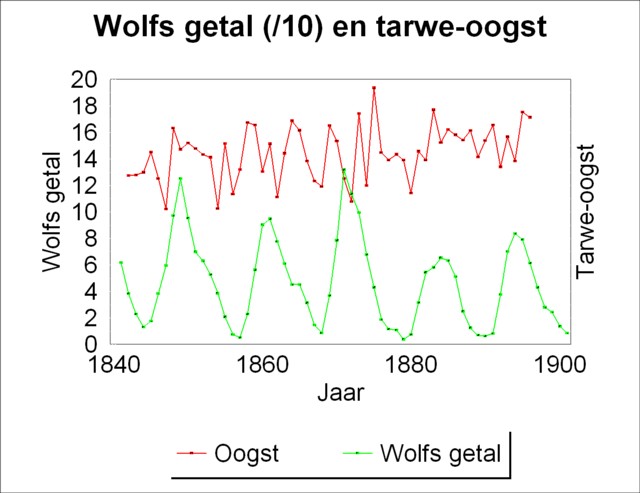

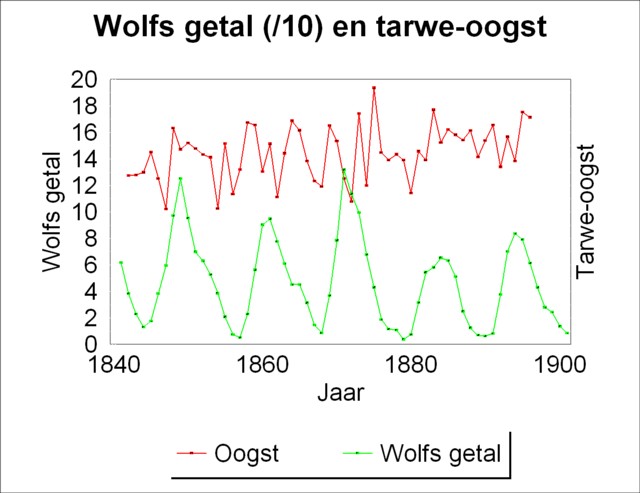

Figure 1: The number of Wolf, divided by 10,

and the French corn harvest, taken from literature (2)

In a preceding column the dual cycle movement of the conjuncture is described, that has been derived by Sam de Wolff on the basis of the index number of Sauerbeck and of other empirical data1. De Wolff has not limited himself to the empirical data of the conjuncture, but he has added a modeltheoretical explanation. From his materialistic orientation as a marxist De Wolff locates the cause of the conjuncture in the economic developments themselves, and not in accidental external shocks like wars or cultural revolutions. He uses the designation organic for this internal cause, and thus also for the crises2.

De Wolff assumes that the primary cause for the economic conjuncture consists of natural processes, The most obvious natural factor is the yield of harvests in the agriculture. An abundant harvest reduces the production costs, because the large offer will lead to falling prices of agricultural products. In the first place the falling prices have the effect of reducing the nominal wage of the workers, without altering their real wage. Second, the agricultural products are used as raw materials in the industry, so that the falling prices will also lower the prices for the means of production3. Falling costs of production offer room for additional profits, and thus for prosperity.

An important indicator of the prices of foodstuffs is the price of corn. Therefore many economists have studied the historical fluctuations of the corn harvest. A popular idea is that the yield of the harvest is determined by the weather conditions, so by meteorological factors, which in turn could be influenced by cosmic causes. In this way the economic cycle is connected to the meteorological cycle, that results from astronomical cycles. An important contribution to this theory had been made by the famous economist J.S. Jevons, who in addition has made a name for himself due to his pioneering studies of the marginal utility of consumers.

Jevons bases his theory of business cycles on the fluctuations in the activities of the solar spots. In this way he tries to explain the short economic cycles, those with a period of about ten years. In spot-rich years a lot of rainfall is expected, so that the harvests would be abundant. They are characterized by wet and cool summers. On the other hand, the minima of the activity of solar spots is expected to be accompanied by poor harvests, which would raise the corn price. De Wolff elaborates on the idea of Jevons, and in his analysis makes use of the numbers, which have been calculated by the astronomer R. Wolf (the so-called Relativzahlen), as a measure for the activity of the solar spots. The Relativzahlen of Wolf are largest in years with many solar spots.

Just like Jevons, De Wolff (the economist) discovers that when the cycle in solar activity with a period of ten years reaches its maximum number of solar spots, the harvest of corn is also maximal. On the other hand the worst harvests occur during times with a minimum number of solar spots. De Wolff finds this correlation in the statistics of harvests from both England and France. A typical example of this correlation in the statistical data is shown in figure 1, where the yield per hectare of the French corn harvest is shown for the period 1840-1895. The figure also shows the Relativzahlen of Wolf, divided by ten in order to facilitate the comparison. De Wolff notes that the harvests are indeed maximal in 1847, in the period around 1860, in 1882 and in 1894. He omits the peak in 1874, because here the aftermath of the French-German war of 1870-71 would distort the picture. The four mentioned maxima of the corn harvest coincide with the maxima in the numbers of Wolf.

Moreover De Wolff mentions, that the short cycles of the harvests can not be simply equated to the short cycles in the economic conjuncture. For during the nineteenth century the short cycle in the conjuncture appears to decrease in duration from about ten years to about eight years. This change destroys the original correlation with the ten-yearly fluctuations in the harvests. Later in this column the decoupling of the harvests and the conjuncture will be scrutinized more closely.

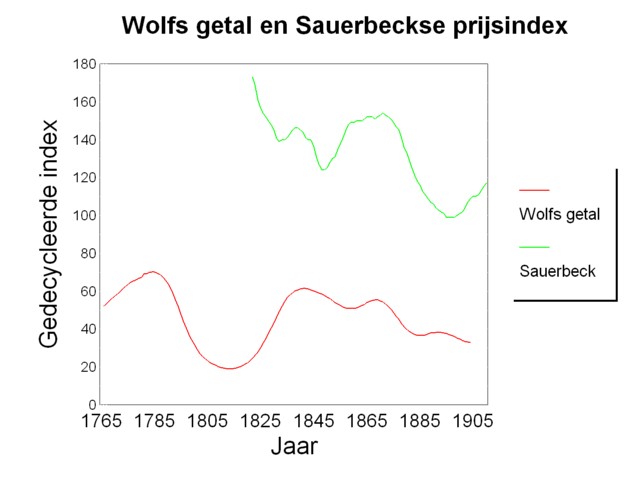

According to De Wolff some astronomers, including his namesake R. Wolf, think that the activity of the solar spots displays a long cycle, in addition to the short cycles which have been described just now. Of course this interests De Wolff, because this long cycle reminiscences of the economic tide, that he himself has observed in the economic conjuncture. Therefore he transforms the Relativzahlen of R. Wolf by means of a triple decycling operation according to the procedure, which he also applies to the index numbers of Sauerbeck4. The result is shown in the figure 2, together with the decycled price index of Sauerbeck, corresponding to the calculation in the previous column. According to p.258 of his book, De Wolff feels that the results confirm the long cycle in the conjuncture. Indeed the Relativzahlen of Wolf and the price index of Sauerbeck exhibit a similar behaviour, at least between 1850 and 1895, after decycling.

An important question is what consequences an abundant corn harvest will have on the income of the farmers. On the one hand, their yield Q is larger, but on the other hand the corn price p will fall. The so-called price elasticity ε of the demand is a good measure for the combined influence of these two effects on the income. The price-elasticity is defined by5

ε = (ΔQ / Q) / (Δp / p)

Here Δp is the price change due to the yield change ΔQ. Of course, the price-elasticity is usually negative. However, when ε > -1 (that is to say, ε lies between 0 en -1), then the income decreases when the production rises (ΔQ > 0). This price behaviour is called inelastic. In practice it is found that indeed the prices in agriculture behave in an inelastic manner6. It sounds like a paradox, but apparently an abundant harvest is a disadvantage for the farmers. Of course the artisans gain by an abundant harvest and by the low food prices, which accompanies it.

De Wolff notes, that in capitalism the corn prices need not necessarily behave in an inelastic manner. For there are always unemployed labourers. As soon as the harvest is abundant, and the prices fall, the nominal wage will also fall. Therefore the industry can employ more workers. This expansion of employment creates an additional demand for corn, which will halt the fall of the corn price. Besides, the employment of additional workers implies that the industrial production will grow. Therefore, the abundant harvest tends to stimulate the economy as a whole, even when perhaps the farmers lose some of their income. De Wolff supposes, that the income of the farmers wil not decline at all7.

The prosperity, that is caused by the abundant harvests, stimulates new investments. The demand for industrial goods, such as machinery, metals and coal, will increase. The production of capital goods will (at least temporarily) grow faster than that of consumption goods. At the same time, the additional demand will push up the prices of raw materials. The rising prices increase the costs of production, so that finally the profits will get squeezed. The prosperity stagnates and changes into a crisis. An incidental peculiarity is that until halfway the nineteenth century the machinery (steam-boilers, spinning-jennies etcetera) were depreciated in about eleven years. Thus the period of depreciation is of a similar duration as the short cycle in the solar acitivity and in the harvests. Each time when the harvests become abundant, the machinery needs to be replaced at the same moment. Therefore the industrial cyle reinforces the natural cycle.

De Wolff states that since about 1850 the machinery is depreciated faster than before. Around 1875 it was usual to calculate with a depreciation duration of on average about eight years. This means that the machinery has to be replaced within the period of the poor harvests. De Wolff writes: The navel-string, that connected the society to nature, has been tied up. The capitalist way of production has gotten its own blood circulation and now obeys completely to its own laws8.

De Wolff does not state whether this decoupling of the nature and the industry also holds for the long cycle. However, that seems likely. For he defends the opinion, that the long cycle is five times the duration of the short cycle. Since the duration of the short industrial cycle is determined by the period of depreciation, and this period reduced in duration, the long industrial cycle should also shrink. However, there is no reason why the natural (harvest) cycle should shrink as well. Actually De Wolff believes that until 1855 the depreciation duration is ten years, then between 1855 and 1882 she becomes nine years, between 1882 and 1906 eight years, and thereafter seven years. Therefore the interval between two booms shrinks9. According to De Wolff the crisis will occur generally in autumn, because at that moment the harvest starts, and the prices of agricultural products become known. Incidentally, in the modern economy the agriculture is less important to such an extent, that this rule of thumb is no longer valid. Nevertheless, J. van Duijn has applied the De Wolff scheme of crises with an ever increasing frequency, and estimates that on this basis the capitalist production would collapse in the year 199410.

In his studies De Wolff searches for compelling relations between the economy and societal phenomena. For instance, he believes that during the rising movement of the long cycle, which ends in the spring-tide, the society will be characterized by a conservative and egoistic attitude. Then the labour movement prefers a reformist (appeasing) strategy, at least on the national level. The large labour organizations, like the First and the Second Internationale, were founded during the spring-tide. De Wolff analyses the spring-tides 1846-1870 and 1891-1910, and concludes that these periods are rich in wars11. On the other hand, the downward slope of the long cycle is marked by a violent class struggle and by other internal revolts, which prohibit an international expansion. This is an interesting idea, although the importance of social regularities may be overestimated here.

These columns are absolutely not intended to criticize the ideas of de Wolff. That would hardly be fair, in view of the enormous amount of knowledge, that has been gathered in the past century. Besides, De Wolff appears to take a defendable stance, thanks to his good economic intuition, even in cases where the main stream has in the end chosen a different approach. However, two more recent works with regard to the cycles of the conjuncture are worth mentioning. The first work is the review, which the well-known Dutch economist Jan Tinbergen wrote after the publication of Het Economisch Getij12. Tinbergen writes: Incidentally, several facts deserve consideration, namely in the first place, that the cycle in the USA is much shorter (3 or 4 years), and in the second place, that also in Europe some cycles with a very short duration have occurred,, notably the German cycle of 1925-1926. These two facts show, that some problems remain to be resolved which are not addressed by the theory of De Wolff or by his book. ... In view of such cases it is gratifying that the modern conjuncture research has developed into a general dynamic-economic field, which also studies abnormal cycles. Tinbergen explicitely refers to the leading works of the German Wagemann and the American W. Mitchell.

The name of Mitchell is a bridge to the second important work, that your columnist likes to mention, namely The Business Cycle13, by H.J. Sherman. Sherman has continued the study of business cycles on the basis of Mitchell's methodology. Sherman investigates the short cycle in the USA, for the era 1949-1982. He succeeds actually in determining an average shape of the cycle for that era. The properties of the cycle, like the relative fluctuations of its most important indicators14, seem to have a universal validity. It is striking that Sherman leaves the period of the short cycle variable. He does not divide the period of the cycle in years, but in eight cycle segments. According to Sherman the shortest cycle lasts only 2.5 years, and the longest almost 5.5 years (if the cycles in war time are omitted, since these are stretched artificially). This makes clear on the one hand, as Tinbergen already noted, the short duration of the American cycles. On the other hand, the duration of the American cycles does not exhibit the regular pattern, that De Wolff observes in his studies.