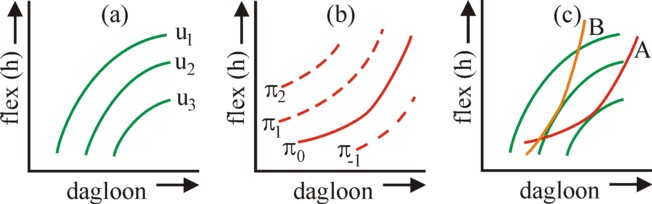

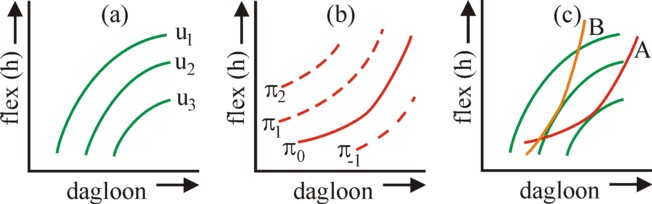

Figure 1: choice of the best job

(a) worker's preferences; (b) profit-curves of the enterprise A; (c) paring to A

In a previous column about the public goods a text about external effects has been announced. Here it is, with an application to labour. A situation with external effects is formed out of the competitive market, and therefore she is not Pareto optimal. The optimal situation can still be reached by means of laws (for instance quota), Pigouvian taxes, or a negociation process.

An externality or external effect occurs, as soon as the utility level and therefore the well-being of an actor in the economy is influenced directly by the actions of another actor. The word direct expresses, that the influence is not exerted in an indirect manner, by means of market prices. The actor can be an individual consumer or a household, but also a productive enterprise. In the latter case the reason for existence is related to the generation of profit, so that the external effect will influence the degree of profitability.

An external effect can be either stimulating or harmful for the receiving actor. That does not affect the theoretical analysis, but it does evidently show up in the political interpretation of the interaction. Opposing interests and conflicts command more effort for finding a solution than do natural unanimities. The most important field of application for the theory of the external effects is the environmental control. Often the enterprises want to shift their polution to other enterprises, or to households. But also for instance noise pollution of a single household belongs to this category of problems.

External effects are clearly also present in the labour market. The theme of the disutility and utility of labour recurs regularly on this webportal, for instance in the column about the views of De Man, Deppe, and Sie Dhian Ho. In that column a scheme is presented, which has been developed by De Man for the most important factors with regard to the labour quality. It is shown, that the enterprise can impose a variety of displeasures on his workers, ranging from bad and unsafe equipment to an extreme fatigue and an existential insecurity. The question is what the theory of the external effects can contribute to the insights here.

As far as your columnist is aware, it is unusual to apply the theory of external effects to the factor labour. It is common in economics to treat labour as a good, which is exchanged on the labour market. And in those cases, where market interactions are concerned, all displeasure is expressed in the price, in this case the wage and the secondary terms of employment. The present paragraph will sketch a model, which explains the market mechanism in the compensation of the displeasure of labour. Subsequently the same phenomenon will be discussed for the case of externalization. For the sake of convenience the following text chooses the example of the distressing flexibility in working-hours. However the same argument can be applied to other displeasures and griefs1.

The assumption, that labour is exchanged on a market, is based on three suppositions. First, the workers are aware of the distressing conditions, which accompany their work. They prefer to choose work, which satisfies them as much as possible. Second, they dispose of all information, which is need to make a choice. The proverb "why care about the unknown?" is not a part of the vocabulary of the homo economicus. And third, the labour market must really allow for job mobility. Obstacles, which may hinder the change of jobs, are ignored.

This model is controversial, just like any other. The labour mouvement has argued, that the market is not real, because the worker is forced to sell his labour force. He needs his wage in order to survive. Moreover there is no clearing of the market, because there always remains a reserve army of unemployed2. Therefore the model of the labour market is an abstraction, which is more or less credible, depending on its application and the personel taste. The model in this paragraph is called the hedonistic wage theory, because the workers are willing to reduce their wage demands in favour of the additional terms of employment. They are utility-enhancers, who prefer to maximize their pleasure3.

Suppose that the workers dislike flexwork. It is obvious that sometimes a worker will appreciate flexibility, but there are also many negative aspects. Flexibility is often accompanied by fewer rights and by a rather uncertain existence. The column about the pleasure and displeasure of labour elaborates on these aspects4. Therefore according to the market model the workers will only accept a larger flexibility, when they receive a larger daily wage in compensation. The figure 1 shows several iso-utility or indifference curves of a worker5. They have a concave shape, that is to say, according as the flexibility becomes more pressing, the worker demands a larger compensation in his wage. Apparently the flexwork introduces wage differentials.

Figure 1: choice of the best job

(a) worker's preferences; (b) profit-curves of the enterprise A; (c) paring to A

On the other hand the indifference curves of the enterprise are concave towards the y axis. In fact these are iso-profit curves, since the profit is the aim of the enterprise. Especially the first measures to increase the flexibility will raise the profits. A part of that profit is given to the workers in the form of significant wage rises. According as the flexibility is enhanced, more difficult constructions are needed, which are less profitable. Thus the wage compensation must also be reduced. This concave behaviour is called the decreasing marginal yield of flexibility. It is shown in the figure 1b.

The hedonistic model assumes, that the enterprises produce in a situation of perfect competition. Then the profit of the enterprise equals zero, and thus for each enterprise there is merely a single indifference or iso-protit curve, namely π0. In the figure 1c for two enterprises A and B these curves are displayed. Also the indifference curves of the worker (figure 1a) are shown once more. It is obvious that the worker reaches his largest utility by taking up office at the enterprise A. It is true that the enterprise B can offer a higher wage than A for lower flex levels. But the indifference field of this worker is such, that he is fairly tolerant towards flexwork.

A hallmarkt of the hedonistic wage theory is that the behaviour of the workers can be explained. For a worker with another indifference field will perhaps prefer the enterprise B. For instance in the figure 1c the enterprise B is more attractive for workers, who value a high job security and therefore have almost horizontal indifference curves. Some workers prefer a high hourly wage, and other a high job security. In the same way some branches can offer a high job security, whereas others are merely profitable under conditions with a high degree of flexwork.

If the hedonistic wage theory is indeed a reasonable approximation of reality, then similar jobs must have a different wage, depending on the degree of flexibility. The economists Ehrenberg and Smith give in the book Modern labor economics a survey of the empirical studies, that have been published in the specialized literature6. This kind of ceteris paribus (in otherwise equal conditions) studies turns out to be difficult to perform, because the extent of the available statistical data is insufficient. Nevertheless Ehrenberg and Smith cite several results. It turns out that night shifts receive approximately 4% more wage than the day shifts. In case of qualified nurses this even becomes 12%. And there are indications, that jobs with a larger chance of a fatal accident are paid better.

Branches with a small job security pay on average 4% higher wages than otherwise equal work elsewhere. It concerns work, where the layoff is predictable, for instance due to seasonal influences or due to regular changes in the productive machinery. In the automobile industry this is even 6-14%, and in construction 6-11%. In agriculture the seasonal workers get 9-12% more wage than permanent personnel. The two economists suppose, that such differences (differentials) are indeed attractive for certain groups of workers, who do not object to periods of inactivity. Think also about the unemployment of teachers during the summer-holidays. These results suggest, that the labour market is really effective7.

What will happen, when there is a structural unemployment, so that some workers are forced to accept any job? Then there is no possibility of mobility and thus not a market. And suppose, that the worker has never experienced anything but flexwork. Then the job security lies beyond his horizon of knowledge. Or perhaps he has never really analysed his labour contract, and is not aware of the flex clauses. Also then the market is dysfunctional. In such situations the entrepreneur does not have to pay compensation to the worker. He can shift his costs to the personnel, so that a negative externality exists8.

Consider the case of a bilateral externality9. There is an entrepreneur and a worker, who conclude an engagement. In the contract the flexibility is fixed at the level h, where a higher value of h implies more insecurity. Both actors maximize their own utility:

(1a) max(x, h) uj(x, h)

(1b) under the restriction p · x ≤ w

In the formula 1a the index j represents the entrepreneur or the worker. The vector x represents the quantities of consumer goods, which are available to him. In the formula 1b the vector p represents the prices of the consumer goods, and w is the income of the actor j. Neither of the two actors can consume more than his budget allows. Another approach would be to let the entrepreneur maximize his profit, under the restriction that the production costs must not exceed the budget. However, that approach would not change the essence of the following arguments.

Suppose that the maximization of the quantities of goods x is independent of the optimization of the flexlevel h. Furthermore suppose, that the degree of flexibility does not influence the income w. It is clear that the enterprise saves on costs, but the hypothesis is that this does not increase the income of the entrepreneur. Then the set 1a-b will get the simple form

(2) max(h) uj(h)

However external effects imply that only the "wrong-doer" can exert influence, and here this is the entrepreneur. He will choose the level h* in such a way, that one has ∂u(h*)/∂h = 0. Now an economic system is only Pareto optimal, when the social resources and technical possibilities organize the production and distribution in such a way, that no single actor can improve his own situation without harming another actor. Since here the entrepreneur optimizes h without taking into account the preferences of the worker, the Pareto optimal situation is not reached.

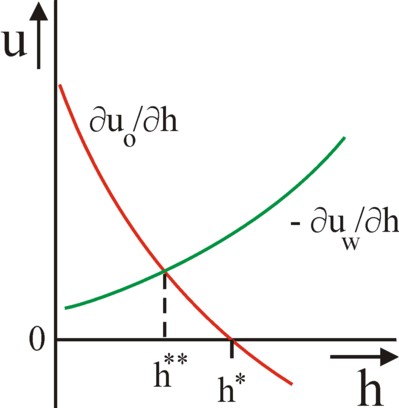

Figure 2: The marginal utilities of o and w

The realization of a Pareto optimal or efficient situation requires that the formula 2 is replaced by

(3) max(h) uo(h) + uw(h)

In the formula 3 the indices o and w represent respectively the entrepreneur and the worker. It follows that in the optimum h** one has

(4) ∂uo(h**) / ∂h = -∂uw(h**) / ∂h

The formula 4 can be explained as follows. The worker does not see flexibility as a utility, but as a displeasure or burden. This implies that his utility has a minus sign. Furthermore a rising level h will lead to a falling marginal utility of the entrepreneur, as is usual, and the marginal disutility of the worker will increase. The formula 4 states that in the optimum the marginal utility of the entrepreneur equals the marginal disutility of the worker. This construction of the optimum is illustrated graphically in the figure 2. There one observes, that h** is less than h*. Apparently the Pareto efficient entrepreneur must restrain himself somewhat in favour of the worker, when he wants to increase flexibility.

Nevertheless, also note that the negative effect is not completely removed. The harm of an externality is not in the occuring phenomenon in itself. That has already been shown by the hedonistic wage theory, where in a well-functioning labour market the workers are willing to accept some flexibility. The compensating wage satisfies their need sufficiently in order to tolerate that displeasure. This shows, that trade unions must not simply try to completely ban all burdens! The harm of the externality is caused by the excess of disutility. Thus the theory teaches a wise lesson.

For the sake of the social well-being the economic system must take account of the external effects. In other words, they must be internalized. For this three alternative instruments are available: commands, taxes, and negociations. This paragraph considers the first two instruments. A command is quite simple: the state obliges the entrepreneur to restrict the level of flexibility to at most h**. Subsequently the entrepreneur will indeed search for the highest allowed level, which realizes the Pareto optimal situation of the formula 4.

The second instrument, the tax, is called the Pigouvian tax, because the economist Arthur C. Pigou has invented it. The explanation makes an additional assumption about the utility function, namely that she depends in a linear manner on the income w. In other words, one has uj(x, h) = wj + φ(h), where &phi expresses the functional dependency on h. This is called a quasi-linear utility function. In fact the basket of goods x is transformed here into a composite good, which is presented entirely by the income wj. The flexibility h does not influence this good.

The Pigouvian tax taxes each unit of flexibility, which the entrepreneur includes in the labour contract, with a percentage of t. The state supplies as it were the missing market power of the worker, by means of the taxation. Then the maximization of the utility of the entrepreneur changes into

(5) max(h) uo(h) − t × h

Note that the argument of the Pigouvian tax remains the same, when the entrepreneur does not maximize his utility, but his profit. In that case the tax merely fines each expansion of the flexwork with a fall in profit.

When the state wants to reach the Pareto-optimal situation, then he must exactly equate the rate of tax t to the marginal disutility of the worker in the optimum. In mathematical terms this is

(6) t = -∂uw(h**) / ∂h.

For then the maximization of the formula 5 will automatically lead to the requirement of identity in the formula 4. The entrepreneur internalizes as it were the externality, which harms the worker.

The Pigouvian tax is preferable to a command, because it is a permanent incitation for the entrepreneur to reduce the flexwork, until finally h=0 is reached. This could become important, when the cost reductions due to flexwork would diminish. Both instruments have the problem, that the state must determine in some way the Pareto optimal point h**. The state must know the needs of the entrepreneur and of the worker. Often this is only possible after a long process of trial and error. It is again stressed, that the aim is not to completely eliminate the flexwork.

The economist Ronald Coase has invented a third instrument, which allows to reach the Pareto optimal situation, namely by means of negociations between the concerned actors. The negociations have the advantage, that the state does not need to interfere. The state must merely allocate the property rights of the action, which causes the external effects. One of the two actors, the owner, can forbid the action, so that the other actor must reach his goal by means of seduction and compensation.

The instrument of Coase is for instance applicable in a situation, where the trade union concludes a collective agreement. This could determine, that flexwork is illegal, unless the workers approve of it. Then the workers own the right to work in a flex-free organization. Next the entrepreneur can offer a wage rise Δw, provided that the workers are willing to accept some flexibility.

The question is what offer will be accepted by a worker. A smart worker will try to obtain an optimal deal. It is defined by

(7a) max(h, Δw) uw(h) + Δw

(7b) onder de voorwaarde uo(h) − Δw ≥ uo(0)

Note that for the sake of convenience again quasi-linear utility functions are employed, so that the offer Δw can represent both a monetary sum and a quantity of utility.

The formula 7a makes immediately clear: the worker simply wants to maximize his utility. The formula 7b guarantees, that the entrepreneur will not be worse off, and will really make this offer Δw for a flexibility level of h. No matter what Δw is desired by the worker, he will try to keep h as low as possible. Therefore the worker will make certain, that the entrepreneur accepts the most favourable situation for the worker, which is the lowest boundary of the inequality, namely uo(h) = Δw + uo(0). In fact for this offer the entrepreneur does not care whether the worker agrees with the offer or not.

The ultimate offer Δw of the entrepreneur can be inserted in the formula 7a, with as the result

(8) max(h) uw(h) + uo(h) − uw(0)

It is obvious that the term uw(0) can be ignored during the maximization, which implies that the formula 8 is identical to the formula 3. Once more the Pareto optimal situation is reached, with a flexibility of h**. This third instrument has an advantage in comparison with the two previous ones, namely that the state is not obliged to collect information about the needs of the two actors. The actors themselves do have to know each others preferences.

Note that the quantity Δw/h** is the price of a unit of flexwork, as it were. The bargaining process has created a kind of market for the right to produce external effects, When not two, but many actors would be involved in this market, then they all must change into price takers. The direct influence of the external effect would be reduced to the indirect influence of the price.

This portal would not be worth its name, when this column would not also discuss the view of Sam de Wolff with regard to the labour market. She has been presented in a previous column. As a marxist De Wolff is convinced, that in capitalism the unemployment is structural. He has even developed a theory in order to prove this. A special aspect of his theory is the relation between the wage level, the labour-time, and the employment. Since the entrepreneurs optimize their profit and therefore will maximize the degree of exploitation, the wage rise will be accompanied by a reduction of the working day. The reduced hours must prevent, that the wage costs will rise too much.

Moreover the theory of De Wolff merely allows for rising wages, when also the employment increases. Unfortunately he does not elaborate on this supposed mechanism. For unemployment implies that the market is not cleared, so that a larger demand for labour does not need to cause rising wages. At least this is the argument of Marx. It is also not clear, why a falling wage level will automatically coincide with an increasing unemployment. It is true that the traditional neoclassical model predicts that in a situation of falling wages the workers will prefer more leisure time. But it is generally admitted, that this representation of the facts is too simple10. Besides, a marxist such as De Wolff does not sympathize with neoclassical ideas.

Then how can it be explained that in a non-clearing labour market a decreasing unemployment leads to a higer wage level? Does De Wolff believe that strong labour unions can at least in economically good times prevent that the unemployment undermines the terms of employment?11 But is it really true, that during times of increasing unemployment the entrepreneurs insist on longer working-hours? Who knows?