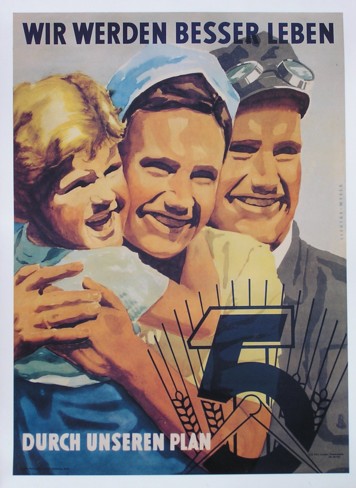

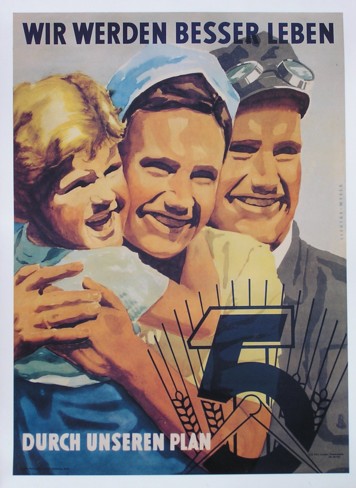

Figure 1: GDR poster

An often heard criticism of the planned economy, and of state enterprises, is that the absence of a private market makes the price formation irrational. Yet the Polish economist Oskar Lange has already in 1937 refuted this criticism. The present column sketches this controversy. Besides, it is explained how the price formation is organized in the former Leninist planned economies. The Leninist price formula uses a fascinating value modification. The plan encompasses both the material streams and the money streams. The concerned professional literature gives the impression, that the planned price system is pre-eminently rational.

The production prices do not appear in a natural manner, but they are the result of human barter and compromise. In the common economic paradigm it is indeed argued, that in the system of perfect competition the product prices emerge from the market equilibrium. However, in reality this situation never occurs in the private market. For, in an economic branch either the oligopoly rules, or the monopolistic competition1. In the oligopoly a few large enterprises act as the market leaders, which together determine the product price. Previously that was done in public, in a cartel or trust.

Nowadays these organizations are forbidden by law, so that they have been replaced by silent agreements between the market leaders. In the monopolistic competition the branch consists of enterprises with comparable products. Yet the enterprises can determine their own product price, albeit within certain market margins. Namely, they obtain some monopoly power by concentrating on partial markets, and by differentiating their product or advertising. Thus the price formation is always a process of barter and compromise, irrespective of the branch.

From the preceding text it can be concluded, that the price formation is never a purely rational and objective process. The price system is always amenable to improvements. The question arises, what then is the point of deregulated product prices. It is of course convenient for the state, that he does not need to interfere with the price formation. No civil servants are necessary for the development of a price policy, and that saves costs. Yet there is also a disadvantage, namely that the transparency of the planned economy is given up. Thanks to the plan, in a political democracy everybody can observe the bartering of the price formation, whereas in capitalism it is delegated to the backrooms.

Oskar Lange mentions in his article Zur ökonomischen Theorie des Sozialismus2, that the economists E. Barone and L. Mises have defended the view, that the planned economy is principle unable to prescribe rational product prices. Their adherents had to admit, that the price formation in the planned economy does represent an alternative. However, then F.A. von Hayek and L.C. Robbins (the same person who publicly denied the existence of the cardinal utility) argue, that the planning in practice requires such an enormous effort, that a success is inconceivable. The criticism of Mises is for instance also repeated by the opponents of the socialization proposals of the SDAP.

In this paragraph the planning method of Lange will be explained again. The method has been explained in a previous column, but it is repeated here for the sake of completeness, in somewhat different words. Lange uses the assumptions of the neoclassical model of complete competition, which the reader can consult in the column about Pareto optimality. The aim is to equilibrate both the consumer markets and the markets of the producion factors in an optimal manner. The state can realize these policy aims simply by fixing and prescribing all production prices and all factor incomes in an all encompassing plan.

First, consider the consumer markets, numbered i (i=1, ..., N). In the optimal equilibrium the needs are optimally satisfied. In order to realize the equilibrium, the planning agency must estimate the consumptive needs, which are expressed by the citizens, and the product prices pi that they are willing to pay. It is obvious that the planning agency does not need to know the needs of each individual. It suffices to divide the population in various categories and professions, and subsequently to determine the needs of all those separate groups. The calculated group averages are called normatives.

Stock is taken of those needs by means of opinion polls, data of the retail business, etcetera. Moreover, the state can be paternalistic and stimulate certain needs, if he believes that they further the social development. Consider for instance a healthy lifestyle. In the last resort the state determines the needs, but before he consults his citizens. In fact the planning agency takes stock of the social marginal utilities ∂ui/∂xi of the i products, where ui is the utility and xi their number. According to the neoclassical paradigm the various markets will equilibrate, when for each pair of products i and j the ratio pi/pj of the product prices equals the ratio of the marginal utilities. Thus the planning agency determines the N prices3.

Next consider the market of production factors, numbered k (k=1, ..., M). The planning agency looks into the production techniques, that are applied in the various economic branches k. For, these allow to calculate the production costs, which are the lower limit of the production price. It is clear that not every enterprise must be analyzed, but merely the hallmarks of certain types of enterprises. Each branch k is characterized by its own normatives for the production. The state (or the planning agency) can influence the production costs, because he himself prescribes the prices wk of the production factors.

The planning agency assumes, that each enterprise i or each branch i maximizes its profit. That is to say, each enterprise must realize an exploitation, which covers the costs. According to the neoclassical paradigm this requires, that the value of the marginal product of a production factor k equals its reward. The marginal product is determined by the production techniques, which are made available by the society. In formula the neoclassical requirement is pi × ∂xi/∂fk = wk, where fk is the number of units of the factor k. This formula shows, that the planning agency must compute the product prices and the factor incomes at the same time. Here the total quantity of the factor k, which is available in the society, imposes a natural limitation on its distribution over the branches.

The state will always try to stimulate the economic growth. Real economies are dynamic, and variable. Also here the importance of the various needs must be weighed. Notably, the planning agency must prescribe the accumulation rate. For, she determines the size of the investments in new means of production, and thus the economic structure. Thus a balance is sought between the welfare of the present generation, and the welfare of future generations.

The interesting aspect of this method of Oskar Lange is, that the central planning agency is not obliged to give detailed directions to the enterprises. The prescribed production prices and factor incomes provide a complete guidance. Thanks to this information the enterprises naturally choose the right production volume, at least as long as they produce efficiently. Indeed the Leninist planned economies have more or less followed the recommendations of Lange. This is clear from the previous column about price formation in the former GDR, and the following paragraphs give further evidence.

It is obvious that the sketched method is purely theoretical. Even the best preparation of the planned prices will not equilibrate the markets in all branches. For that situation Lange recommends the method of trial and error, which implies a stabilization by the planning agency, with the help of small adjustments to the original planned prices. The equilibrium will never be reached, but a satisfactory approximation is possible. Indeed the Leninist states were fairly successful in the satisfaction of the needs of their citizens, although sometimes a deliberate shortage in supply was maintained. The citizens were fairly free in their consumption and in their choice of work.

Two publications about the price formation in the Soviet Union will be consulted here, namely Die wissenschaftlichen Grundlagen der planmäßigen Preisbildung, edited by the Russian economist V.P. Diachenko and De toekomst van de perestrojka by the Russian economist A.G. Aganbegian4. The book of Diachenko appeared in 1968, when the Soviet Union was implementing an economic reform program in order to make the enterprises cover their costs of production. The book of Aganbegian dates from 1989, when he was still an authoritative advisor of president Gorbachev.

The price formation in the Soviet Union was less impressive than in the GDR, which has been discussed in the previous column about the planned economy. In the Soviet Union the economy was generally more primitive and less well organized than in the GDR. Often there are abuses and perverse situations, especially in the Soviet republics at the periphery of the Union. A long series of horror stories by Aganbegian sketches a terrifying image of the planning policy, which he calls the command system. The reader may consider, that often comparable problems could be solved in a satisfactory manner in the higher developed GDR.

The book of Diachenko contains an original price theory. The monetary value S of the production in the branch i with a physical volume Qi is expressed in the formula

(1) S = M + L + L × rL + K × rK + R × rR

Then the product price is pi = S/Qi. In the formula 1, M represents the material costs of the production, and L is the wage sum. Together they form the production costs, or in the Leninist terminology the self costs. The remaining terms form the profit, or in the Leninist terminology the pure income.

The pure income consists of three components, corresponding to the production factors labour, capital and land. The variable K represents the value of the capital goods, which mechanize the production process. The variable R represents the value of the used land surface. The variables rL, rK and rR are the rents (as rates), that are obtained from the three factors. Hard-core marxists recognize in the formula 1 a modification with respect to the labour value. The profit components from capital and land are common, also in western economics. But the labour component is surprising. Diachenko uses this find, because he believes that the labour productivity (in short a.p.) will affect the created value5.

According as the a.p. increases, the monetary yield of the production will rise for the case of a constant piece price. That increases the profit, at least as long as the incomes of L, K and R remain unchanged. Diachenko wants to analyze the factors, that may contribute to the rise of the a.p. The a.p. is independent of the material costs M. However, in the wage sum L a profit can be made, namely by improving the organization. Apparently the factor labour offers opportunities for a rent, and he is more than merely a cost. Note, that the western textbooks ignore this possibility, because they assume, that in case of an increasing a.p. the workers and the trade unions will demand a corresponding raise of the wage sum L.

Diachenko gives a somewhat different explanation for rK and rR than Lange. According to Lange each production factor k has its own marginal productivity ∂xi/∂fk, and she determines the corresponding rent rk×fk. This is the typical neoclassical view, that the productivity originates from the factor itself. But according to Diachenko the capital K and the land R generate a rent, because they increase the productivity of labour. The factor K represents the mechanization of labour. And the factor R represents the fertility of the soil, which furthers that the labour produces a rich harvest.

There is scientific proof, that the formula 1 of Diachenko is indeed applicable, also in capitalism. Namely, the economist Nils Fröhlich has shown in a statistical approach, that for the German economy in 2004 the market prices correlate just as well with the labour values as with the neoricardian product prices6. This refutes the assumption of the neo-ricardian theory, that the profit is determined completely by a uniform interest on capital rK (with rL=0). The assumption of the labour theory of value, that the rent on wage rL (rate of surplus value) is uniform (with rK=0), is also wrong. The rents are both relevant for the profit and thus for the price formation. Branches with a relatively low interest on capital rK try to compensate that by increasing the rate of exploitation rL of labour.

In the history of the Soviet Union the producers have sometimes neglected the economic importance of the factor efficiency. The result was a waste of economic resources. For instance, Aganbegian tells in 1989, that the Soviet Union produces twice as much steel as the United States of America (in short USA), but makes less machines and equipment of that steel. And for each cubic meter of wood the Soviet Union produces three times less products than the USA. According to Diachenko before the price reform of 1967 the Soviet production of coal and iron ore is structurally unprofitable (respectively -33% and -20%)7.

The interests or rents rk are important, because they point to the branches i, where the concerned production factor can be employed best. It is essential to remember, that in the society the scarcity of production factors is inevitable. Oskar Lange shows, that in the ideal situation the factor efficiencies and factor incomes will be uniform. However, the society is so complex, that (like Fröhlich has shown) in the capitalist reality the factor efficiencies are never uniform across all branches i.

First, each branch has various profit rates due to the so-called market imperfections. Notably, there is never a free mobility of the capital between branches. Capital can not simply be removed from a branch, because it is fixed (sunk in) in unique equipment and real estate. And the entrance of new competitors in a branch is sometimes impossible, because there are quantitative (financial) thresholds for the establishment of a profitable production. This is of course especially true, when the incumbent producers benefit from a better efficiency thanks to their continuously expanding larger production scale.

Besides, the economic system in the modern capitalism is mixed. For instance, states like Germany and the United Kingdom have maintained coal mines during many decades, merely for political-strategical reasons. Notably, the aim was to keep the supply of energy diverse, in order to remain independent of foreign suppliers. Moreover the branch is an important source of employment. This policy has been continued even when the national coal production was no longer competitive on the global market. This example illustrates, that all kinds of social motives and needs lead to profit rates, which differ for each branch. Another example is the subsidies for public transport, which is considered to be of social interest. Then there are external effects.

In the planned economy the situation differs from the capitalist economy. There is no "invisible hand", which furtively sets the prices in backrooms. If desired, the planning agency can prescribe uniform factor efficiencies for the whole economic production. Diachenko explains, that the Soviet Union did not do this, because that method would be too rigid. Halfway the sixties of the last century an economic reform has indeed been initiated, including a new price system, but its primary aim is to cover the costs of the operations of all producers. The enterprises must learn to work efficiently, and to reduce their waste of resources.

The ideologists of planned economies stress again and again, that the management of the enterprise must keep a significant degree of autonomy. For, they must realize the efficient and effective production. They are responsible for their own bookkeeping. Nevertheless, the planning system requires, that the planning agency is the highest authority, and thus can intervene in the operation of the enterprise. The planning agency is a political body, because it must express the popular will. Therefore the planning agency is embedded in the network of political interest groups. Note, that the highly praised general interest tends to get lost in the political power game. The general interest is not the total sum of the partial interests.

In 1966 and 1967 the industry prices have been adapted to the real costs. That is a complex operation, because the use values of the products must be compared. For, according to Oskar Lange the relation pi/pj = (∂ui/∂xi) / (∂uj/∂xj) must be satisfied. Sometimes this fails, simply because the needs i and j are incommensurable (incomparable). Moreover, the Soviet Union is so large, that the planning agency prefers to divide the union in territorial price zones. In principle the prices of one product must be coupled in the various regions by means of the transport costs.

The price reform must prevent, that some enterprises obtain such large marginal costs, that they can never produce in a profitable manner. Besides, the development of the a.p. can differ from branch to branch, and that leads to different profit rates ri in the branches. Therefore the planning agency formulates requirements for the factor efficiencies rK, that differ for each branch. For instance, the petrol industry, which can supply energy in an efficient manner, must realize an interest rate on capital of 14.6%, whereas in addition her profit is heavily taxed. The coal industry must satisfy a lower requirement of rK = 8%, in order to keep its supply competitive on the energy market. Diachenko calls this an accounting price. The economy as a whole must yield a rent of rK = 14.6%8.

According to Diachenko another deranging phenomenon is, that real estate (factory halls and the like) has a lower rent than machines and equipment. Yet both are capital goods, with values that are aggregated in K. In short, the method of Oskar Lange is generally applied, but the social reality of its realization demands some compromising and bartering. The model of Lange is too rigid and simple. In some cases the unprofitable enterprises are subsidized even after the reform, but only when that is inevitable for political reasons. Thanks to the formula 1 and the new system of realistic prices the planning agency knows the costs of those compromises.

The Leninist economics differs from its western equivalent, due to its orientation towards applications. It must produce detailed quantitative calculation methods in aid of planning. Therefore it distinguishes between three price categories, for respectively the industry, the wholesale trade and the retail trade, whereas on the other hand the western models commonly use merely a single product price. The industry- and consumer-prices differ among others due to the sales- or consumer-tax (say, the VAT). Prices are added to the long-term plans by means of scientific studies, and they do not immediately respond to the market behaviour. This makes the planned economy stable and predictable and, it is to be hoped, rational.

It must be stressed, that the planning agency bases her choices on her own utility function, which reconciles the interests of the producers and the consumers. The central planning agency heads the branch-ministries, which elaborate on the central plan for their own productive branch. It is worth mentioning, that this structure resembles the design, which the then Dutch party SDAP made for the production councils under public law. In the design the Central Economic Council heads all branches, and it delegates its authority to the Administrative Councils. The influence of the state and the ministries is guaranteed by means of cross-connections and double-mandates.

According to Aganbegian the price reform of 1967 got bogged down due to bureaucratic opposition, after ten years. Since 1985 the perestroika under president Gorbachev is a new attempt to make the operations of the enterprises profitable. Aganbegian has witnessed all endeavours since the fifties, and apparently has become so frustrated and traumatized, that he has developed extremely liberal ideas9. Therefore the present column is reserved in citing his arguments.

According to Aganbegian the reforms of 1964-1965 were fairly successful. The economy revives and the level of welfare rises appreciably. The production of food increases with yearly 4% or more. During the period of the five-year plan 1965-1970 the volume of the production of consumer goods rises with a factor of 1.5. The housing of yearly ten million people is improved. Just like Diachenko, Aganbegian mentions that henceforth the most important indexes for the judgement of the operational results are the volume of the sold production and the profit (in other words, the labour productivity)10.

However, five years later, so in 1970, the command methods return. Aganbegian calls it a "bureaucratic mania of the central government and the branch ministries"11. The independency and the profitability are abandoned. The reason is probably, that the wages rise faster than the labour productivity, and the government refuses to combat this with a policy of wage moderation. Due to the wave of central guidlines the economic growth shrinks again. In 1979-1982 there is even a negative growth. It is difficult to judge if this part of Aganbegian's argument is realistic. He even tells, that at the time his analyses and explanations were rejected by prime minister Kosygin.

Also Aganbegian wants to reduce the subsidies. Around 1989 the state still uses 13% of the total state budget for subsidies of the most needed provisions. Aganbegian wants to abolish the subsidies, but must admit that they are popular among the people. He even talks about a yellow-press campaign, which would publish (too?) many letters of his opponents. He does not recommend more rational prices, but a free price formation on the private markets. Another proposition is the establishment of an independent wholesale trade for capital goods. This must replace the state provisioning office, which until now mediates in the demand and supply of the capital goods. Because the centralized distribution is the foundation of the command econmy, which he wants to destroy12.