied for, just in order to thwart the efforts of other enterprises. Thus he believes, that the patent laws have little effect on innovations. Often the lead in time is more important than the patent. An exception are the pharmaceutical and medical branches, where patents turn out to be indeed useful.

Nevertheless, patents are sometimes used for pushing close competitors out of the market. And the patent agency has its own interest in maximizing the number of patents. A similar phenomenon is the copyright of authors. Nowadays the right has a duration of no less than seventy years, and that is so long, that no public interest is served by it. According to Martin such a copyright is simply a means to obtain monopoly profits. All in all Martin concludes, that most of the patent laws are scientifically controversial.

Last year the economist M. Mazzucato wrote a pamphlet about innovation, that here and there drew the attention. Her arguments, with the title The entrepreneurial state, are provocative, and therefore it is interesting to sketch the purport9. Mazzucato analyzes the policy, that is used in the USA for the stimulation of innovation. She restricts the discussion to the ICT branch (notably Apple), the clean technology industry, and the pharmaceutical branch. Her conclusion is that the private sector appropriates profits from the innovative products, whereas the losses and risks are shifted to the state, and therefore to society. The public-private cooperation is insufficiently balanced, and therefore the innovative system is not durable. For instance, in the USA Apple, the pharmaceutical branch and the like make excessive profits, whereas the budget of the federation generally has deficits.

Just like Martin states, in the USA the ministry of defense distributes gigantic funds for research and development. An important money-lender is the agency DARPA (defense advanced research projects agency). Mazzucato is enthusiastic about this agency, which is free to make its own decisions about investments in research. Thus the DARPA is like a spider in the innovation network. For instance, the iPod, iPad and iPhone of Apple could only be made thanks to the inventions of DARPA projects. Consider the internet, microprocessors, micro hard drives, directly accessible memory (RAM), and learning machines. The touch screen and the Global Positioning System also have a military origin10. However, Apple has hardly paid for the right to use all of these techniques. And that situation is characteristic for all innovative activities. That is unfair, exclusive, and not durable.

Mazzucato obviously acknowledges, that the state itself must do the research, that is too risky for the private sector. For, thanks to the external effects the state receives large social benefits. In fact, the state would prefer to yet expand the research funds, in the style of the DARPA. However, when a certain reseach becomes a commercial success, then a part of the profits should flow back into a collective fund for innovations. This profit share is also an acknowledgment of the entrepreneurial qualities of the state. The state is a dare-devil, that prefers goals in the long term, such as clean energy. Conversely, the state must end projects, when they do not fulfil their promise. The state was even already economically active, before capitalism existed. It is clear that Mazzucato radically propagates a strong and actively speculating state. Martin is not in favour of this. Your columnist will return to this point in the evaluation, but now already admits that Mazzucato has not convinced him.

Loyal readers of the Heterodox Gazette will not be surprised, that your columnist studies the experiences of the workers with ragard to innovation. Innovation is not always in their interest, namely when the ap increases, whereas the consumptive demand does not increase as well. For, in that situation the unemployment increases. Therefore they have often rebelled against the invention of machines, and against various other forms of rationalization. However, Marx states already halfway the nineteenth century, that the mechanization is desirable for the social advancement. And during the second industrial revolution at least the reform-oriented social-democracy has a positive attitude towards the rationalization. She merely wants to combat the possible abuses. This standpoint is elaborated and expressed well by the politician Otto Bauer, in his book Kapitalismus und Sozialismus nach dem Weltkrieg11.

Bauer uses the largest part of his book for analyzing the rationalizations during the decades after the First Worldwar. It is true that this description is impressive, but nowadays it is naturally no longer relevant. It is worth mentioning that Bauer as a true marxist believes that the rationalization is always accompanied by savings on labour and by an expansion of the capital goods. At the time the state is still barely involved in the rationalizations. And this is precisely the fact, that Bauer resents. He defends the standpoint, that rationalizations can hurt society, although they perhaps increase the profits of the separate enterprises. In modern terms it is said, that the enterprise shifts certain negative external effects towards society. Bauer calls such situations wrong rationalizations. Here he distinguishes between four damaging developments.

First, the rationalization often makes workers unemployed, and then these must take pains to find a new job. Then the profit of the enterprise is accompanied by the costs of the unemployment benefit, and perhaps of retraining. The balance is not always favourable for the society. Second, the rationalization sometimes forces the workers to make more efforts. This affects their physical and mental health, so that they become disabled for work at a relatively young age. Then again the society must bear the costs of the benefit. Third, sometimes just-in-time production is introduced, in order to save on the costs of stocks. However, that causes fluctuations in the demand for labour, so that during the quiet periods unemployment benefits must be paid. Bauer believes that is such cases the continuous industry is preferable.

Fourth, capitalism generates an economic conjuncture, and she hurts society. The conjuncture is caused by the incomplete information, that is used in the decisions of the management. For, they do not know the decisions of their competitors. Therefore Bauer advocates the central coordination of the decisions by the state. The state disposes of sufficient knowledge and information in order to control the whole economy, and therefore can design a plan for the most desirable development - just like the enterprises Mark II plan all their internal operations. Incidentally, here Bauer makes the well-known error of socialist thought to suppose, that the central planning necessarily requires the nationalization of the industries. He ignores, that it is much easier to simply regulate the private enterprises12.

In this respect Bauer is still rather orthodox. Several years later the Dutch SDAP would publish the Plan of Labour, where indeed the regulation is advocated. The social-democracy began to understand, that there is insufficient support for large-scale nationalizations. Thereafter, it still took more than half a century, before she would understand, that state enterprises often produce in an inefficient manner. Therefore nationalizations must preferably be avoided. However, it is laudable that the social-democracy betimes recognized the need for social rationalizations, in addition to the rationalizations within the enterprises. Nowadays this problem of the external effects is generally recognized within the economic community. Incidentally, it is interesting, that at the time the Dutch social-democrat Th. van der Waerden wants to give the workers a say in the rationalizations, by means of the works council13.

It has previously been mentioned, that Marx describes the innovation as an endogenous phenomenon of the economy. The economists Domar and Harrod also make this assumption, and model the domestic product as Y(t) = K(t) / κ, where K is the stock of capital goods, and κ is a constant. Moreover, Marx, Harrod and Domar suppose that the economic system is intrinsically unstable. Conversely, the neoclassical theory supposes, that the innovation is exogenous (from outside). She calculates with dynamic production functions of the form Y(t) = A(t) × F(K, L), where Y is the domestic product, and the function F represents the influence of the production factors capital K and labour L. Here the function A(t) represents the technical progress, and is a residual term which can not be logically explained by economics. In this model the markets are in equilibrium.

A well-known example is the growth-model of Solow, where F has the form of the so-called Cobb-Douglas function. The function A(t) shows, that the state of the technology is a separate production factor, which directly affects the economic growth. It models among others the state interventions, which depend on political decisions. However, when during the seventies of the last century the economic growth starts to falter, the economists again search for models, that can give an endogenous explanation of the technical progress14. In these models the technical progress is simply a continuing process of knowledge accumulation. When the state invests in improvements of the national level of knowledge, then that results in a structurally larger growth rate.

There can occur positive externalities, for instance because the fundamental research of the universities benefits the industries. There is a cross-pollination, which can even accelerate the growth and the profits. A variety of this idea is, that the human capital is raised. The workers themselves become more productive. Human capital also causes positive external effects due to the interactions among people. Thanks to such models, now the neoclassical theoreticians also advocate active interventions by the state. Sometimes this new movement is called the new growth theory.

As an illustration of this new branch of the economic science this paragraph will describe a model of research and development, that is invented by the economists G.M. Grossman and E. Helpman15. This model uses two branches, namely the branch I of the consumer goods, and the branch II of R&D. The branch II continuously generates innovations, which can be commercially integrated in the consumer goods. Consider the just mentioned example of the iPad, which can be made thanks to the availability of microprocessors, internet, touch screens, etcetera. The number of such intermediate products is represented by A. It is assumed, that A is proportional to the national level W of knowledge. That is to say, one has A = β×W, where β is a constant.

Suppose that the branch II employs a number LII of workers. Then it seems reasonable to assume, that the number of intermediate products increases according to ∂A/∂t = W × LII. In this formula t represents the passage of time. The variable W can be eliminated from this formula, so that one finds the result

(1) (∂A/∂t) / A = LII / β

Note that the formula 1 represents the growth rate of A. When LII does not change with time, then both A and the level of knowledge W grow exponentially. Next one wants to calculate the size Y of the branch of consumer goods (say, the iPad). The model assumes that one has

(2) Y = Aα × LI

Here LI is the number of workers in the branch I. The parameter α is a positive constant, which expresses the degree, in which the intermediate products can mutually be substituted. A large value of α implies that each intermediate product is unique, so that the addition of a new intermediate product will contribute significantly to the added value in the branch I. Note, that for the sake of convenience the factor capital K has been omitted in the formula 2. The model is very schematic, and focuses on the essence. Suppose furthermore, that LI does not change with time. Then the growth rate of the product Y can directly be calculated from the formulas 1 and 2. One finds

(3) (∂Y/∂t) / Y = α × (∂A/∂t) / A = α × LII / β

The formula 3 illustrates, that a large branch of R&D is favourable for economic growth. It is desirable that the state maintains a policy of stimulation. Thus this simple model gives a mathematical interpretation of the qualitative arguments in the preceding paragraphs. The model serves naturally merely to summarize the ideas, and is not very realistic. For instance, the economy produces in reality not just iPads, but a large diversity of consumer products. Furthermore, this theory also has exogenous aspects. For, an external agency must determine the distribution of the workers over the branches I and II. The distribution is based on considerations of utility, that emerge from the personal preferences of individuals. Besides, the granting of patents, which temporarily limit the general access to W, should be included.

In the preceding paragraphs it is striking, that in the beginning the economists still have primitive ideas about innovation. Innovations are equated to mechanization, and thus they are reduced to the expansion of the stock of capital goods. Even halfway the twentieth century many are still convinced, that innovation is only possible in the big industries (Mark II). Innovation should proceed in a planned manner. This misconception has had desastrous consequences, mainly in the Leninist economies, where the regimes have always relied on increasing scales and on concentration of all activities.

For the social-democrats as well, innovations is little more than the rationalization of the industries. They are convinced, that this can be planned well. They ignore the necessity of the spirit of entreprise. The arguments of Bauer about wrong rationalizations are interesting. It would be rather bizarre to solve this problem by means of nationalizations. What is needed, is the inclusion of the costs, that the industries try to shift to society in the form of a negative external effect. Nowadays this solution is generally accepted, because the industries also have understood the importance of human capital.

Only in the last half a century the notion has grown, that innovations are a complex phenomenon, which develops differently in each branch. Moreover, one becomes aware of the positive external effects, that emerge in an innovative economy. Innovations are socially highly profitable. Models have been developed, that stress the cumulative character of knowledge. Therefore nowadays even liberals are willing to accept the active state interventions for the sake of more innovation. The state must develop a policy of stimulation. And fundamental knowledge is a collective good, also in an economic respect.

Mazzucato even advocates a state, that becomes a speculator, eager to take risks. However, even the state is not omniscient, and politics is not really the very picture of effectiveness. It is not clear, why the state would be a better entrepreneur than the individual companies. Moreover, the democratic process requires, that the state is accountable to its citizens. It is not appropriate, that state agencies speculate at will with tax revenues. In any case, the Leninist states were not successful. It may be doubted that the American DARPA is truly as effective, as Mazzucato tells her readers. All in all your columnist is not very enthusiastic about her arguments.